Applied Materials (NASDAQ:AMAT) recently reported earnings that beat the Zacks Consensus Estimate. The problem is they guided next quarter below the consensus and when the consensus falls, so does the Zacks Rank. Let's take a look at the details in this Bear of the Day article.

Description

Applied Materials offers a diverse array of flexible service solutions to increase equipment uptime and factory efficiency, enabling fabs to focus on chip production, while lowering cost per wafer. The Company's display service portfolio has been developed to address the customers' specific needs and offers a variety of services that provide support for every maintenance activity on an Applied Materials display tool. Applied Materials is committed to the success of the customers throughout the product and factory life cycle and their crystalline silicon solar (c-Si) services enable the customers to focus on increasing cell efficiency and meeting factory goals.

Recent Report

I see the company beating the Zacks Consensus Estimate of $0.79 by $0.02 for a 2.5% positive earnings surprise. That is good to see, but Wall Street cares more about what you will do than what you have done.

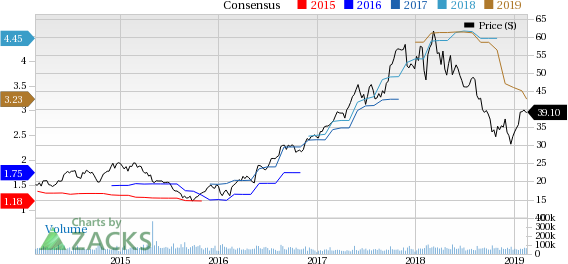

The company guided next quarter EPS of $0.62 to $0.70 and that was well below the $0.78 estimate at the time. In fact, the number for this quarter was $0.82 60 days ago and came in by a penny as of 30 days ago. A week ahead of earnings the number was $0.78 so you can see estimates were softening ahead of the report.

The next quarter has also seen a shift lower in estimates with the Zacks Consensus Estimate dropping from $0.90 to $0.78 over the last 90 days.

Implied Earnings Growth

The full year earnings estimate for fiscal 2019 has dropped from $3.64 to $3.23, and that will send you to the low end of the Zacks Rank.

There is hope though, as fiscal 2020 is looking for $3.94 in EPS so there is some implied earnings growth ahead for AMAT.

Chart

Is Your Investment Advisor Fumbling Your Financial Future?

See how you can more effectively safeguard your retirement with a new Special Report, “4 Warning Signs Your Investment Advisor Might Be Sabotaging Your Financial Future.”

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Original post

Zacks Investment Research