Forex News and Events

BCB’s rate dilemma

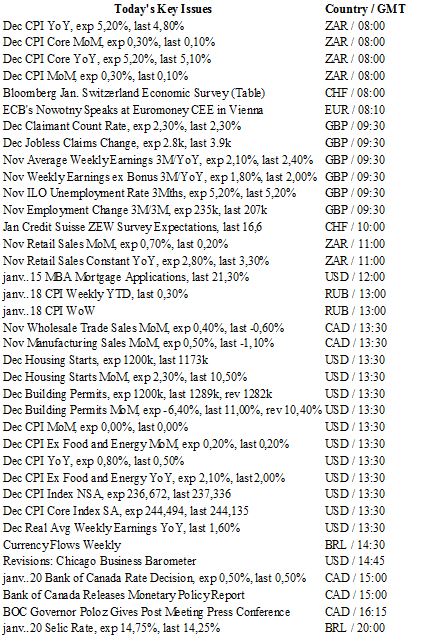

The Brazilian Central Bank will announced its interest decision later today. Most participants expect Alexandre Tombini to increase the Selic rate by 50bps to 14.75% while others believe that the BCB Governor will rather stay on hold in an attempt to protect the economy from another hard blow. The Brazilian situation was already a nightmare before the commodity sell-off and renewed fears about China’s growth outlook; but now that investors are dumping risky assets to seek safe-haven shelter, it just got worse.

In our opinion, the BCB should come back into play and raise interest rates to try to anchor inflation expectations to the cost of the Brazilian economy. The fact is, Governor Tombini has limited option; if he does not commit to his mandate - by letting inflation moving further away from the 4.5% target - it will hurts the central bank’s credibility that took many years to build. All about the credibility/recession trade-off.

On the short-term, even if the BCB resumes the interest hiking process, it won’t be supportive of the Brazilian real as the global market volatility and risk-off sentiment should keep investors away from EM currencies. USD/BRL should trade range-bound above 4.00 for now.

US: Deflationary pressures set to increase

The Federal Reserve will be paying close attention to December’s inflation data which will be released this afternoon. Indeed, recent data is concerning - especially last week’s retail sales data, which fell 0.1% m/m in December and printed only up by 2.1 y/y in 2015, the weakest year since 2009. Winter this year cannot be blamed for such low retail sales as we were told last year. Warmer temperatures should normally have boosted sales.

As a result, markets are lowering the likelihood of a March Fed rate hike to 24%. The overall environment, including the oil price collapse and China’s slowdown is likely to keep weighing on the data. Today, the consensus is that CPI will rise to 0.8% y/y. In contrast, we firmly believe that deflationary pressures are likely to increase, especially as we expect countries whose revenues depends largely on commodities to increase their production in an effort to maintain their GDP. This move will have a deflationary impact on the U.S economy. We think that the greenback is likely to suffer today on this release and that 1.1000 represents a possible issue.

BoC to cut as oil drops

The Bank of Canada rate decision is likely to result in a 25bp cut to the overnight rate. Weaker oil prices continued to negatively affect the broader economy while the rapid deprecation of the CAD is inadequate to provide critical support (defacto easing). Yet, new government potential accommodative fiscal policy is unlikely to deliver the BoC confidence to take a wait-and-see approach. The BoC now estimating that the effective lower bound for interest rates is at -0.50% from .25%, indicates that additional cuts will likely also approaching. However, there is a probably that the BoC might opt for an asset purchasing program rather than sending interest rates lower. With limited expectations for any meaningfully recovery in oil prices (Western Canada select crude is now trading at $15/bbl) USD/CAD bullish run should continue (we anticipate a reflection point for oil in March) alongside other commodity exporters and emerging market currencies. USD/CAD break of key resistance at 1.3465 implies an extension to the 1.40 area. The latest damaging news for the energy industry emanated from the IEA, which further cut its price forecast on the back of weak global demand (specifically China). Elsewhere, Canadian manufacturing and wholesale sales for November will also be released.

EUR/GBP - Reaching one-year high.

The Risk Today

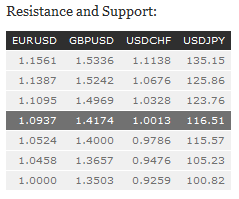

EUR/USD EUR/USD lies in a short-term uptrend channel. Hourly resistance may be found at 1.1096 (28/10/2015 low) while hourly support can be found at 1.0524 (03/12/2015). Expected to show further increase. In the longer term, the technical structure favours a bearish bias as long as resistance holds. Key resistance is located region at 1.1453 (range high) and 1.1640 (11/11/2005 low) is likely to cap any price appreciation. The current technical deteriorations favours a gradual decline towards the support at 1.0504 (21/03/2003 low).

GBP/USD GBP/USD has broken key support at 1.4231. Hourly resistance is given at 1.5242 (13/12/2015 high). Stronger resistance can be found at 1.5336 (19/11/2015 high). Expected to show further weakness below 1.4000. The long-term technical pattern is negative and favours a further decline towards the key support at 1.4231 (20/05/2010 low), as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200 day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY USD/JPY is declining. Hourly resistance lies at 123.76 (18/11/2015 high). Hourly support at 116.18 (24/08/2015 low) has been broken. Expected to show continued weakness. A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 116.18 (24/08/2015 low).

USD/CHF USD/CHF's uptrend momentum keeps going as long as the pair remains in the upward channel even if the pair currently lacks momentum. Hourly support is located at 0.9876 (14/12/2015 low) while hourly resistance can be found at 1.0125 (05/01/2015 high). Expected to monitor hourly resistance at 1.0125. In the long-term, the pair has broken resistance at 0.9448 and key resistance at 0.9957 suggesting further uptrend. Key support can be found 0.8986 (30/01/2015 low). As long as these levels hold, a long term bullish bias is favoured.