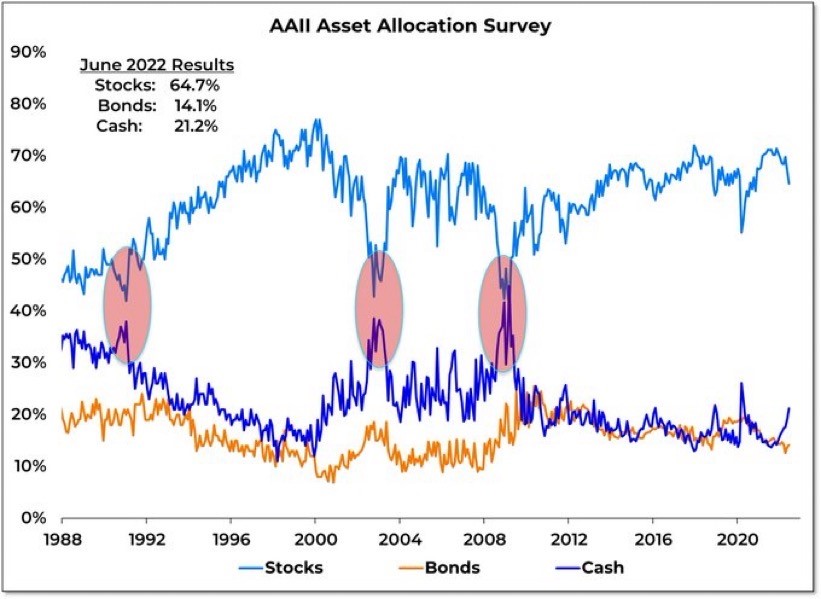

In recessionary bear markets, individual investors dramatically lower their stock allocation. In the 2000-2002 bear, individual investors dropped their stock allocation all the way down from 75% to nearly 40%. In the 2007-2008 financial crisis, the equity allocation went from 65% to 40%.

In other words, individual investors need to throw in the proverbial towel before a stock bear can run its course. They need to sell in droves.

Here in the 2022 stock sell-off? Individual investors have only reduced the stock percentage from 70% to 65%.

That’s not capitulation.

Additionally, stocks are still expensive on a wide range of measures. On price-to-sales:

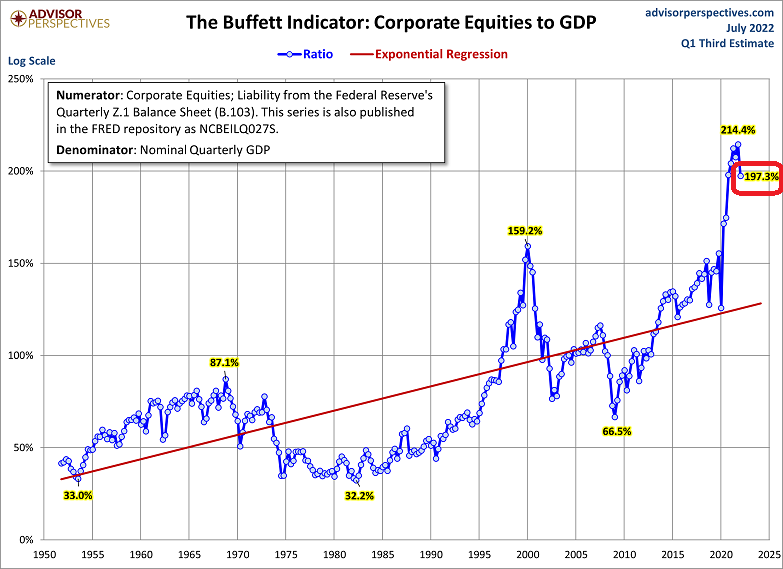

On market capitalization to GDP:

Not that bonds are cheap, but they have not been this attractive relative to stocks in over a decade.

In fact, if history rhymes, bond prices will have to gain a whole lot of ground before the current stock bear goes for an extended slumber. Across previous bear markets, the 10-year Treasury yield fell an average of 125-140 basis points from the top. (Bond prices gain when yields fall, and vice versa.)

What does that mean for the current bearish cycle? The stock carnage is unlikely to subside until the US 10-year is yielding 2%. It’s currently above 3%.