Forex News and Events

Stay short GBP ahead of BoE meeting

In the wake of the UK vote to leave the European Union, the BoE decided to back away from an immediate response, preferring to wait for the smoke to clear before using its last few shots. Indeed, the BoE will only be able to cut interest a couple of times before reaching negative rates. However, we do not believe the BoE will ease further its monetary policy next week as the available data did not suggest a substantial deterioration of the UK economy since the July meeting. Inflation data surprised to the upside in June with both the headline and the core measure ticking higher. GDP figures released yesterday were rather encouraging as it showed the UK economy grew 2.2%y/y in the second quarter, beating estimate of 2.1% and above previous quarter reading of 2.0%.

The BoE has limited room for manoeuvre before switching to negative interest rates. Therefore we expect the central bank to leave its benchmark rate unchanged at its next meeting on August 4th, waiting for further information about the implication of Brexit for the UK economy. On the other hand, the BoE could increase the target for asset purchases without cutting rates. GBP/USD strengthen slightly in overnight trading in response to a slightly dovish FOMC statement. Overall, the currency pair is still trading sideways with a negative bias.

CBR in an easing cycle but will hold this week

Russia has been grabbing the global news cycle recently allowing the Bank of Russia to conduct operations without much fanfare. We anticipate that for the July meeting the CBR will hold policy unchanged at 10.50%. At its June MPC meeting the central bank cut 50bp from its key rate for the first time in nine month. With inflation moderating to 7.5% y/y and outlook subdued we expect the CBR to further ease monetary policy. However, the pace of cuts will be critical in balancing market confidence with risk of shifting inflations trajectory. A cautions accompanying statement should assist in perception that the CBR is acting conservatively. We anticipate another 100bp worth of cut in 2016 but cut are likely to be staggered. Given the broader risk-taking environment in EM (see rallies in TRY, ZAR and BRL) we forecast RUB will remain firm against the USD, especially considering our base scenario of no Fed hike in September.

Summer heat creates “September” hike delusion

The combination of summer heat and long days sometime makes investors see things that are not there. This is case-and-point with yesterdays Fed rate decision and accompany statement. The fed held policy unchanged as provided in our view a statement in line with expectation. Rumors of a hawkish statement are delusional. The inclusion of the wording "near-term risks to the economic outlook have diminished" are referred by some to predict a “live” September meeting. However, we and the markets remains skeptical that risk contracted but rather increases especially with the Brexit vote and impending US presidential election. The FOMC concerned over weak fixed investment and low inflation expectations will undermine solid job markets and volatile household spending. US treasury yields ending the day lower while EUR/USD rallied to 1.119 indicating markets are skeptical over the Fed perceived optimism. We remain bearish on the USD as expectation for a September hike remains low.

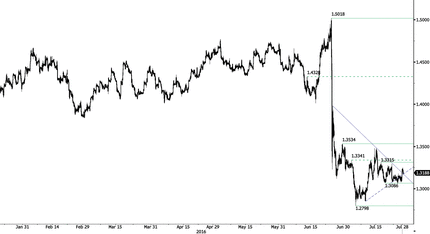

GBP/USD - Range-bound.

The Risk Today

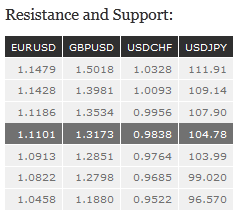

EUR/USD has broken the resistance at 1.1000 declining trendline, suggesting a persistent buying interest. A break of the resistance implied by the top of the range (around 1.1186) is needed to negate the current bearish bias. Hourly support can be located at 1.1149 (15/07/2016 high). An hourly support lies at 1.1056 (27/07/2016 base), while a key support stands at 1.0965. In the longer term, the technical structure favours a very long-term bearish bias as resistance at 1.1714 (24/08/2015 high) holds. The pair is trading in range since the start of 2015. Strong support is given at 1.0458 (16/03/2015 low). However, the current technical structure since last December implies a gradual increase.

GBP/USD continues to move within its channel range. Hourly resistance is located at 1.3291 (22/07/2016 high). Stronger resistance is located at 1.3534 (29/06/2016 high). Support located at 1.3058 (26/07/2016 low). The long-term technical pattern is negative and favours a further decline as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200-day moving average). Key support at 1.3503 (23/01/2009 low) has been broken and the road is wide open for further decline.

USD/JPY made an intraday bearish reversal on Wednesday. Hourly supports can be found at 104.85 (27/07/2016 low).Technical structure bearish features would be supported by a challenge of 103.91 support. Hourly resistance is located at 106.42 We favour a long-term bearish bias. Support is now given at 96.57 (10/08/2013 low). A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems absolutely unlikely. Expected to decline further support at 93.79 (13/06/2013 low).

USD/CHF is declining sharply, breaking the hourly support at 0.9894 (12/07/2016 high). A test of the support at 0.9837 is likely. Another support stands at 0.9764 ((14/07/2016 low). An initial resistance lies at 0.9868 (27/07/2016 bearish pause). In the long-term, the pair is still trading in range since 2011 despite some turmoil when the SNB unpegged the CHF. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours a long term bullish bias since last December.