The EUR/JPY bears finally closed the price below the crucial support of 127.92, dragging it to a 10-month low. We should expect further declines with completing the double-top pattern by closing below this support.

However, in the short-term perspective, the bears are expected to take a short break as the price has not yet stabilized below 127.92, with buyers having resurfaced today, attempting to retest the broken support as new resistance.

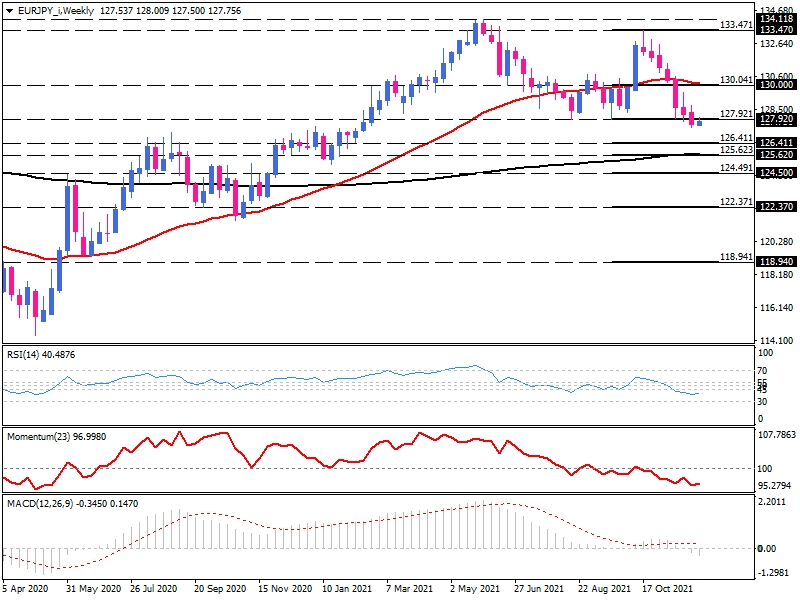

Weekly Charts Paint a Bearish Picture

According to the weekly chart, after bulls failed to reclaim the peak of May around 134.12 and posted the lower high at 133.47, the pair fell directly to September’s low of 127.92.

By closing below this hurdle, we should expect further declines with completing the double-top pattern. Despite this, the price has not yet stabilized below this handle as buyers have resurfaced today, attempting to retest the 127.92-barrier.

The bearish pressures could intensify if sellers succeed in diving below the low of the previous candlestick, sending the price to the 126.41-handle. If the sellers break below this support, they may test the 200-week linear weighted moving average at 125.620. If the slow MA fails to halt the fall, EURJPY could slide towards the 124.500 and 122.370 hurdles, respectively.

Short-term momentum oscillators also imply a prevailing bearish outlook. In the current situation, RSI is heading lower into the selling territory, and momentum is trending downward below the 100-mark.

Likewise, the MACD histogram is drifting more profound into the negative territory below its signal line.

Should the sellers take a breather, the bulls may target the 130.00-hedge, the 61.8% Fibonacci retracement of the previous move upwards.

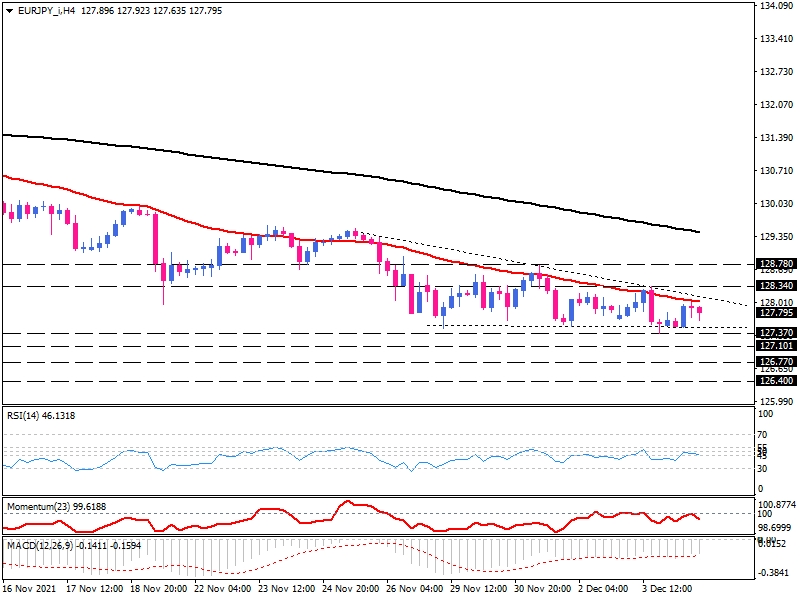

EUR/JPY Short-Term Consolidation

Since early November, a downtrend has been evident on the 4-hour chart as the fast MA crossed below the slow MA following the price’s crossing over the 200-period Moving average. EUR/JPY is consolidating within a descending triangle pattern between the 127.37 support level and 128.340 resistance level.

To resume the downtrend, the price must fall below the 127.37-stretch. The immediate support would then come from the 127.10 mark, while further losses would put the 126.40 in their sights.

However, the short-term oscillators suggest that negative bias is fading. The RSI hovers in the neutral zone while the momentum is heading up near the 100-threshold following posting a divergence. The MACD also indicates a weakening bearish sentiment by holding above its signal line in the selling zone.

In the bullish scenario, the trend might change to the upside if the 128.34-barrier is decisively broken above. This would place the pair at the 128.78-mark, and overcoming this obstacle would set off further movement towards the 200-period WMA.

{{yt-K_CXC-ZTZh0|Daily Technical Analysis | EUR/JPY bears edged below two-month lows | 06.12.2021}}