Performing biotech fund at a discount

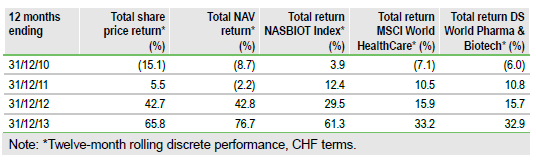

BB Biotech AG, (BIONn) is a Switzerland-based investment company investing in mid- to large-cap biotech companies. Its strong performance has continued during the last 12 months (BION’s share price and NAV are c 16% and c 29% ahead of the benchmark NASDAQ Biotechnology Index respectively). The managers believe that new products being developed by portfolio companies could drive an acceleration of their average earnings, and M&A could enhance returns. BION’s significant discount and capital distribution policy (5% cash distribution, up to 5% buybacks per year) also merit attention (see page 7).

Investment strategy: Profitable and late-stage biotech

BION aims to generate a total return of 15% pa, over the long term (three to five years plus), by investing in a focused portfolio (20-35 stocks) of global biotech companies. The managers look for companies whose products address areas of significant unmet medical need and are capable of generating above-average sales and profit growth. These tend to be either already profitable or have drugs in the late stages of development. A modest level of gearing (typically 5-8%) is used to enhance returns over the longer term. Natural turnover is relatively modest (15-20% a year).

Outlook: Sentiment improving, valuations rising

The healthcare and biotech sectors benefit from a favourable demographic backdrop with increasing demand from ageing populations, most noticeably in the western world, and growth in population and utilisation, particularly in emerging markets. Biotech has provided a strong performance during the last five years and has experienced a significant re-rating during the last two. Valuations multiples have expanded, potentially leaving the sector more open to a correction but, for those investors able to take a longer-term view, the manager believes valuations are attractive and large-cap biotech’s current P/E premium over large-cap pharma is justified because of biotech’s superior growth prospects.

Valuation: Comparable to long-term averages

BION’s discount of 24.4% is broadly in line with its three-year average of 21.3% and its five-year average of 22.4%. BION’s board has committed to return up to 10% of capital each year (5% capital distribution/ up to 5% share buy-backs). Given the strength of the portfolio performance both in absolute and relative terms, it is surprising that the discount has not already narrowed. BION’s discount is appreciably above the average for its peer group of 14.1% (3.3% excluding BION).

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

BB Biotech AG: Sentiment Improving, Valuations Rising

Published 01/08/2014, 10:15 AM

Updated 07/09/2023, 06:31 AM

BB Biotech AG: Sentiment Improving, Valuations Rising

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.