Investing.com’s stocks of the week

On to our first (complimentary) daily technical report…

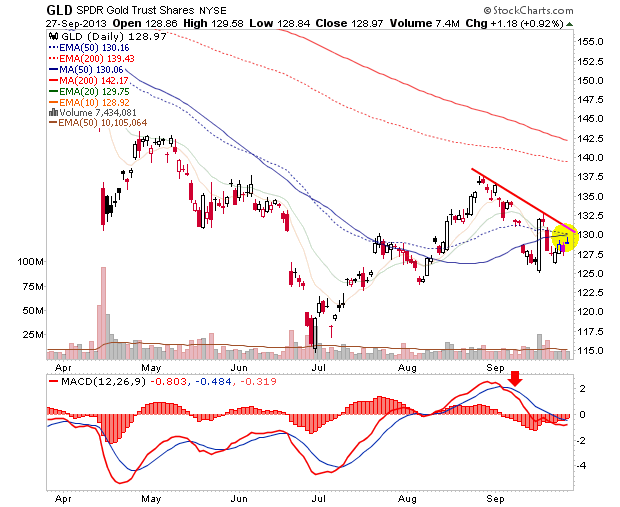

GLD is on a bear signal with MACD triggered down, below zero and price below a short term downtrend line and the 50 day moving averages.

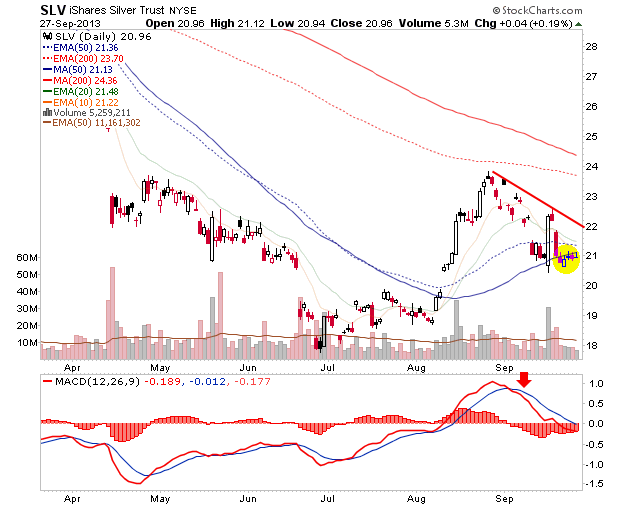

SLV is on a bear signal with MACD triggered down, below zero and price below a short term downtrend line and the 50 day moving averages.

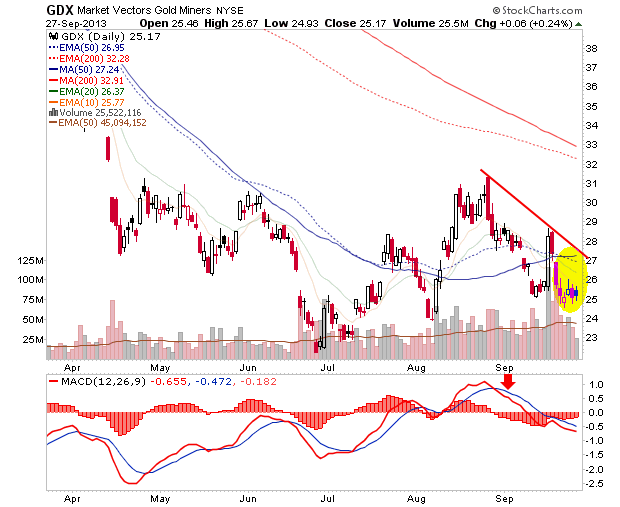

GDX is on a bear signal with MACD triggered down, below zero and price below a short term downtrend line and the 50 day moving averages.

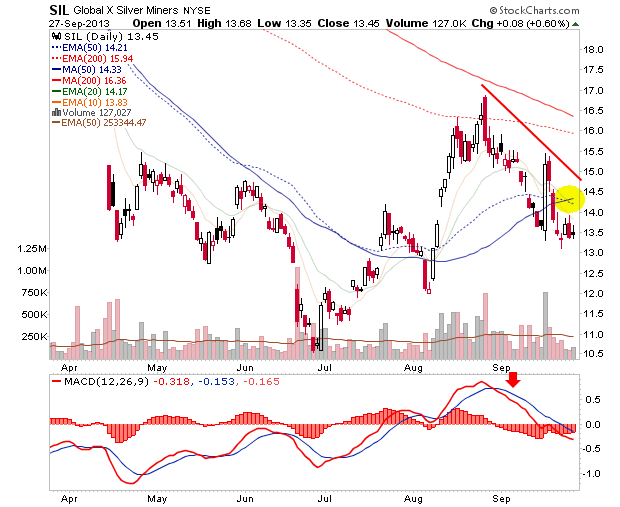

SIL is on a bear signal with MACD triggered down, below zero and price below a short term downtrend line and the 50 day moving averages.

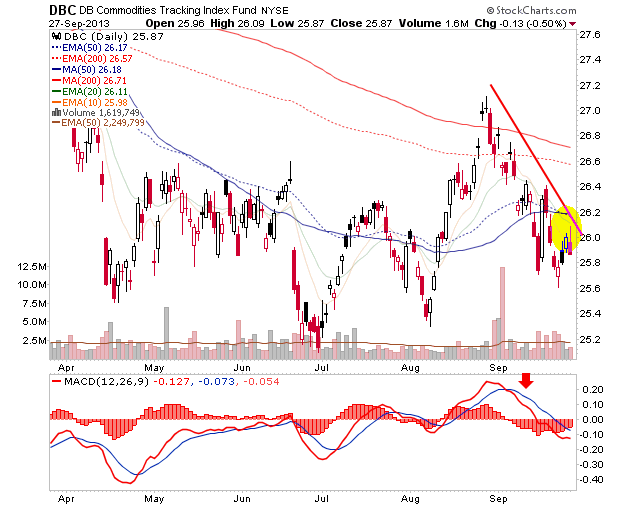

DBC is on a bear signal with MACD triggered down, below zero and price below a short term downtrend line and the 50 day moving averages.

