Casella Waste Systems (CWST) is a Zacks Rank #5 (Strong Sell) and it is the Bear of the Day. I still like this name as I held it in Home Run Investor, a newsletter service that looks for small and mid cap growth stocks. I recall this name being in the portfolio a few times and may have even started out in Stocks Under $10, another service that I manage here at Zacks.

The stock still sports the growth and value divergence that I love to see. CWST has an A for Growth and a D for Value, and that tells me right away that I am on the right path. Growth investors and value investors are looking for different things so when I see a big difference between the style scores I know that I am looking at the right thing.

CWST has a chance to change the story with earnings coming out on 2/21 after the close.

Earnings History

I see that over the last four quarters there were two misses, a meet and a beat. That isn't the best I have ever seen but it isn't the worst either.

Earnings Estimates

I see estimates falling and that is what you would expect from a Zacks Rank #5 (Strong Sell) stock. The current quarter has seen the Zacks Consensus Estimate move from $0.15 to $0.11 over the last 90 days.

I see the 2018 full year number move to $0.62 from $0.68. That is just a few cents, but the direction is the real issue.

The 2019 numbers have come in just a little, from $0.90 to $0.85... but that could all change with a strong report later this month.

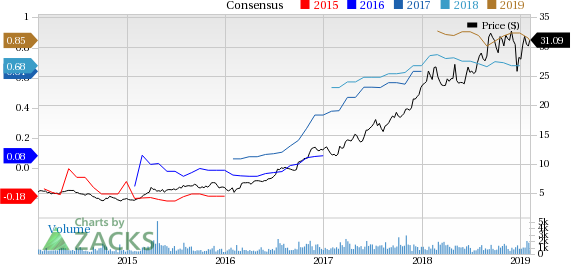

Chart

Zacks' Top 10 Stocks for 2019

In addition to the stocks discussed above, wouldn't you like to know about our 10 finest buy-and-holds for the year?

From more than 4,000 companies covered by the Zacks Rank, these 10 were picked by a process that consistently beats the market. Even during 2018 while the market dropped -5.2%, our Top 10s were up well into double-digits. And during bullish 2012 – 2017, they soared far above the market's +126.3%, reaching +181.9%.

This year, the portfolio features a player that thrives on volatility, an AI comer, and a dynamic tech company that helps doctors deliver better patient outcomes at lower costs.

Casella Waste Systems, Inc. (CWST): Free Stock Analysis Report

Original post

Zacks Investment Research