I last profiled Jamba Inc. (JMBA) as the Bear of the Day in early November after they reported a weak 3rd quarter. In January, the stock slipped back to a Zacks #5 Rank so I want to revisit that report because one theme since then could continue to weigh on the company's efforts and its stock price.

That theme is record cold for much of the nation. The company noted weather as an adverse factor for the quarter that ended with the tail end of summer, so I'm wondering if we will hear and see the same in the coming sales report due in early March.

JMBA, through its subsidiary Jamba Juice Company, offers delicious blended beverages, juices, and fruit smoothies. The company reported third-quarter EPS of $0.15 cents missing the consensus of 18 cents by 16.7% and the year-ago quarter’s earnings of 21 cents by 28.6%. But it was the forward guidance, as we shall see, that really tasted sour.

Total revenue in the quarter was down 6.3% year over year to $61.4 million owing to the decline in company sales and lower comps. Quarterly revenues were also below the Zacks Consensus Estimate of $62 million by nearly 1%.

Less to Squeeze?

The company could offer a host of reasons to explain the sales and profits dip, including the uncertain economic and political environment, which may have led cash-conscious customers to spend less on eating out. Adverse weather in some major markets also seems to be responsible for such disappointing results in the third quarter.

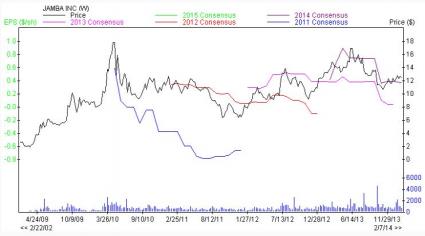

But the bottom line for food, just like fashion, is that customers can be fickle and the competition can be fierce. With new venues like Protein Bar in Chicago offering healthy, delicious, and fast shakes, the Jamba appeal may be less juicy. And the Zacks Price & Consensus chart below shows what the analysts think of the numbers going forward...

3rd Quarter Highlights

Sales at the company stores dropped 7.6% year over year to $57.1 million in the third quarter. Comps (same-store sales) in the quarter were mostly affected by low consumer spending, inclement weather in major markets and stiff competition. Failure of some marketing campaigns has also been held responsible for such lower sales results.

Franchise and other revenues were up 15.8% year over year to $4.3 million, driven by increased royalties. CPG and JambaGO revenues were $0.8 million as against $0.7 million in the year-earlier quarter.

Comps at franchise-operated restaurants declined 1.3% during the third quarter versus comps growth of 1.0% in the year-ago quarter. System-wide comps were down 3.4% as against the year-ago quarter’s comps growth of 2.5%. Operating margin decreased 150 bps year over year to 5.4% due to lower top line.

Store Update

Jamba operates 849 stores including 517 franchised and 287 company-owned units. The company unveiled 26 franchised restaurants in the domestic market and three stores at international locations. During the quarter, they introduced JambaGO machines in 1000 markets, bringing the total number of JambaGO served locations to 1,800.

The company plans to set up 60–80 stores in the U.S. and international market in 2013 as well as in 2014. They also intend to add JambaGO stations in another 1,000 new locations by the end of 2014.

Chilly Outlook

Emeryville, California-based Jamba lowered its guidance for 2013 following the lackluster third-quarter results. The company said it expected company-owned comps to be flat to up 1% vs 4-6% expected. Store-level operating margin was estimated to be 16%–17%, down from 20%. Operating margin was guided in the range of 1% to 2%, down from the prior expectation of 2.5%–3.0%.

This outlook made it easy for analysts to slash their growth estimates. So, while the store growth and innovation in the form of JambaGO stations are impressive, most investors still need to see the earnings estimates turn back up before they can get really excited about this juicy story again.

On January 13, the company reaffirmed this guidance, including comparable store sales guidance range of flat to 1%. The company also released strategic priorities and initiatives that will guide Jamba's growth in 2014. Jamba expects to achieve the following results for fiscal 2014:

Deliver positive company-owned comparable store sales of 2%-4%

Deliver store-level margin of 18% to 19%

Achieve income from operations of 2.0% to 3.0%

From the company press release...

"Our 2014 priorities provide continuity and a blueprint for focusing our resources. Important drivers of our growth initiatives will be a dramatic expansion of our exciting whole food blending and premium juice beverages, continued rapid global store growth and the leveraging of our significant JambaGo® opportunities. In addition, Jamba is pursuing an enterprise-wide cost savings initiative that will result in a 100 - 200 basis point improvement in operating margins."

Potential Sunshine

In early January, Jamba announced that the company entered into a master franchise development agreement with Foodmark, the Food and Beverage division of Landmark Group, to develop 80 Jamba Juice stores across the Middle East region over the next ten years. The first Jamba Juice store is expected to open in Dubai in 2014.

This might explain the stock's rise from below $11 to $13 in the past few months. Also helping in January were an upgrade from Dougherty and Company and on January 27 an SEC filing revealed that Glenhill Advisors took a 5.2% passive stake.

Whether there is value in JMBA shares at these levels remains to be seen and I'm not giving them the benefit of the doubt. I'll wait for the next earnings report card to decide otherwise.