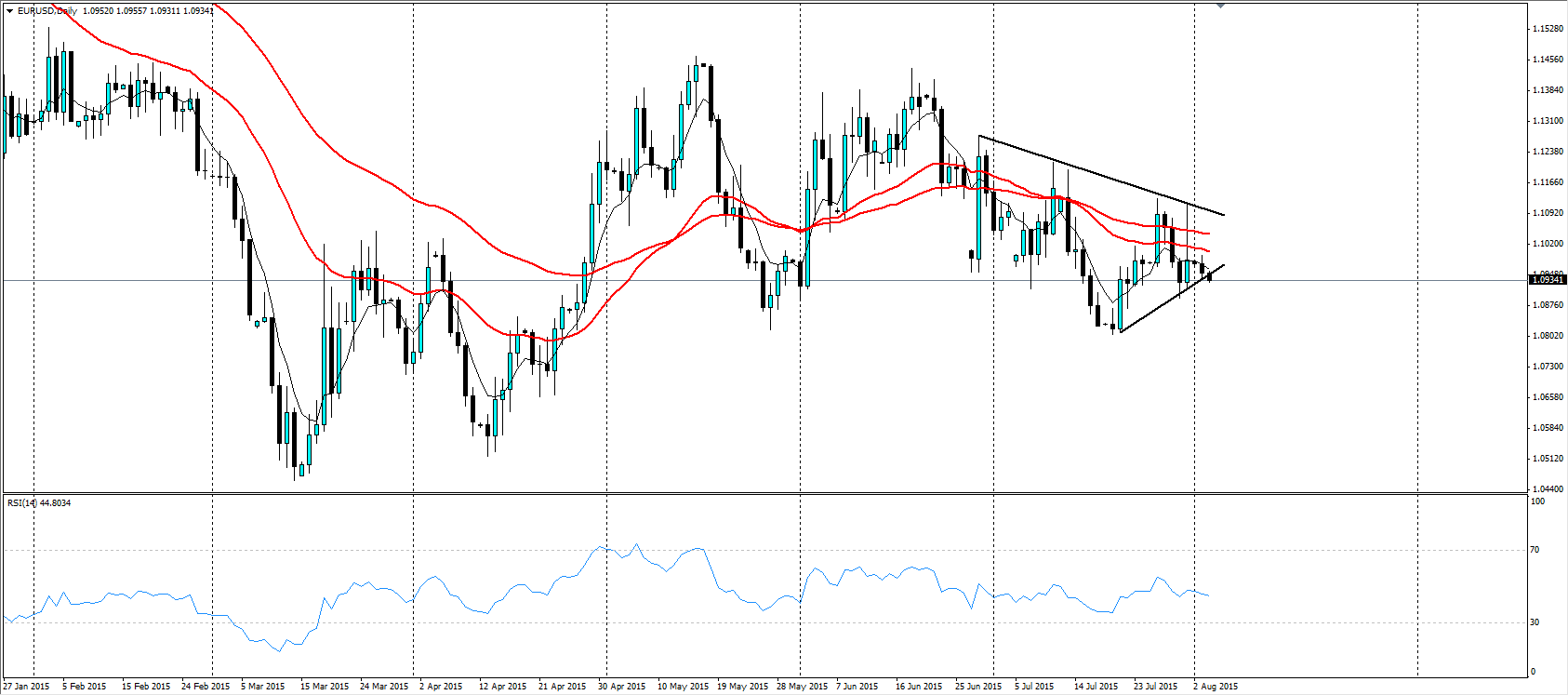

The euro has continued to feel the selling pressure this week as the market’s focus shifts towards a resurgent US dollar. The euro has subsequently drifted lower whilst its price action has formed a distinct wedge pattern on the daily chart. Considering the lows are getting lower, it might be time for the euro to experience a squeeze to the short side.

In a week that includes a slew of U.S economic figures, including the closely watched Non-Farm Payroll data, the market is looking for any sign of strength that the Fed may use to stump up their case for a rate rise.The pair is subsequently under considerable scrutiny as traders look for a reason to short the currency.

For now, the euro’s price action is squeezed between a wedge pattern that will be decisive in the coming days. Today’s morning Sydney session saw price action decline strongly to challenge the bottom of that wedge formation. The moving averages also tell a story of bears firmly in control as the price action, as well as the 30EMA, remains firmly below the 60EMA.

