Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

USD/MXN is trading sideways since the beginning of June and it looks like it is forming a big, bearish Elliott wave triangle in wave IV that can send the price even lower for a wave V, once fully developed. That said, we see four of the needed five legs within a triangle as finished, so the latest intra-day rally from the lower triangle line can be part of a final leg E of IV. Possible resistance and a new reversal zone for the pair can be at 22.4/22.5 area.

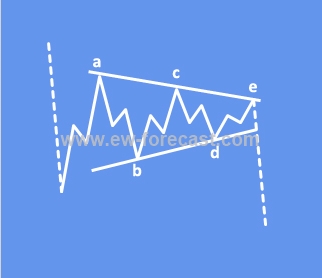

A Triangle is a common 5-wave pattern labeled A-B-C-D-E that moves countertrend and is corrective in nature. Triangles move within two channel lines drawn from waves A to E, and from waves B to D. A Triangle is either contracting or expanding depending on whether the channel lines are converging or expanding. Triangles are overlapping five wave affairs that subdivide 3-3-3-3-3.

Triangles can occur in wave 4, wave B, wave X position or in some very rare cases also in wave Y of a combination.

Symmetrical triangle in downtrend:

Trade well!