In our first post where we mentioned that worrying signals were seen across major European markets, markets had completed their first downward movements and were pulling back up correctively. We mentioned that although the US markets were not showing such worrying signals, it was inevitable that one would be influenced by the other. It was more probable that US markets would correct together with the European ones because their rally had extended too far without a correction. European indices moved towards their 61,8% retracements. Not all of them did, just the major ones. This upward movement fooled a lot of people, into believing that the trend was again towards the upside, but only here you were alerted before hand for the impeding correction in Europe and US. So lets take a look at the updated european charts.

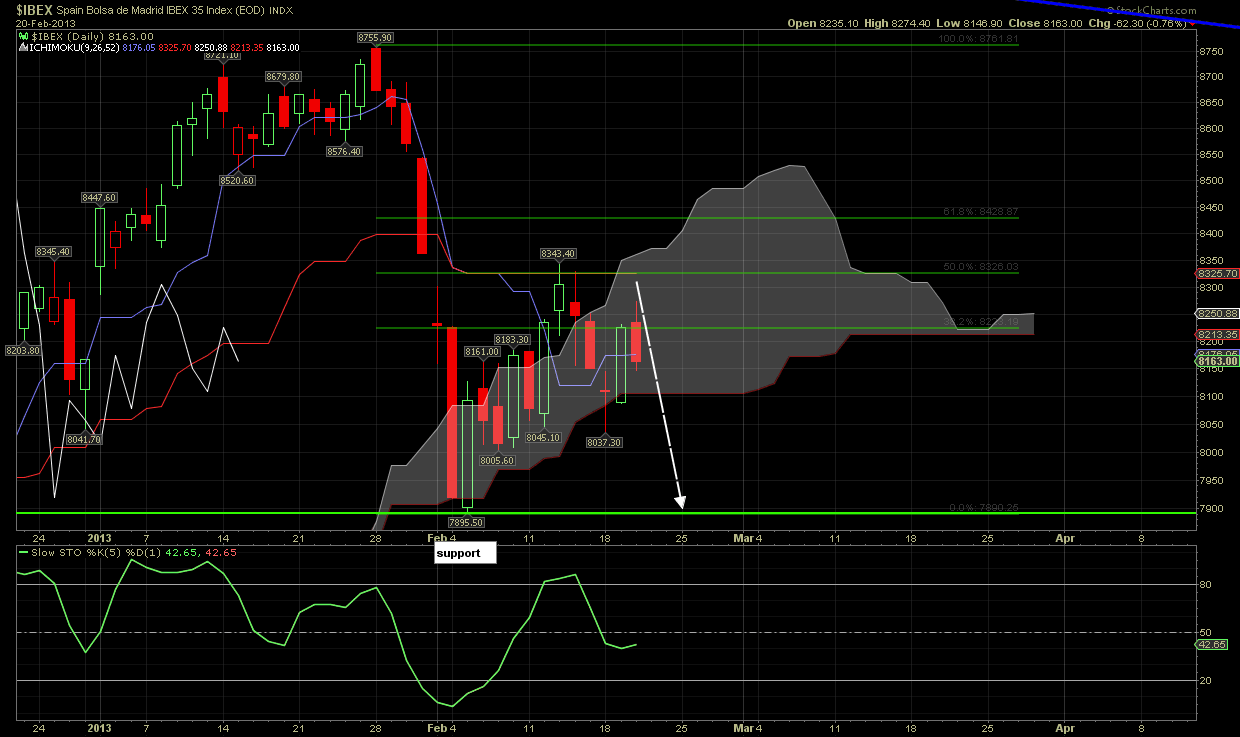

IBEX:

IBEX is already trading below the Ichimoku cloud and confirms our view that this market is downward biased. Now at 8030 spot price testing support. Could pause here before another leg down.

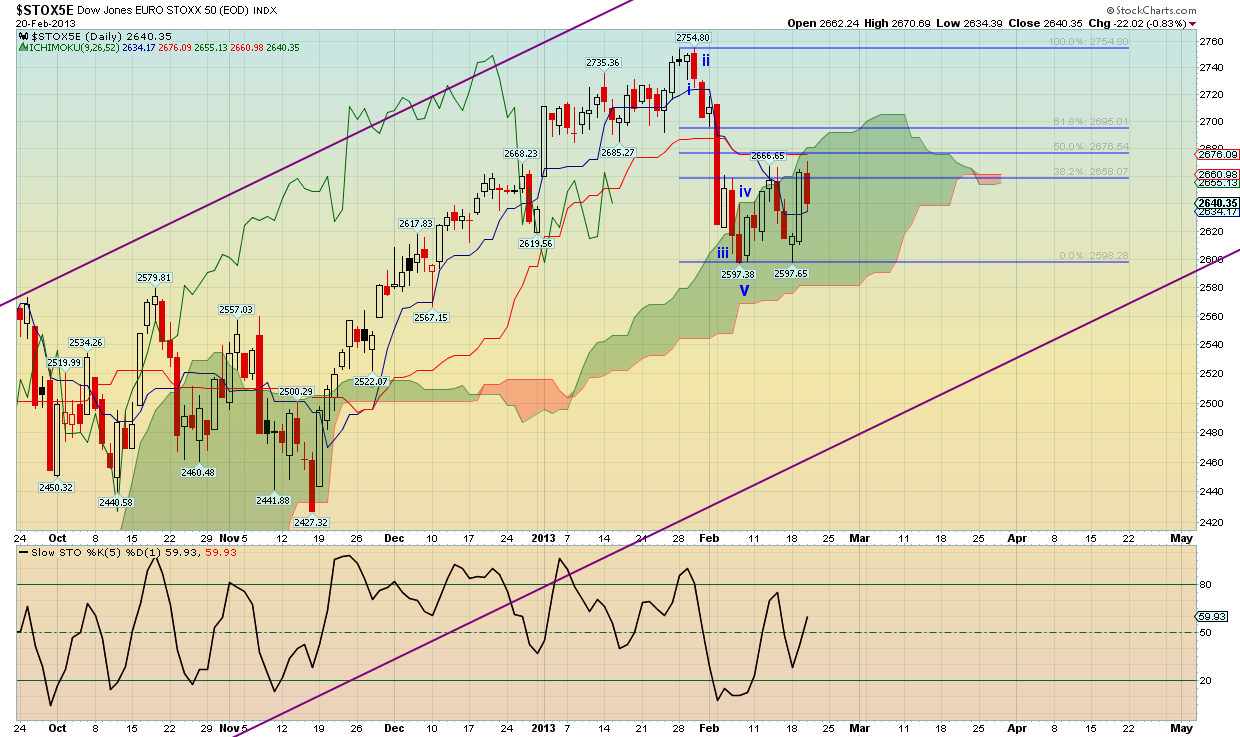

Eurostoxx50:

EUSTOXX has the similar behaviour as IBEX. It pulled back up towards the 50% retracement and now below 2600 breaking the lows, showing weakness and further downward potential.

