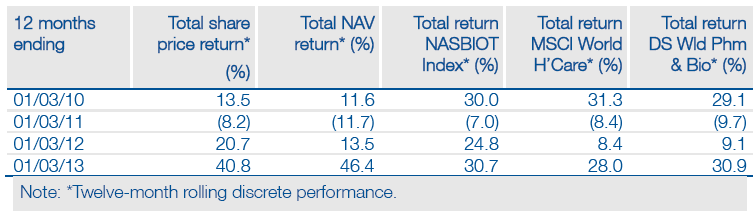

BB Biotech AG (BION) is a Swiss-based investment company investing in mid- to large-capitalisation biotech companies. Over the past, year BION’s net asset value beat comparable indices and was more than 10% ahead of its benchmark, the NASDAQ Biotechnology Index. In 2012, BION resisted an attempt to unitise the company and implemented a strategy to reduce its discount. The managers believe their stocks are attractively valued and see the prospect of M&A activity, driven by patent expirations in the pharmaceutical industry. BION’s portfolio contains a number of drugs in the later stages of development and these could help drive further NAV growth.

Investment strategy: Profitable and late-stage biotech

BION aims to generate a total return of 15% pa over the long term by investing in a focused (20-35 stocks) global portfolio of biotech companies whose products address areas of significant unmet medical need and are capable of generating above-average sales and profit growth. These tend to be either already profitable or have drugs in the late stages of development.

Sector outlook: Positive on M&A and new developments

In 2012, 14 new drugs were approved by the FDA and the managers are optimistic that 2013 will be at least as good a year for product approvals. The managers believe regulators are taking less time to approve products. They see a number of promising therapies on the horizon, including oral treatments for Hepatitis C, drugs to tackle aggressive cancers and drugs aimed at rare diseases, and they are optimistic about new technology platforms based on RNA interference and antibody drug conjugates to tackle malignant cells.

Valuation: Unitisation rejected, capital return reinstated

At 21.8%, BION’s discount is narrower than its three-year average of 22.1%, but wider than its UK-listed peer group. In November 2012, an unsolicited approach from Vontobel offering to unitise the fund (for a substantial fee) was withdrawn as it would have had adverse tax consequences for BION shareholders. BION’s investment approach could also have been compromised in an open-ended structure. It would have hindered the managers’ ability to take long-term views and might have necessitated the maintenance of large cash balances causing a cash drag on returns. In March 2013, BION will reinstate its programme of capital distributions, targeting 5% per annum, and aims to buy back an additional 5% of its share capital each year.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

BB Biotech AG: Profitable And Late-Stage Biotech

Published 03/10/2013, 05:06 AM

Updated 07/09/2023, 06:31 AM

BB Biotech AG: Profitable And Late-Stage Biotech

Promising pipeline

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.