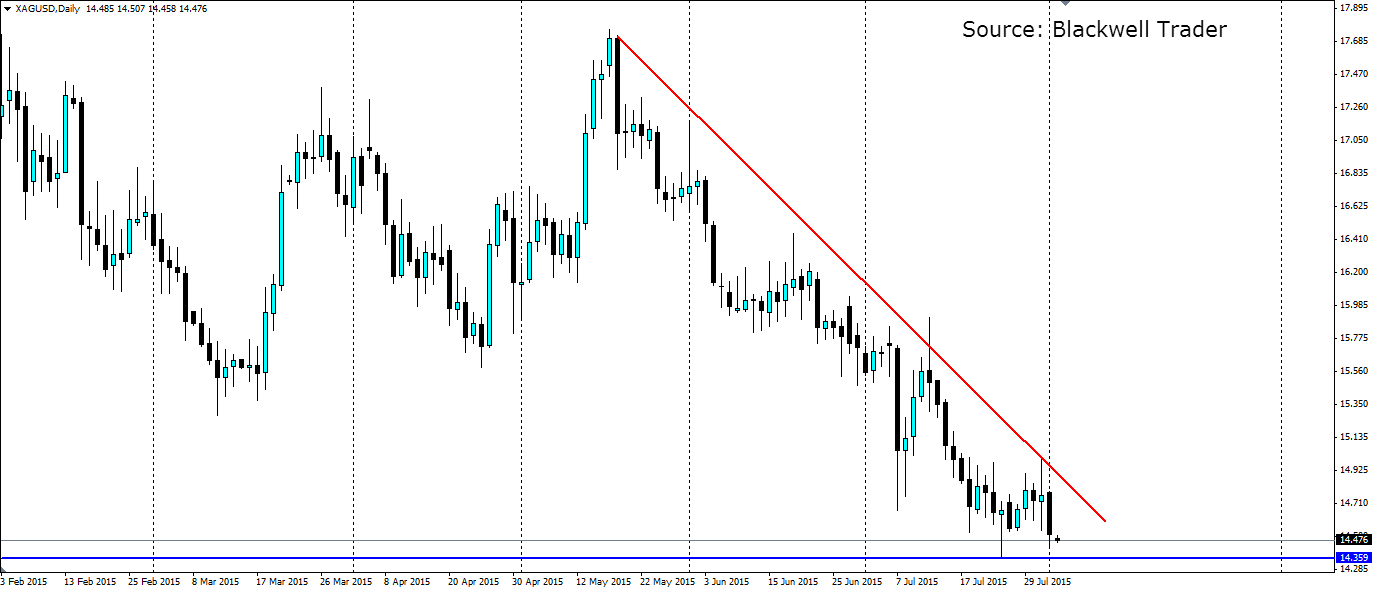

The prospect of a rate rise from the US Federal Reserve in September has all but sealed the fate of Silver recently. The bearish trend has been dominating and the recent 6-year low now looks to be the target.

The sentiment has been undeniable and relentless. The market believes a rate rise in September is inevitable and certainly the Fed is only adding to that speculation. FOMC member Bullard said last week that the Fed was “in good shape” to raise interest rates in September. The data has remained relatively mixed and if the Fed does push ahead with a rate rise, it will be based on the headline Unemployment rate and growth, not inflation.

The US Unemployment rate has fallen to a 6-year low at 5.3% which is certainly a positive for the US economy, but the underlying data remains mixed. Personal income rose by 0.4% vs 0.3% expected, but the prior month was revised lower by 0.1%. Personal spending rose by 0.2% as expected, but the prior month was revised lower to 0.7% from 0.9%. On Friday we saw the slowest pace on record for wage and salary growth since 1982, but the Fed will point to the headline figure when deciding rates.

Growth has remained strong at 2.3% q/q (annualised), however Q1 growth was revised downwards from 0.2% to -0.2%. The winter months are generally slower and the Fed sees this result as robust. Headline inflation is the big problem for the Fed at just 0.1% y/y, largely thanks to falls in the price of fuel. The core CPI is looking a little rosier at 1.8% y/y but the headline figure is a worry.

So will the Fed raise rates and where does this leave Silver? The Fed appears resolute on raising interest rates in September despite the data not demanding it. The Fed needs the breathing room of higher interest rates if a downturn comes and the equity bubble needs some air taken out of it. Silver has been taken close to its 6-year lows thanks to the market’s expectation that the Fed will push ahead with a rate rise.

Leading into the FOMC meeting on September 16th-17th we will likely see an increase in volatility in Silver and traders and banks will take their positions. Keep in mind that we haven’t seen a change to interest rates since December 2008, so the market will be fizzing at the prospect of a rate move. Silver generally moves inversely to interest rates because it doesn’t pay a return, so higher interest rates make bonds more attractive. It is safe to assume that if we see a rate rise, the bear trend will likely deepen.

Until then, keep an eye on the support at $14.359 an ounce. This is likely to come under heavy pressure as the speculation only grows. If this line fails under the expected volatility, stops will be triggered and it will provide a nice breakout play for anyone looking to take advantage of the short bias.

Silver has been dominated in recent months by a bearish trend thanks to the market expecting a rate rise from the Fed. The data doesn’t necessarily call for a rate rise, but the speculation is that the Fed will push ahead anyway. This is only going to lead to further bearish moves in Silver.