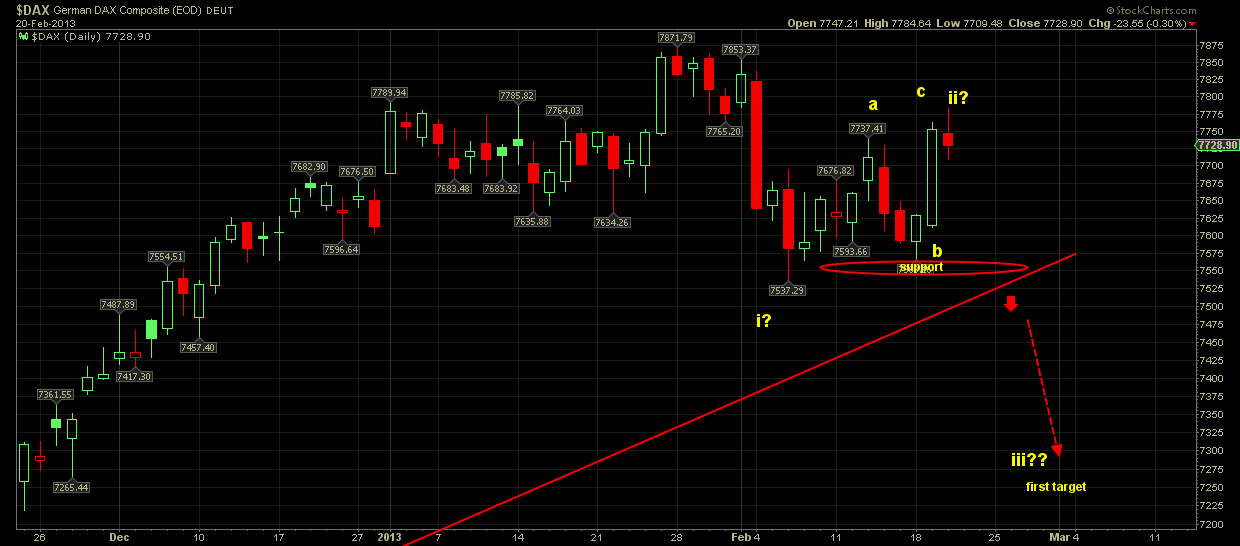

DAX:

DAX made another try upwards to break past the 61,8% retracement but came back down strong. Weakness is evident here too as we expected after the initial 5 wave down movement. The index is now testing the 7600-7550 support that if broken, the road towards 7200 will be open. We favor the bearish scenario as long as prices trade below the recent 7785 high.

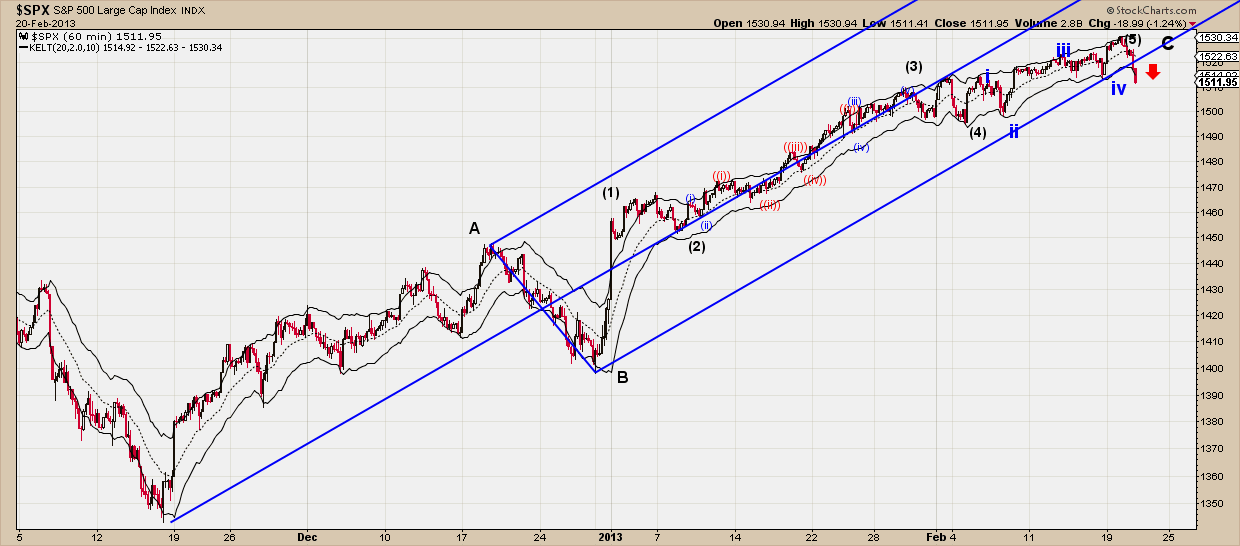

S&P:

Members have been updated about the impeding correction that was imminent for S&P. The rise was complete and prices were expected to be influenced by the weakness across Europe. The collapse in Gold and Silver was another sign that usually comes before a decline in US markets.

S&P making a start for a correction that could test 1490-70 area. Bulls were alerted many times before that any sign of weakness should be taken seriously as the chances for a big correction have increased.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Bears Over Europe: Take 2

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.