Beacon Roofing Supply, Inc. (NASDAQ:) reported adjusted earnings of 84 cents per share for second-quarter fiscal 2017, falling behind the Zacks Consensus Estimate of 90 cents. However, earnings increased 9% on a year-over-year basis positively impacted by sustained strength in residential roofing, strong complementary products demand and attractive operating cost leverage.

Including acquisition-related items, the company reported a profit of 73 cents per share in the quarter compared with 68 cents in the prior-year quarter.

Operational Update

This distributor of residential and non-residential roofing materials posted record sales of $1.214 billion, exhibiting a 5.3% year-over-year rise, also marked the fourth consecutive quarter of sales exceeding $1 billion. Revenues however missed the Zacks Consensus Estimate of $1.27 billion.

Residential roofing product sales increased 8%, while non-residential roofing product sales dropped 4.7%. Complementary product sales were up 15.7%. Existing markets same day sales, excluding acquisitions, increased 2.2% for the quarter.

Cost of goods sold increased 5.2% to $916 million. Gross profit was $298 million, up 6% from $282 million in the year-ago quarter. Gross margin remained flat at 24.5%.

Operating expenses for the quarter increased 8% year over year to $213 million. Operating income in the quarter was $85 million, compared with $78 million in the prior-year quarter.

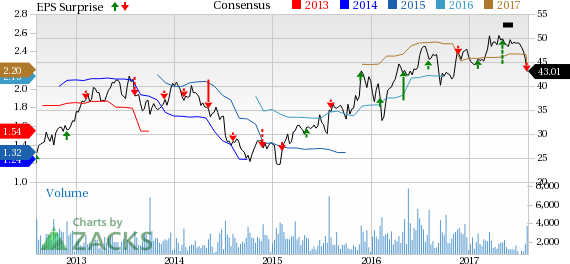

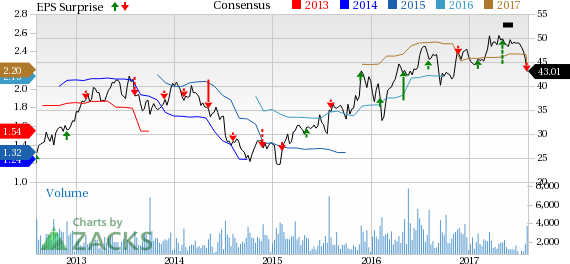

Beacon Roofing Supply, Inc. Price, Consensus and EPS Surprise

Beacon Roofing Supply, Inc. Price, Consensus and EPS Surprise | Beacon Roofing Supply, Inc. Quote

Financials

Beacon Roofing reported cash and cash equivalents of $33 million as of Jun 30, 2017, compared with $31.4 million as of Sep 30, 2016. The company generated $74 million in cash from operating activities for nine months ended Jun 30 2017, flat compared with prior-year comparable period.

2017 Outlook

The company guided revenue growth range for 2017 from 6–9% to 5–6%. This factors in lower-than-expected sales rate in the third quarter due to higher rain and more limited reroof work as a result of milder winter weather. While the company expects a more normal rainfall impacting the fourth quarter, the drag effect from this past winter will continue in certain northern markets, impacting the quarter’s sales. Organic growth outlook for the full year is 2–4% on a daily sales basis. The company now expects adjusted full year EPS to be between $2.15 and $2.25.

Beacon Roofing has underperformed the industry in the past one year. The stock has dipped 6.4% compared with the 8.4% rise recorded by the industry.

Zacks Rank & Key Picks

Beacon Roofing currently carries a Zacks Rank #5 (Strong Sell).

Some better ranked stocks worth considering in the sector include The Home Depot, Inc. (NYSE:) , Lowe's Companies, Inc. (NYSE:) and Lumber Liquidators Holdings, Inc. (NYSE:) . All the three stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Lowe's earnings estimate for fiscal 2017 currently stands at $4.63, reflecting a 15.92% year-over-year growth. The earnings estimate for fiscal 2017 for The Home Depot is at $7.23, reflecting year-over-year growth of 12.02%. The Zacks Consensus Estimate for Lumber Liquidators for fiscal 2017 is at a loss of 82 cents, a considerable improvement from the loss of $2.51 in the prior fiscal.

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure. See these buy recommendations now >>

Home Depot, Inc. (The) (HD): Free Stock Analysis ReportLowe's Companies, Inc. (LOW): Free Stock Analysis ReportBeacon Roofing Supply, Inc. (BECN): Free Stock Analysis ReportLumber Liquidators Holdings, Inc (LL): Free Stock Analysis ReportOriginal postZacks Investment Research