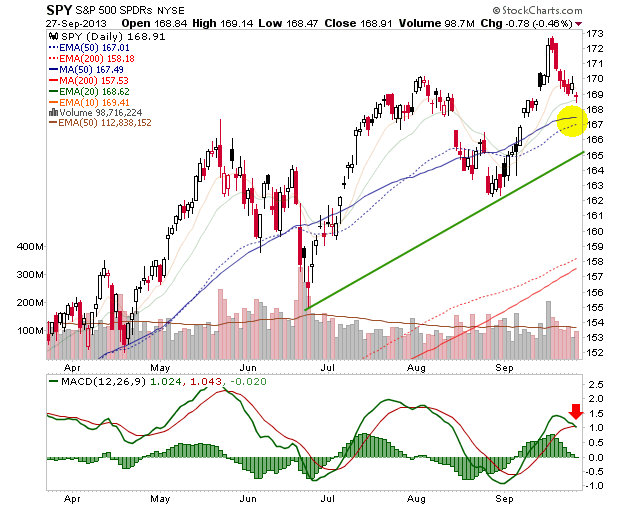

SPY is on a bull signal with MACD triggering down but above zero and price above a short term uptrend line and the 50 day moving averages.

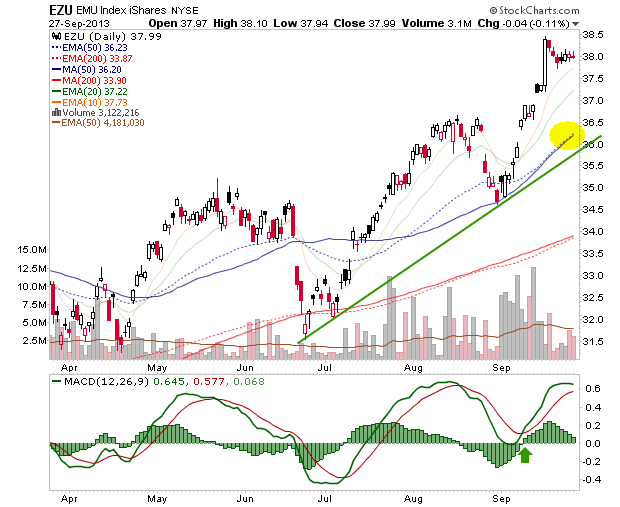

EZU is on a bull signal with MACD triggered up, above zero and price above a short term uptrend line and the 50 day moving averages.

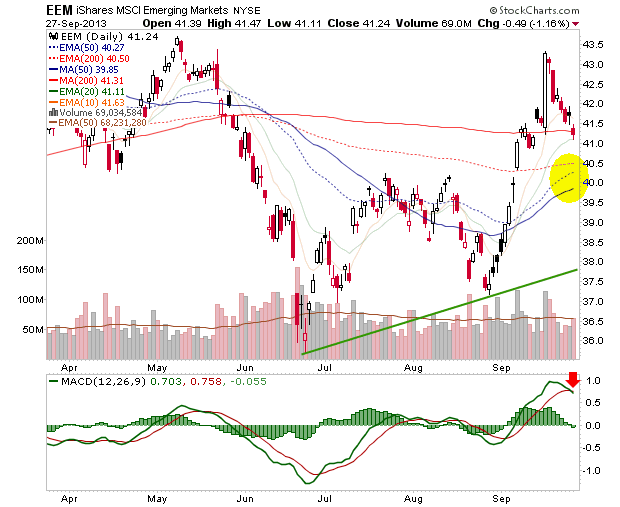

EEM is on a bull signal with MACD triggering down but above zero and price above a short term uptrend line and the 50 day moving averages.

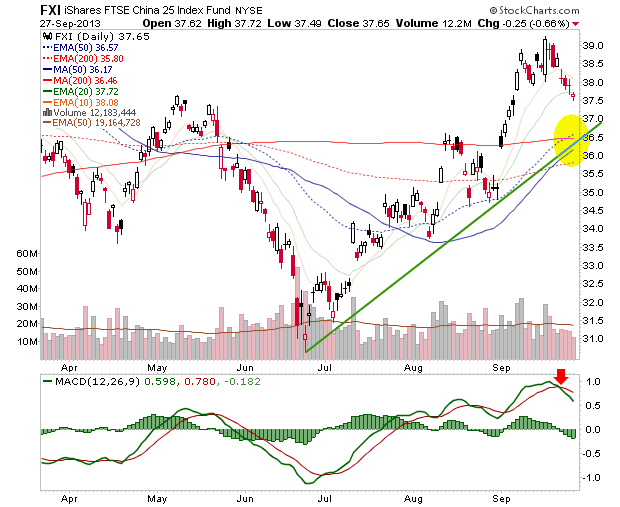

FXI is on a bull signal with MACD triggering down but above zero and price above a short term uptrend line and the 50 day moving averages.

I look forward to providing NFTRH subscribers with an ongoing view from this clear and simple shorter term perspective to go along with our usual macro fundamental and longer term work.