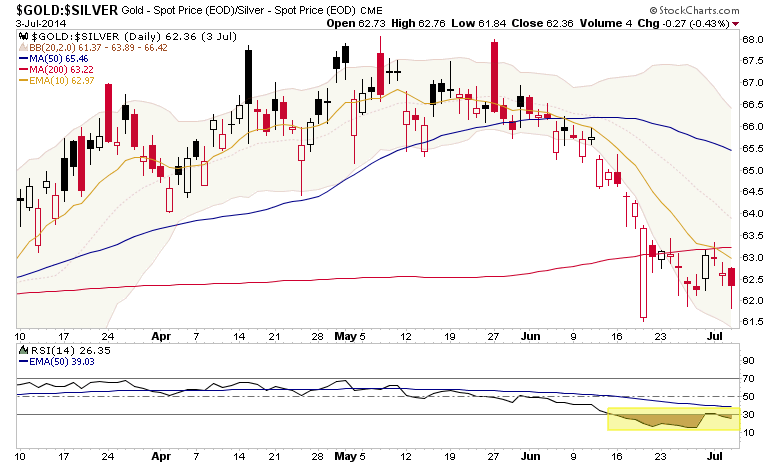

It looks like the machines have been rolling from one speculation to another, long or short. Just this year alone, the Ag’s (via PowerShares DB Agriculture Fund (MX:DBA)) got pumped…

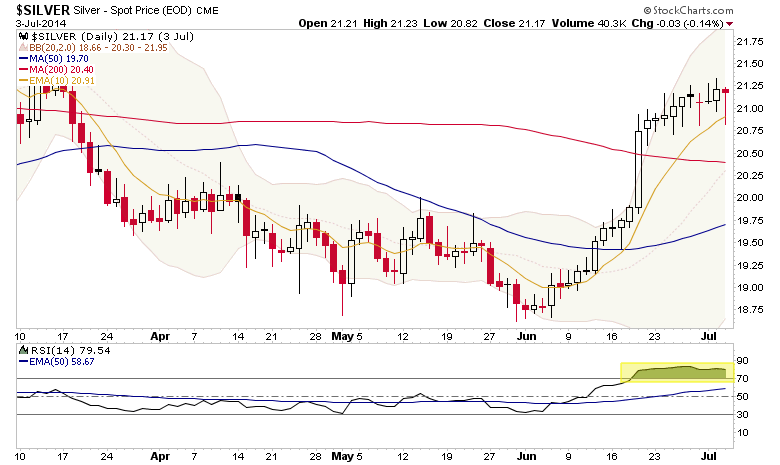

Silver got humped…

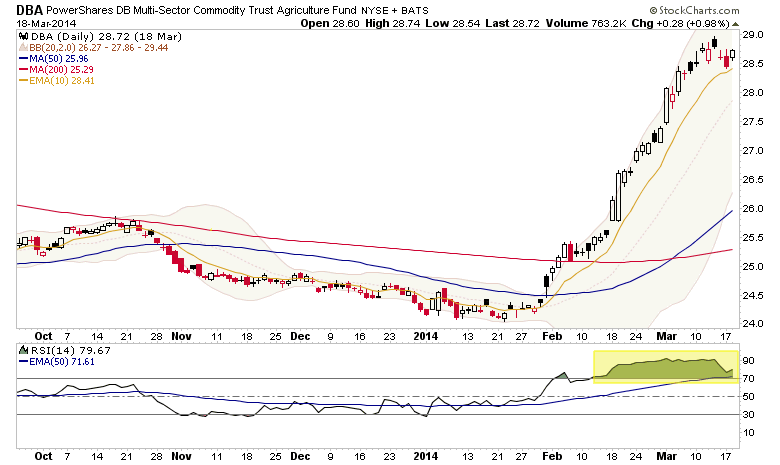

Gold vs. Silver got dumped…

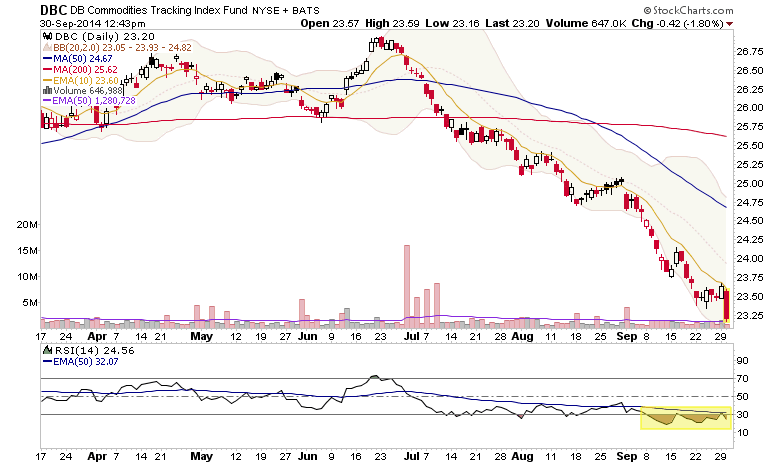

Commodities (via PowerShares DB Commodity Index (ARCA:DBC)) have been wood shedded (and lost major support to boot)…

