It has been ages since I have have gone on a rampage concerning the bean-counterization of the private sector. One cannot blame Obama (or Bush or Clinton, Reagan et al), the political parties, or even the Supreme Court or laws.

Follow up:

This diatribe was triggered by a recent John Mauldin Outside the Box - The Financialization of the Economy. Memories of my past life came flooding back which I left after 25 years to go out to sea. The reason was simply that the end product became secondary to revenue. The boardroom discussions had started discussing monetary matters first - and at the beginning of my career they began with technical discussions of product. The bean counting MBA's had taken control of the company, and only had a layman's understanding of the product. This situation is common throughout most of corporate world.

Without product, there is no revenue.

There is a balance between product and revenue. Corporations for a large part have become radically profit-centric which results in short term gains but tends to destabilize long term corporate viability. However, under few circumstances, it is unlikely that any company with a single product will survive long term. All products have a cycle:

The beginning stage – A product is conceived, developed, and brought to market. Sales are likely low. However expenses will be high due to r&d, testing, funding and other costs necessary to bring the product to market. In a new company with little to lose, whatever funds exist are leveraged to get the job done. In a mature company - costs are controlled, and it usually is cheaper for a mature company to buy a new company to acquire a new product. Cost control works against product development.

Growth Stage – The company starts to benefit from economies of scale in production. This is where the benefits of cost control start become apparent - and laymen beancounters running product management can be more successful (sometimes much more successful) than the developers of the product.

Maturity Stage – The primary focus is to maintain market share and continue to improve profits. They consider product modifications for a competitive advantage. But this is where a beancounter becomes detrimental as they only have layman's understanding of the technical aspects of a product.

Decline Stage – Eventually, the market for a product will start to shrink. This shrinkage could be due to the market saturation, or switching to a different type of product. This happens no matter whether a product is managed by a bean counter or a technical person. This is where a replacement product needs to be developed and brought to market (and the cycle repeats or if there is no new product - the company dies).

It is important for company survival that an entrepreneurial spirit remains in a part of the company to ensure long term viability. In this regard one might ask related a rhetorical question: Does a product exist to produce a good profit or is profit the reward for producing a good product?

Other Economic News this Week:

The Econintersect Economic Index for November 2015 marginally improved - but remains in the low range of index values seen since the end of the Great Recession. The most tracked sectors of the economy generally showed some growth. Still our economic index remains in a long term decline since late 2014. Our employment six month forecast continues to forecast weakening employment growth.

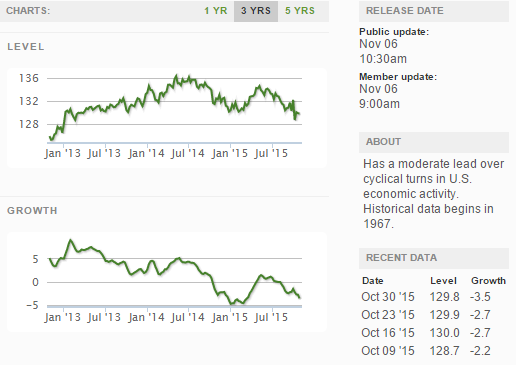

The ECRI WLI growth index is now in positive territory but still indicates the economy will have little growth 6 months from today.

Current ECRI WLI Growth Index

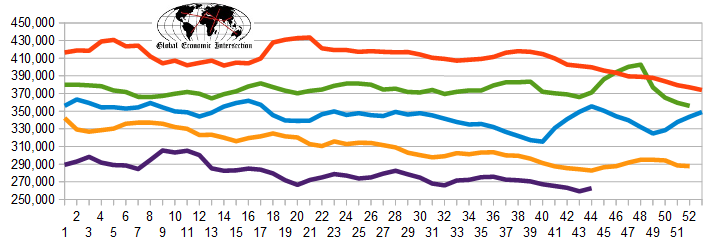

The market (from Bloomberg) was expecting the weekly initial unemployment claims at 256 K to 270 K (consensus 262,000) vs the 276,000 reported. The more important (because of the volatility in the weekly reported claims and seasonality errors in adjusting the data) 4 week moving average moved from 259,250 (reported last week as 259,250) to 262,750. The rolling averages generally have been equal to or under 300,000 since August 2014.

Weekly Initial Unemployment Claims - 4 Week Average - Seasonally Adjusted - 2011 (red line), 2012 (green line), 2013 (blue line), 2014 (orange line), 2015 (violet line)

Bankruptcies this Week: Privately-held Fresh & Easy, Privately-held Freedom Communications, BioNitrogen Holdings, Escalera Resources

Click here to view the scorecard table below with active hyperlinks

Weekly Economic Release Scorecard: