The top stocks are often found top industries. It makes sense because if the whole industry is doing well, individual companies are likely to experience the same tail winds as other companies within that industry. At the same time, stocks in industries which are struggling can face headwinds that make it very hard to consistently deliver profits. Today’s Bear of the Day is a stock that’s in a struggling industry.

Today’s Bear of the Day is Zacks Rank #4 (Sell) Canon (CAJ). Canon Inc. manufactures and sells office multifunction devices (MFDs), plain paper copying machines, laser and inkjet printers, cameras, diagnostic equipment, and lithography equipment. The company operates through four segments: Office Business Unit, Imaging System Business Unit, Medical System Business Unit, and Industry and Others Business Unit.

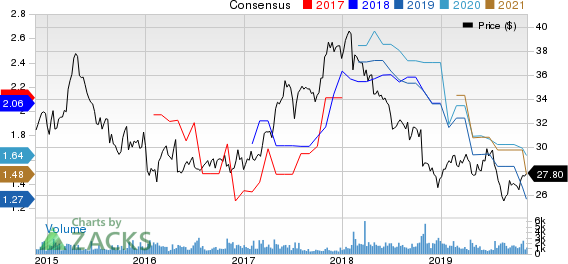

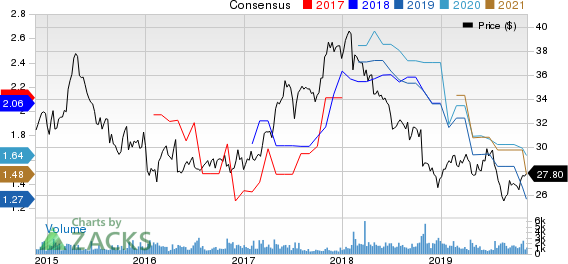

Canon, Inc. Price and Consensus

Canon is in the Office Automation and Equipment industry that currently ranks in the Bottom 4% of our Zacks Industry Rank. The stock itself is a Zacks Rank #4 (Sell). The reason for the unfavorable rank stems from the series of negative estimate revisions coming from analysts. Over the last ninety days, two analysts have cut their earnings estimates for the current year and next year. The bearish moves have made a negative impact on our Zacks Consensus Estimates. The current year estimate has come down from $1.55 to $1.28 while next year’s number is off from $1.73 down to $1.64.

The negative estimates have made an impact on the stock price. Canon was trading near $40 in early 2018. That was before estimates started coming down. A quick look at the Price and Consensus Chart shows estimates going in a negative direction since then. It should come as no surprise that the stock has been tumbling since then. Lately, there’s been a bit of divergence. Over the last few months, CAJ has rallied from $25 to nearly $28. At the same time, estimates have continued to fall. That is troubling sign for long-term holders of the stock.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our just-released Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

Download Free Report Now >>