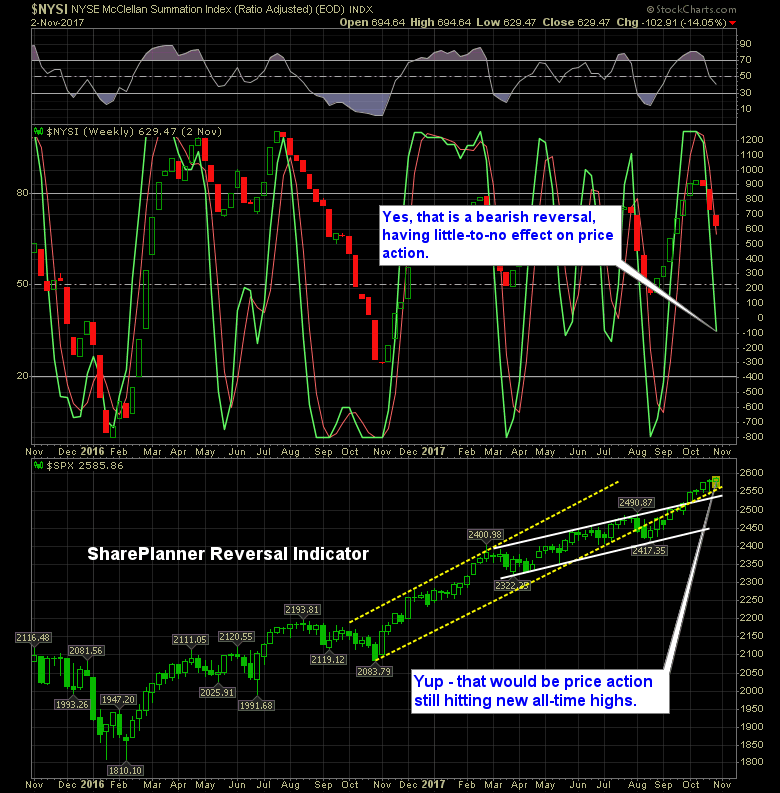

Never before has a bearish indicator meant so little to the market.

Considering how relentless this market has been on trading higher, the SharePlanner Reversal Indicator has done fairly well, relative to other indicators. Two out of the last four bearish signals on the indicator, has spurred on a small amount of selling thereafter. Nothing much, but it did pinpoint the only real selling this market has seen all year long.

But right now, in the middle of a bearish signal on the indicator, the market continues to march higher. Not by much, but some, and essentially making the bearish signal on the SharePlanner Reversal Indicator a mute point.

Perhaps the SPRI is vindicated at the tale end of this reversal signal, but I don't have high hopes for that happening.

Here's the SharePlanner Reversal Indicator: