The yen was already supported by global growth concerns, before the ECB took a sledge-hammer to the Euro with a fresh round of TLTRO’s and slashed growth forecasts. And judging from price action on EUR/JPY, we don’t think bears are done just yet.

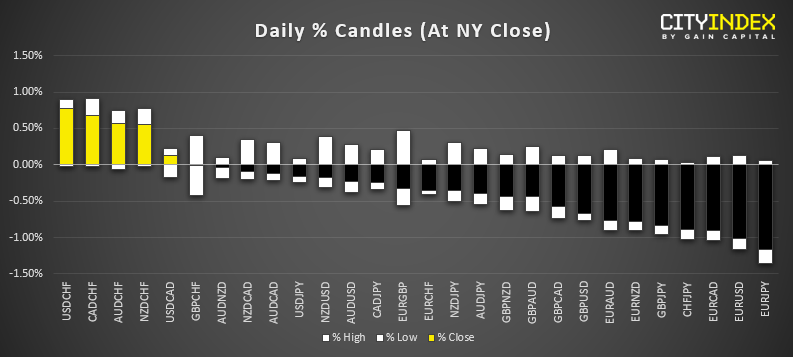

By the close the cross had suffered its second most bearish session this year (behind January’s flash-crash) and was the biggest move/loser among FX majors and crosses. Still, we can see on the daily chart that it’s found support around the May 2018 low, so a minor bounce from current levels seems plausible following such an extended move. Regardless, the bigger picture likely points lower.

The trend remains bearish overall since the 133.13 high, and two corrections (which included a symmetrical triangle and a corrective channel) are interconnected with clear phases of bearish momentum. Granted, the recent retracement was quite deep at nearly 78.6%, but its ‘last-hurrah’ at 127.50 failed to hold onto its upside break of the bullish channel, which makes the momentum-shift the more compelling.

Once the obligatory bounce from support is done, we’d be looking for a break of the May 2018 low to target 123.40 and 122.39 – a break of which brings the flash-crash low back into focus. The bias remains bearish whilst beneath 127.50 / Fibonacci resistance zone, although the higher the bounce from current levels, the less appealing a short may become as we’re looking to hop onto a firmly bearish, momentum move.