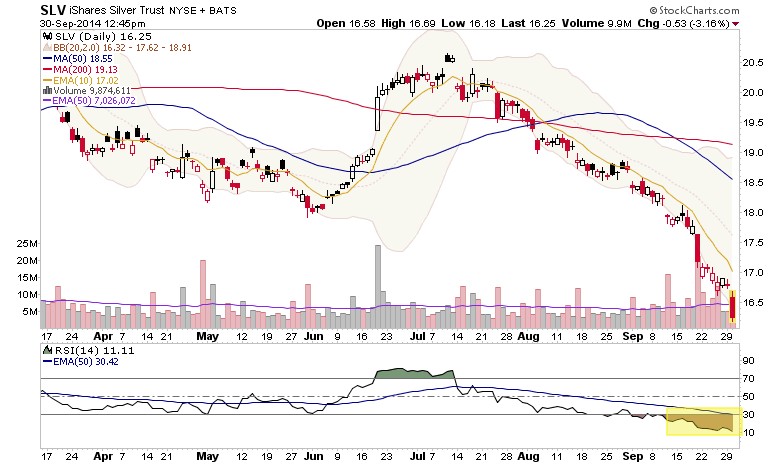

Silver (via iShares Silver Trust (ARCA:SLV)) got blown up (and more and more looks like it is headed for an important bottom, i.e. major capitulation, sooner rather than later)…

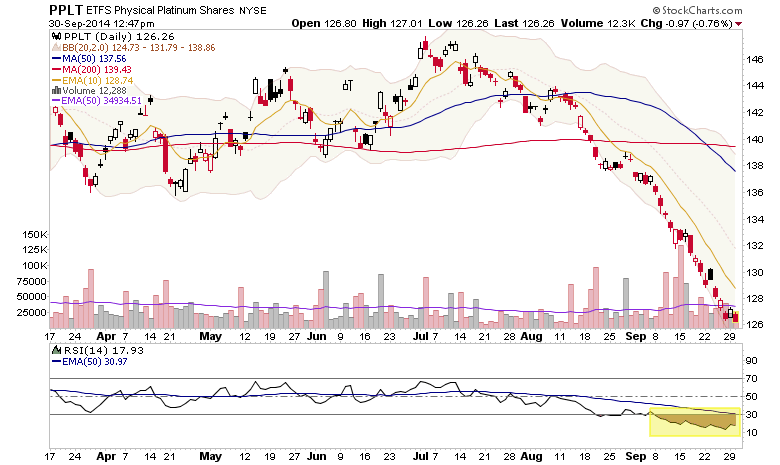

Platinum (via ETFS Physical Platinum Shares (NYSE:PPLT))got destroyed…

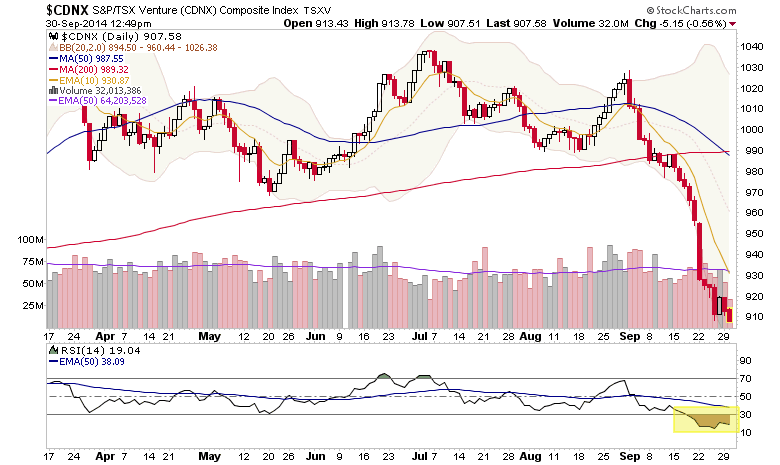

Canadian junk stocks (via the S&P/TSX Venture Composite Index) of all kinds were destroyed…

