Headquartered in Deerfield, Illinois, Baxter International Inc. (NYSE:BAX) is a global medical products and services company. The company’s Hospital Products business manufactures products used in the delivery of fluids and drugs to patients. Renal portfolio is mainly for patients with kidney failure/disease and their healthcare providers.

Currently, Baxter International has a Zacks Rank #2 (Buy) but that could change following its second quarter 2017 earnings report which has just released. (You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.) We have highlighted some of the key details from the just-released announcement below:

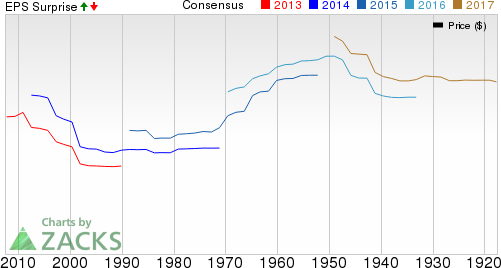

Earnings: Baxter’s adjusted earnings of 63 cents per share beat the Zacks Consensus Estimate of 57 cents and increased by 17 cents from the year-ago quarter.

Revenues: Baxter posted sales of $2.6 billion, marginally beating the Zacks Consensus Estimate for revenues of $2.59 billion. At constant currency (cc), revenues increased almost 2% on a year-over-year basis.

Key Stats: Hospital products sales increased 2% at cc, while renal products increased 3% from the year-ago quarter.

Major Factors: Hospital Products sales in the quarter were driven by solid sales in the U.S. fluid systems, and select anesthesia and critical care products. Hospital Sales were also favorably impacted by solid demand for parenteral nutrition therapies and international bio-surgery products.

Renal products sales were driven by solid demand for in-center hemodialysis (HD) products in the U.S., international acute renal care sales and global sales of peritoneal dialysis (PD) therapies.

Baxter increased its financial outlook for the full year and estimates sales growth of approximately 4% at cc. Adjusted earnings from continuing operations are forecasted in the band of $2.34 to $2.40 per share.

For the third quarter, adjusted earnings are expected in the band of 58 cents to 60 cents per share.

Stock Price: Shares have risen roughly 11.7% over the past 3 months, while the broader industry has gained 7.7% over the same time frame. However, following the earnings release, share prices did not show any movement in the pre-market trading session.

Check back later for our full write up on this Baxter International report later!

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaries,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Baxter International Inc. (BAX): Free Stock Analysis Report

Original post