Clothing retailer Express Inc (NYSE:EXPR) is continuing this week's onslaught of retail earnings, as the company is scheduled to unveil its second-quarter report before the market opens this Wednesday, Aug. 29. Today, EXPR is up 4.4% at $10.20, catching a lift from the well-received results of fellow retail stock DSW. And in the wake of tomorrow's pre-open report, speculative players are looking for Express stock to make a bigger-than-average move on the charts.

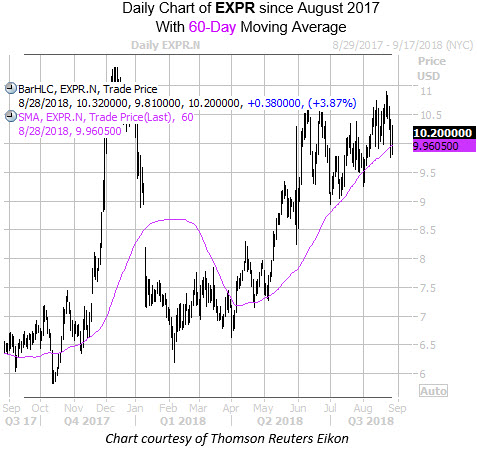

It's already been a volatile year for EXPR. The stock gapped lower in early January after disappointing holiday sales prompted the retailer to slash its full-year forecast, leading EXPR to bottom out at $6.17 at its Feb. 6 session low. The stock has since marched higher along the support of its 60-day moving average, but EXPR has chopped around its year-to-date breakeven at $10.15.

Looking at the stock's earnings history, EXPR has closed lower the day after the company reported in six of the last eight quarters, including a 25.5% plunge in August 2016. Over the past two years, the shares have moved 13.5% the day after earnings, on average, regardless of direction.

This time around, the options market is pricing in a larger-than-usual 16.2% move for Wednesday's trading. Based on the equity's current price of $10.20, that implies a post-earnings close ranging from $8.55 on a downside move to $11.85 on an upside move (which would represent a new 52-week high).

Ahead of earnings, short-term traders have been favoring puts on Express stock. This is per the equity's Schaeffer's put/call open interest ratio (SOIR) of 3.19, which ranks in the 88th percentile of its annual range. This indicates that speculative options players have been more heavily skewed toward puts over calls on EXPR just 12% of the time during the past year.

Likewise, short interest on EXPR represents a substantial 18% of the stock's total available float, or 12.2 times the stock's average daily volume. So while there appear to be plenty of bears betting on a move lower for Express shares, the stock is well-positioned to capitalize on an unwinding of pessimism in the event of an upside surprise tomorrow morning. That said, today's big pre-event rally is reason for contrarians to proceed with caution.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI