The battle lines over the future of Tesla (NASDAQ:TSLA) (TSLA) are fought daily among traders, institutional investors, and investment bank analysts.

Tesla, Inc. (TSLA): Free Stock Analysis Report

Original post

Zacks Investment Research

The spectrum of views run from "the most revolutionary energy company ever" to an unsustainable dream built on cheap, and soon to be crushing, debt loads.

I'm not here to take a side in this war of words and wealth today, but to share the single metric that has recently made TSLA a Zacks #5 Rank Strong Sell.

That metric is the momentum of earnings estimate revisions by Wall Street analysts. Every day, Zacks collects the latest changes up or down in analyst profit projections and funnels them into an algorithm that weights the magnitude and agreement of the revisions.

So we not only produce a consensus EPS estimate (that is also weighted by the most accurate analysts and most recent revisions), but we also pit over 4,000 stocks against each other to determine the relative strength and direction of those revisions.

I like to call it a "bell curve cage match" because we end up with thousands of stocks distributed accordingly:

The top 5% of upward EPS revisions earn a Zacks #1 Rank (Strong Buy) rating.

The next 15% of upward EPS revisions merit the Zacks #2 Rank (Buy) rating.

The middle 60% of stocks earn the Zacks #3 Rank "neutral" rating because the magnitude and/or agreement of recent revisions was of low impact for investors.

Below this average group, the downward EPS revisions start to stand out in terms of magnitude and agreement, with the bottom 20% of stocks earning either a Zacks #4 Rank or #5 Rank (bottom 5%).

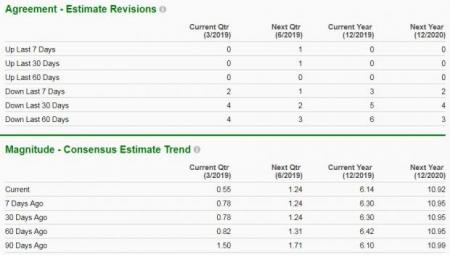

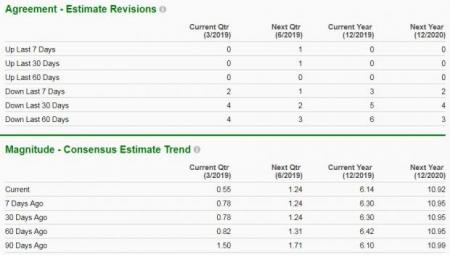

And that's where TSLA finds itself today in the dungeon of the Zacks Rank because the recent downward EPS revisions by analysts were worse than 95% of all other stocks. Here's the current view from the Zacks Detailed Estimates Page...

You can see above that in the past 60 days (the key window for the Zacks Rank calculation), the majority of 8 covering analysts for who we have EPS revisions have all lowered their profit estimates to drive the consensus down from $6.42 to $6.14 for the current year.

Now that's only a 4.4% drop, so the magnitude wasn't big. But the agreement among analysts definitely was significant.

Beyond Agreement and Magnitude, though, are two other quantitative factors in the Zacks Rank algorithm: Upside potential based on the most accurate (or most recent) revisions and Surprise history. Both of these also come up negative for TSLA earnings momentum...

Note that for the current year, one analyst is far more bearish that the crowd with his or her EPS estimate of $4.81 for 2019, implying a potential 21.7% negative surprise.

And regarding actual historical surprises, we see that despite making a big swing to profitability last year, Tesla delivered an earnings miss of 7.2% in Q4. Upside and surprises have smaller weightings in the Zacks Rank algorithm, but they do have an impact relative to their base effects.

Bottom line: Traders can have any fundamental or technical view they wish about TSLA shares, but they will always do better by adding a consistent and unemotional quantitative metric used by institutional investors around the globe. The ranking of stocks by earnings estimate revisions produces a key relative strength metric -- the Zacks Rank -- that gets you on the right side of short-term EPS momentum, up or down.

Zacks' Top 10 Stocks for 2019

In addition to the stocks discussed above, wouldn't you like to know about our 10 finest buy-and-holds for the year?

From more than 4,000 companies covered by the Zacks Rank, these 10 were picked by a process that consistently beats the market. Even during 2018 while the market dropped -5.2%, our Top 10s were up well into double-digits. And during bullish 2012 – 2017, they soared far above the market's +126.3%, reaching +181.9%.

This year, the portfolio features a player that thrives on volatility, an AI comer, and a dynamic tech company that helps doctors deliver better patient outcomes at lower costs.

Tesla, Inc. (TSLA): Free Stock Analysis Report

Original post

Zacks Investment Research