Forex News and Events

BCB: ready to intervene

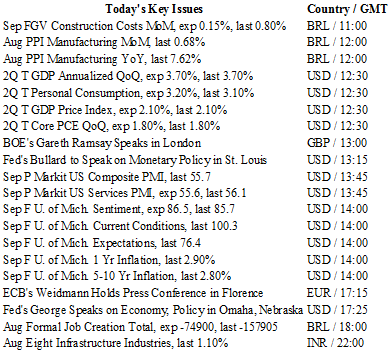

During a surprise press conference yesterday, Alexandre Tombini, Brazil’s central bank governor, announced that he was ready to use “all the instruments” at hand to guarantee that foreign exchange market work efficiently -- even though he reaffirmed that interest rates will be maintained at current levels for an extended period of time -- after the Brazilian real lost almost half of its value against the US dollar over the last 12 months. In addition, BCB’s governor suggested that the FX reserves could be used to support the falling currency, a view that was supported by Finance Minister Joachim Levy. USD/BRL fell 5.76% in São Paulo yesterday, reaching 3.9507. Unfortunately for Governor Tombini, a political crisis requires a political solution; the BCB’s good faith can only offer some temporary respite to the BRL.

The only way of offering some sustainable respite to the BRL is to restore investor confidence in the government’s ability to shore up support for austerity measures. For months, Dilma Rousseff’s government has been facing tough opposition in congress against austerity measures, which would see a cut in spending and an increase in taxes. Opposition lawmakers say Dilma Rousseff’s package of fiscal measures will hurt badly Brazil’s middle class, but have they even considered the fact that the highly uncertain environment stemming from the status quo could also be as harmful for Brazilian people. Unemployment rate reached 7.6% in August from 7.5% a month ago while the central bank raised its 2016 inflation forecast to 5.3% from 4.8% in June, according to the quarterly inflation report released yesterday. Even though the BCB is reluctant to raise the Selic rate further, we believe the market will force them to act as the BCB has been unable to definitively anchor inflation expectations.

We may see a stronger BRL in the short-term but we stick to our view that the BRL will continue to suffer from the highly uncertain political environment.

Japan falls back into deflation

At a conference held at Tokyo, Shinzo Abe revealed his revised plans to boost the Japanese economy and achieve a GDP target of 600 trillion yen from the current 490 trillion yen. He also discussed how “Abenomics” is currently entering a second stage consisting of structural reforms. To give some examples, these will include the creation of special zones where new businesses will benefit from more deregulated environments. This third arrow is coming alongside the first two “arrows” of fiscal and monetary policy. However the success of the first stage of the must still be brought into question. Indeed, inflation remains very close to zero and consumer spending is weak.

This third arrow does not mean that the current policies (monetary and fiscal) will be abandoned. In this regard, Kuroda says he believes that inflation is on a good trend and remains firm. Yet, September’s inflation data came in weak and the country is tumbling back into deflation. The 2% inflation target won’t likely be reached any time soon and we think that monetary stimulus will be stepped up come October. At the moment 12 trillion yen of Japanese government bonds are being bought every month and the Japanese economy still has not shown any specific signs of recovery.

There is increasing unease surrounding the BoJ’s ability to accomplish its mandate. The current policy has now gone too far to retreat and yet not a single week passes without Japanese policymakers voicing their optimistic about the economic upturn. We remain bearish on the JPY-complex and don’t see any favourable issue, at least in the medium-term. The inflation forecast will, one way or another, be revised down.

USD/CAD - The Bullish Momentum Continues

The Risk Today

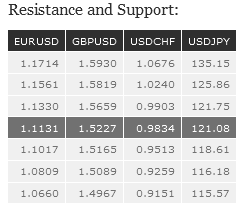

EUR/USD is now targeting support at 1.1087 (03/09/2015 low). The technical structure is confirming an underlying downtrend since the near term peak at 1.1460. Stronger support can be found at 1.1017 (18/08/2015 low). Strong resistance lies at 1.1714 (24/08/2015 high). In the longer term, the symmetrical triangle from 2010-2014 favored further weakness towards parity. As a result, we view the recent sideways moves as a pause in an underlying declining trend. Key supports can be found at 1.0504 (21/03/2003 low) and 1.0000 (psychological support). We have broken the resistance at 1.1534 (03/02/2015 reaction high). We are entering an upside momentum.

GBP/USD has now moved into a consolidation pattern. Hourly support can be found at 1.5165 (04/09/2015 low) Hourly resistance can be found at 1.5659 (27/08/2015 high). In the longer term, the technical structure looks like a recovery bottom whose maximum upside potential is given by the strong resistance at 1.6189 (Fibo 61% entrancement).

USD/JPY is still moving in either direction around the 200-day moving average. Hourly support is given at 118.61 (04/09/2015 low). Stronger support can be found at 116.18 (24/08/2015 low). Hourly resistance can be found at 121.75 (28/08/2015 high). A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 118.18 (16/02/2015 low).

USD/CHF has bounced back on the hourly resistance given at 0.9824 (09/09/2015 high). On the very short-term term, the technical structure is setting lower highs. However we remain bullish in the medium-term. In the long-term, the pair has broken resistance at 0.9448 suggesting the end of the downtrend. This reinstates the bullish trend. Key support can be found 0.8986 (30/01/2015 low).