Source: Blackwell Trader

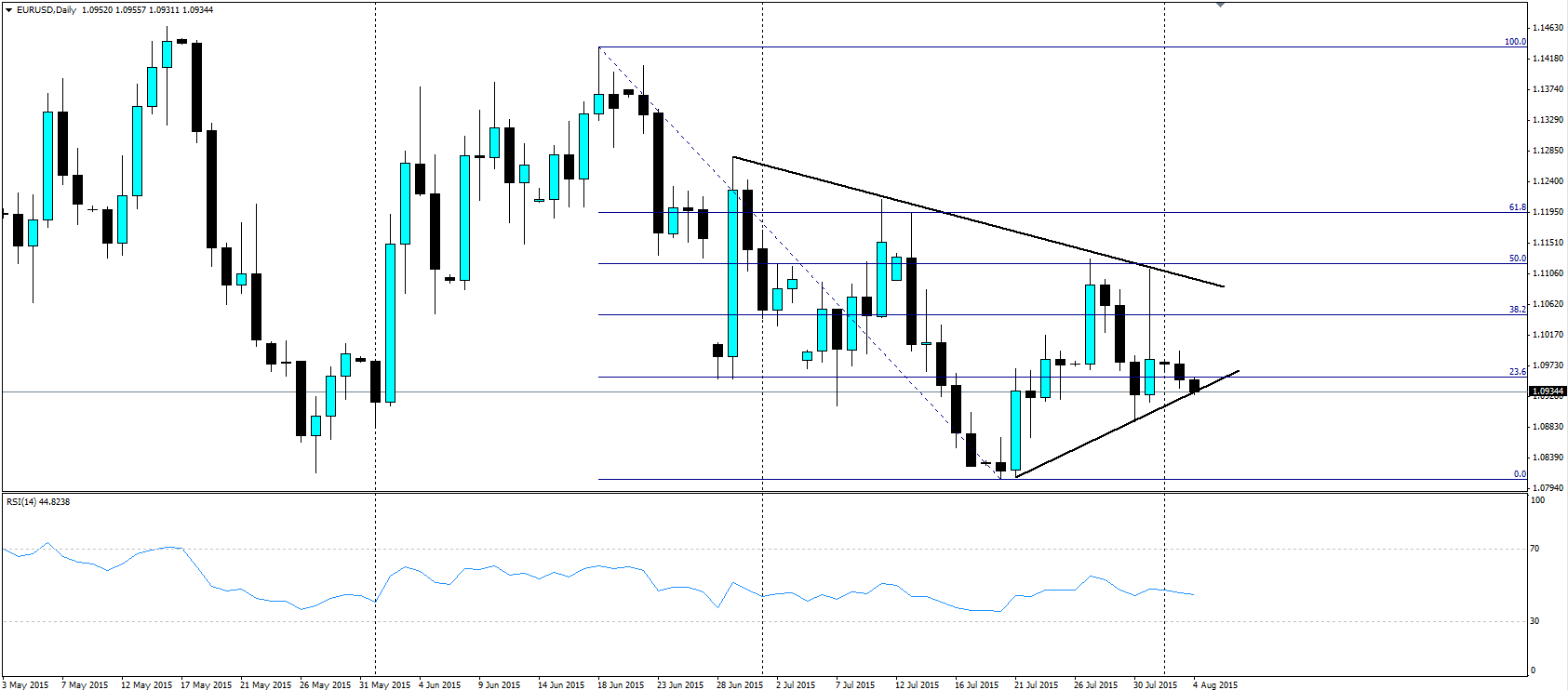

Taking a look at our RSI oscillator also shows an indicator starting to slip lower from within neutral territory. It is also encouraging that the pair has just managed to fall through the 23.6% retracement level on the daily charts. The evidence is subsequently pointing towards any breakout possessing a short side bias.

Source: Blackwell Trader

Moving forward it is likely that pressure will continue to build for a downside push in the coming sessions. If we do indeed see a definite breakout of the current wedge we could see prices sharply correcting towards support at 1.0888. However, wedge squeezes are often difficult to predict and traders should keep a close watchon false breakouts.

Ultimately, the factors are likely to favour a bearish bias but it is important to closely monitor the U.S. economic data due out this week. The U.S. Trade Balance and Non-Farm Payroll figures are likely to show some strength and subsequently should be watched closely as it is highly probably that the results will impact the currency.