Weyerhaeuser (WY) isengaged in the growing and harvesting of timber and the manufacture, distribution and sale of forest products, real estate development and construction, and other real estate related activities. The company has four business segments including timberlands; wood products; pulp, paper and packaging; and real estate and related assets.

The company has a market cap of $22.5 Billion and has a Forward PE of 32. The high valuation is why the stock sports a Zacks Style Scores of “F” in Value. The company has 3-5 year growth rate of 5% and why the stock sports a Zacks Style Scores of “D” in Growth. The stock does pay dividend yield of 4.12%, but that’s about the only positive for the company as stock has been missing revenue expectations and seen falling estimate revisions. These issues are weighing on the stock making it a Zacks Rank # 5 and today’s Bear of the Day.

Earnings

Weyerhaeuser reported Q1 earnings on May 6h, seeing EPS at $0.24 verse the $0.20 expected. The missed on revenue, seeing $1.84 Billion verse the $1.93 Billion expected. The initial reaction to the report was somewhat muted, but investors have sold the stock in the month after as forward looking estimates were being revised downward.

Estimates

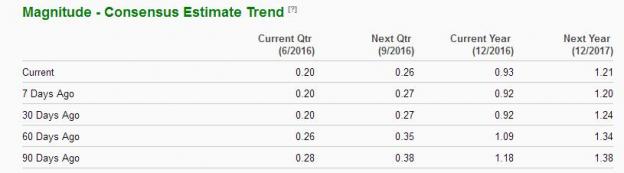

Over the last 60 days, the Weyerhaeuser has seen estimates fall for all time periods. For fiscal year 2016 estimates have fallen from $1.18 to $0.93 or 21%. For 2017, analysts have taken their numbers down 12% from $1.38 to $1.21.

Earnings are on July 29th and investors would be wise to sell and even potentially short the recent bounce in anticipation of further momentum lower.

A Better option

If investors want exposure to the lumber, building material or wood space they would be better going with Louisiana-Pacific(LPX). The company is a Zacks Rank #1 (Strong Buy) that manufactures building materials and engineered wood products in the United States, Canada, Chile and Brazil. The Nashville based company has about 5,000 employees and a market cap of 2.5 Billion. LPX has a Zacks Style Score of “B” in Momentum and is seeing earnings estimates revised higher.

LPX reported an EPS beat on May 9th and beat EPS and missed on revenue. The stock is up over 30% from its 2016 lows. The company reports Q2 earnings on August 2nd.

Note:Want more articles from this author? Scroll up to the top of this article and click the FOLLOW AUTHOR button to get an email each time a new article is published.

WEYERHAEUSER CO (WY): Free Stock Analysis Report

LOUISIANA PAC (LPX): Free Stock Analysis Report

Original post