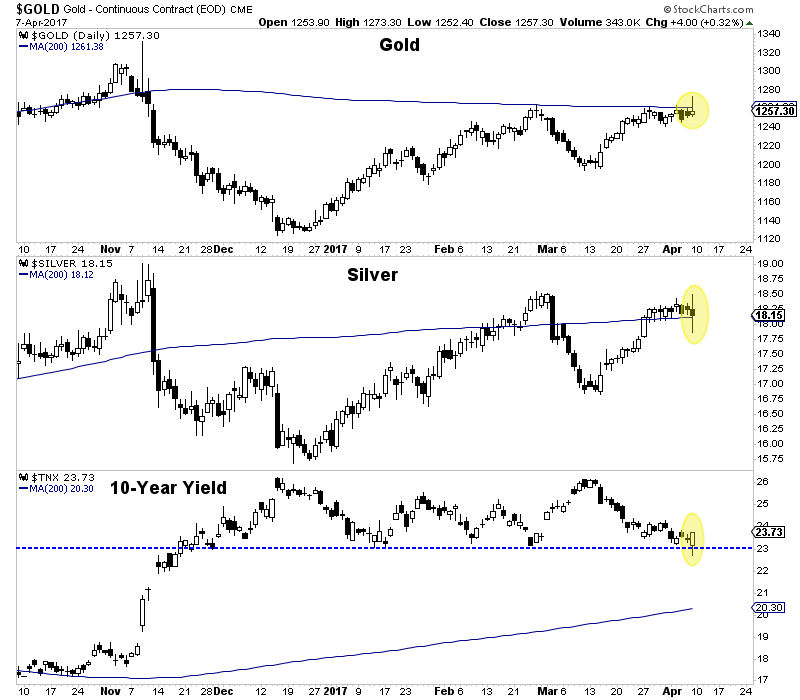

Precious metals ended a quiet week last week with quite a reversal. Gold surged above its 200-day moving average for the first time since November, only to lose the gains and then close below the 200-day moving average. Silver was already trading above its 200-day moving average before it moved higher but it then reversed strongly and even below its 200-day moving average. The miners, which have been much weaker than the metals were mostly unchanged, after opening higher. Friday’s bearish reversal could signal an imminent decline in the entire complex or just signal that more time is needed before the next attempt at a breakout.

As you can see below, the metals reversed course as the 10-year Treasury yield formed a very bullish reversal around key 2.30% support. Precious metals have been tightly correlated to falling bond yields and Friday provided more evidence of that. It is also a concern that the metals formed their reversals at the 200-day moving average. Gold went from below to above then back below, while Silver started the day above its 200-day moving average but closed below it, at $17.99. (Note, there appears to be a data error in the Silver chart).

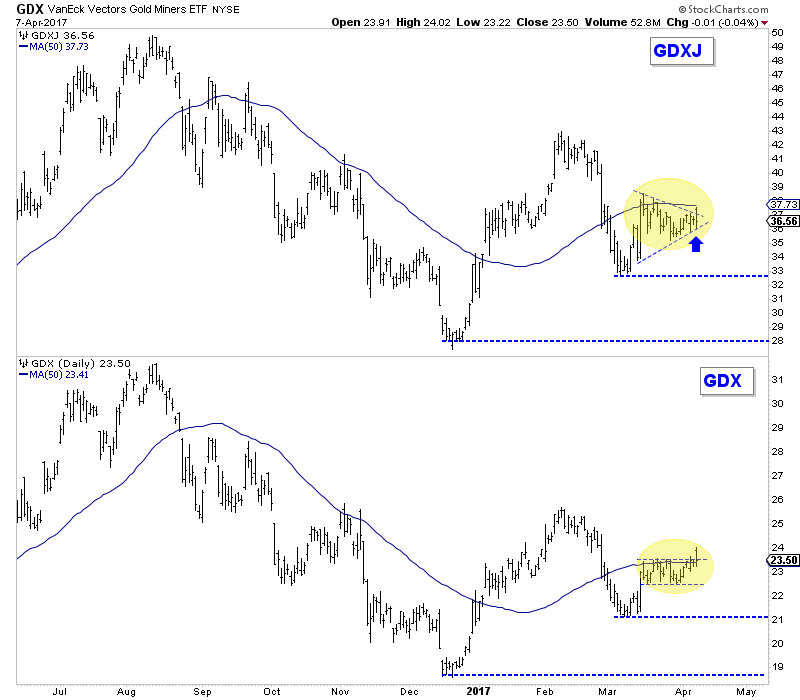

Turning to the miners, we see increased risk for an immediate decline. The failure and reversal in the metals is one reason.

Another reason is the failure in the miners to hold Friday’s opening strength. At the open, VanEck Vectors Junior Gold Miners (NYSE:GDXJ) appeared to be breaking out of its triangle and VanEck Vectors Gold Miners (NYSE:GDX) appeared to be breaking out from its flag formation.

From false moves come fast moves and therefore we must be wary of selling in the miners this coming week. In particular, focus on GDXJ’s trendline support (blue arrow). If that breaks, GDXJ could test its March lows.

Precious metals traders and investors should be on guard for more weakness in the days and weeks ahead. We certainly have been early with this call but Friday’s bearish reversal could be the catalyst that starts the decline.

Metals and miners would need to close above Friday’s open to invalidate this analysis. Friday’s reversal in the metals was not a surprise given recent relative weakness in the miners. For precious metals bulls and speculators, continue to be patient and wait for more weakness.

For this year we want to buy weakness, not chase strength. We continue to look for high quality juniors that we can buy on weakness and hold into 2018.