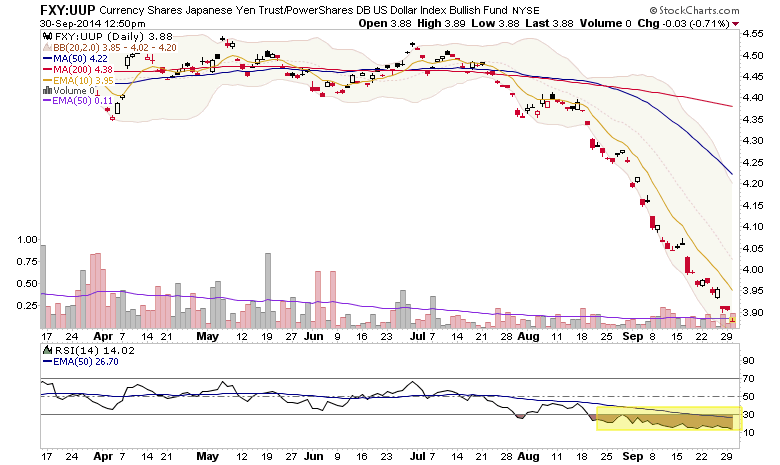

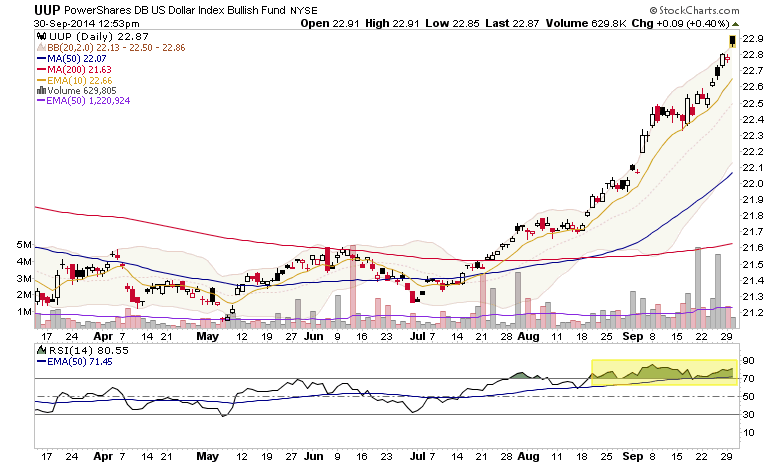

The yen vs. the USD (via RYDEX CurrencyShares Japanese Yen (ARCA:FXY)-PowerShares DB USD Index Bullish (NYSE:UUP)) destroyed, along with nominal yen…

And now we have good old Uncle Buck, the star asset player right now.

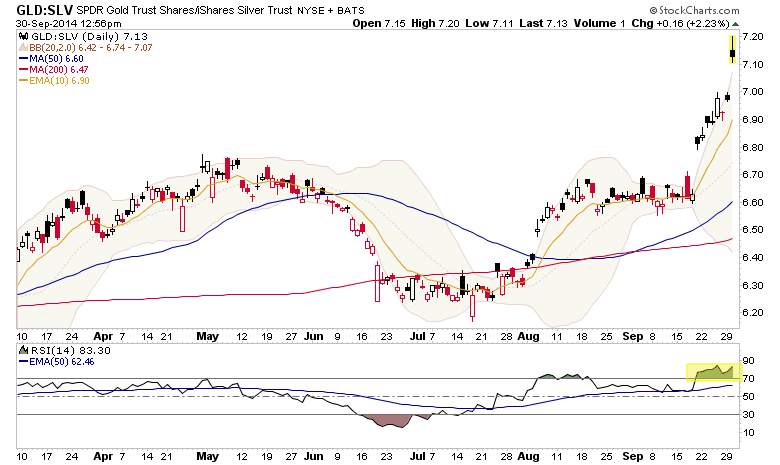

Problem is, we have an indicator that is mimicking Uncle Buck; the Gold-Silver ratio (GSR)…

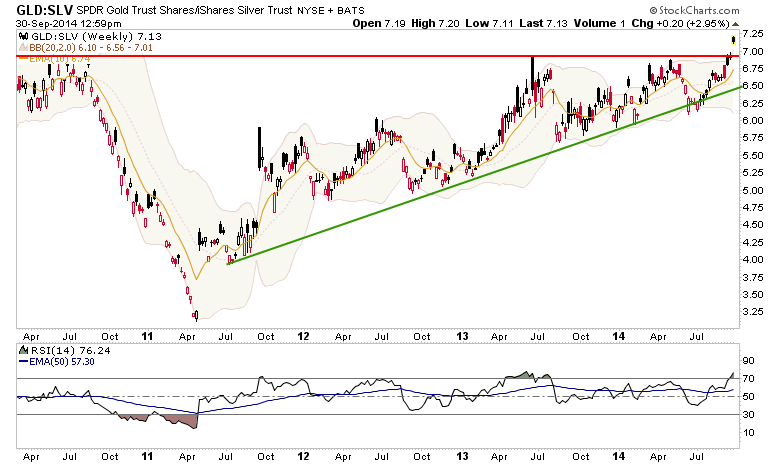

Another problem is, yesterday’s activity is breaking the GSR out above longer-term resistance. We have been monitoring an Ascending Triangle since last year:

If traditional indications hold true, this is very bearish. USD has finally gotten the robo bid from the machines, just like so many assets before it. Only this time, unsurprisingly it comes with some baggage.

Gold rising vs. silver indicates that liquidity is draining out of asset markets the world over. Cyclical commodities and emerging markets, counter cyclical gold… you name it.

US stocks would try to hold up against this with a 90’s style ‘strong dollar’ or ‘king dollar’ story. We’ll remain open minded to that story, but a traditionally bearish indicator is breaking out today. The question is when do we return to a traditional mode in the macro markets? How long can policy inputs keep nontraditional relationships in play?