Forex News and Events

BCB to leave rates unchanged

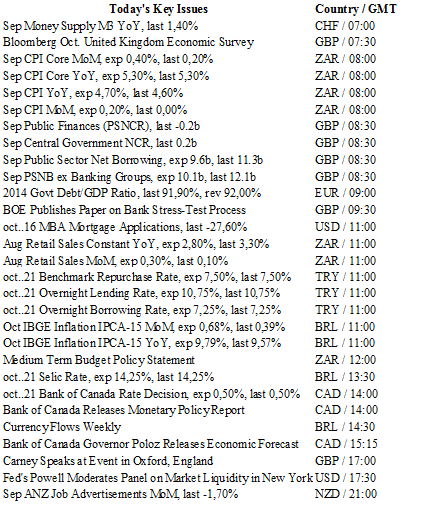

Global investors should not get to comfortable, as the recent correction looks like profit taking rather than a structural led reversal. With the political gridlock and expectations for additional downgrades from rating agencies, BRL downside looks attractive. The situation in Brazil keeps worsening: inflation expectations for 2015 and 2016 are still unanchored and continue to rise steadily. According to the latest BCB survey, inflation should reach 9.46% by year end and 5.87% by the end of 2016. The mid-month inflation report is due this afternoon and consumer prices are expected to have risen 9.79%y/y since mid-September, compared to an increase of 9.57% in the previous reporting period. We anticipate that inflation will remain unanchored as long as the country didn’t address its political crisis.

However, in regard to Copom rate decisions, the markets are discounting the inflation data to focus on the political gridlock. Unfortunately, the political crisis appears unlikely to improve anytime soon. Asides from the fact that the Congress is avoiding the cutting of expenses, impeachment threats started to materialise. Rumours are circulating that the opposition leaders are already preparing a request for impeachment. If successful, the crisis intensification will have profound negative effects on BRL.

With investors patiently sitting on the sidelines, waiting for a clear signal from the politics, we anticipate that the BCB will remain on hold today, trapped by external events more than underlying economic fundamentals. It is unlikely that the Brazilian central bank decides to increase the Selic rate by another 25bps, which would bring it to 14.50%, given the general mess. However, it would be interesting to see whether the BCB acknowledges that a 4.5% inflation rate for 2016 is no longer realistic or keeps going with the hawkish stance

Rate Decision in Canada

The consensus on the Bank of Canada is to keep its rate steady at 0.5%. The most recent data has shown signs that the economy is still struggling to recover from the strong decline in oil prices this year. Since the Central Bank’s last meeting, unemployment rates have increased, retail sales and consumer prices stalled and GDP growth has decelerated. Last but not least, last Friday’s manufacturing data printed, even though above expectations, at -0.2% for August.

The Canadian economy is dependent on the global outlook and in particular on commodities prices, which are still very low. To offset the important oil collapse, the central bank has decided this year to cut interest rates twice. We believe that no rate cut will happen today even if recent data gave hopes to central bankers. From our vantage point, the Canadian economy is still at stake as oil prices are set to plunge further. Iran will soon be back on the oil market while the OPEC will maintain its production above 30 million barrel a day.

The CAD has risen as a result of the recent Canadian elections, where Justin Trudeau’s liberals won majority in the Canadian parliament. However, Trudeau cannot do more for the country, and we remain bearish on the loonie. We target the USD/CAD pair to be back above 1.3200.

Markets brace for ECB QE2

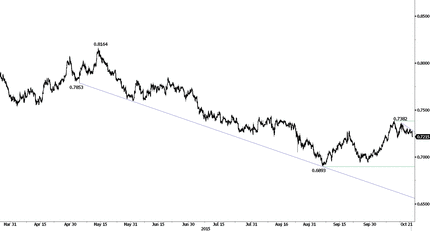

Trading in FX markets remain subdued as we inch towards the ECB policy announcement on Thursday. Commodity currencies were the primary movers overnight, as the broader commodity complex weakened. WTI crude bearish correction moved closer to key support at $44.86. AUD/USD fell -0.65% to 0.7211 against the USD as Australia’s leading indices were mixed. Australia’s conference board leading index fell 0.4%m/m in August, while Westpac leading index rose 0.1% m/m to 97.6 in September following a drop of 0.3% in the previous month. US 10 year-yield fell 1bp to 2.058% indicating that investors are cautious.

With no top-tier Eurozone economic data, Euro volatility should continue to contract heading into tomorrow’s ECB announcement. Markets are pricing in a slightly dovish statement with some over-baked expectations for an actual policy move. Eurozone front-end yields are marginally pricing in the risk of additional easing (ECB QE2). We anticipate further policy accommodation, yet believe the market has gotten marginally ahead of itself. The positive effect of the ECB’s €1.1tn quantitative easing continues to be reported. Recent FT article indicates that stimulus has helped ease Europe sticky credit markets. A very positive development for the mid-long term, yet in the short term, inflation and growth data are heading in the wrong direction. Europe is nearing a point where it needs another injection of cheap liquidity to keep the miracle going. With inflation near zero, economic growth worries and external risk form a decelerating China, there seems enough support for exiting QE. That said, recent statements by ECB President Mario Draghi and policymakers hint at currency management rather than signaling an impending adjustment to its large-scale asset-purchase program (in our view). We anticipate should inflation fail to increase and/or financial conditions tighten, the ECB will launch QE2. However, we don’t expected this prior to 2016. With the market overly dovish, we expect a short term EUR/USD rally on a lack of action at Thursday ECB meeting.

The Risk Today

Yann Quelenn

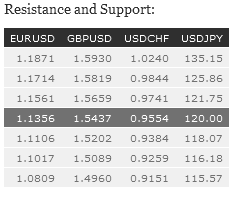

EUR/USD EUR/USD is still in bullish momentum. Hourly resistance for a short-term bounce is given at 1.1495 (15/10/2015 low). The mid-term buying interest is still strong. Other resistance can be found at 1.1561 (26/08/2015 low). Support lies at 1.1087 (03/09/2015 low). Expected test of the resistance at 1.1561. Since March 2015, the pair is improving. Key supports can be found at 1.0458 (16/03/2015 low) and 1.0000 (psychological support). The technical structure favours an eventual break higher. Strong resistance is given at 1.1871(12/01/2015)

GBP/USD GBP/USD remains in a range between support at 1.5078 (05/05/2015 low) and resistance at 1.5659 (18/09/2015 high). A long as prices remain in this range, there is no clear mid-term momentum. Expected test of resistance at 1.5529. In the longer term, the technical structure looks like a recovery as long as support given at 1.5089 stands. A full retracement of the 2013-2014 rise is expected.

USD/JPY USD/JPY has strengthened. The pair has broken the higher bound implied by the downside channel. Hourly support can be found at 118.07 (15/10/2015 low). Strong resistance is given at 121.75 (28/08/2015 high). A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 116.18 (24/08/2015 low).

USD/CHF USD/CHF is not gaining enough traction to break through 0.9600. Other resistance can be found at 0.9740 (07/10/20150 low). Hourly support is given at 0.9476 (15/10/2015 low). Expected monitoring of the support at 0.9476. In the long-term, the pair has broken resistance at 0.9448. suggesting the end of the downtrend. This reinstates the bullish trend. Key support can be found 0.8986 (30/01/2015 low).