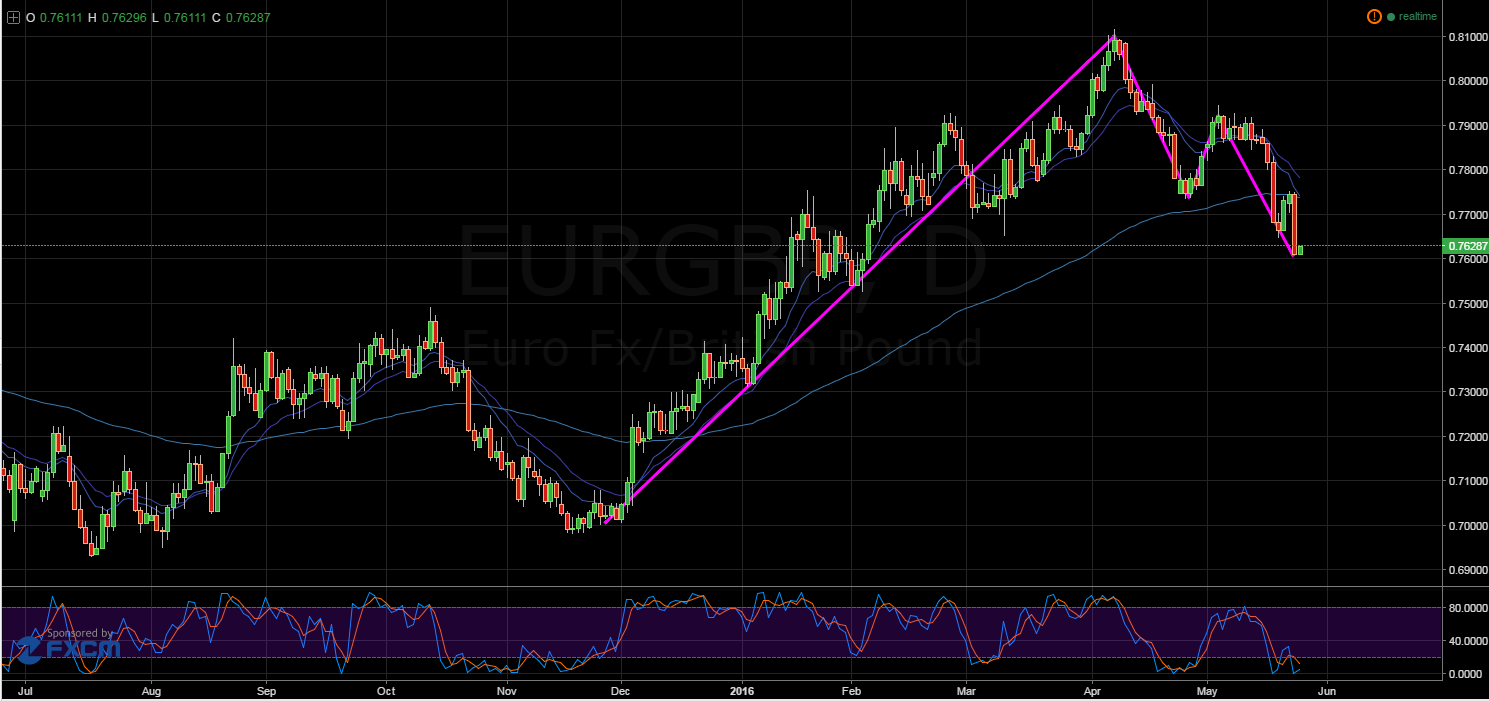

Recent EUR weakness could be signalling that the EUR/GBP is set to remain bearish in the long-term. However, on the pair’s way down, it may have some limited upside potential before it slips again which is worth keeping in the back of one’s mind. Specifically, the recent bearish reversal could be a corrective ABCD or a Bearish Three-Drive pattern. In either case, this means the EUR/GBP could be poised to rally again before pushing lower.

Looking at the daily chart, it’s patently obvious that the EUR/GBP has taken a bearish turn after failing to break resistance at 0.8091. Additionally, it is clear that as the pair moves to the downside it is doing so in a Three-Drive or ABCD corrective pattern. Regardless of which pattern forms, the EUR/GBP should now be moving higher prior to taking another tumble.

What’s more, the pair was likely retracing to the 61.8% Fibonacci level already but was interrupted by the surprise rally of the greenback which saw the EUR collapse. Fortunately, this could give a second chance to those who missed out on the recent rally which came in the wake of last Wednesday's slip. Consequently, the EUR/GBP now looks set to have another go at the 0.7817 price level which coincides with the 61.8% Fibonacci Level.

Furthermore, Stochastic and RSI oscillators are signalling that the pair is presently oversold which will be increasing buying pressure as the session continues. As a result, the EUR/GBP should be buoyed ahead of impending EU fundamental results which could likewise help to push the pair higher.

It’s worth noting, the 100 day EMA is on the cusp of intersecting the 20 day EMA which could initiate a knee-jerk selloff and cause the pair to slide before recovering. However, the crossover here is more likely indicating that the EUR/GBP is becoming long-term bearish and about to retrace and complete a Three-Drive.

Ultimately, the EUR has been weakening for some time but it is unlikely to break the 0.75 support in the short-term. Consequently, we will probably have to wait for the EUR/GBP to retrace before it plunges once again. As a result, it might be worth trying to bag a few pips as the pair recovers on the back of what are likely to be weaker UK figures in the coming week. However, keep watch on the UK GDP results as a strong figure could send the EUR/GBP reeling once again.