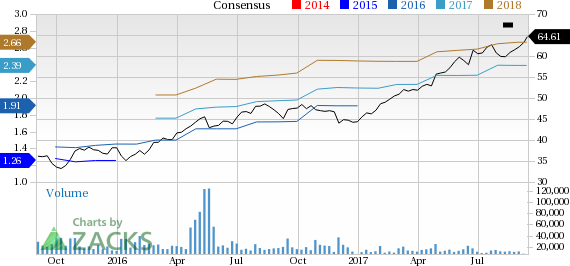

Share price of Deerfield, IL-based Baxter International Inc. (NYSE:BAX) scaled a new 52-week high of $64.75 per share on Sep 13, then closing a bit lower at $4.61. The company has gained around 6.3% over the past month, much better than the S&P 500’s rise of 1.2%.

Over the past three months, this Zacks Rank #3 (Hold) stock has steadily outshined the broader industry. The stock price has climbed 11.5%, substantially higher than the broader industry’s gain of 1.8%. The stock has a market cap of almost $34.5 billion.

Also, the company’s estimate revision trend for the current quarter is favorable. In the past two months, seven estimates have moved up with no downward revision. The magnitude of estimate revision over the same time period increased 7.3% to 59 cents per share. The company also has a four-quarter average positive earnings surprise of 15.3%.

Growth Catalysts

Long-term Outlook Upbeat: Buoyed by stellar growth in earnings and sales in second-quarter 2017, the company raised its long-term outlook. Baxter estimates sales growth of approximately 4% on a compounded annual basis from 2016-2020. Notably, adjusted operating margin in full-year 2020 is expected to be approximately 20% of revenues, much above the previously issued guidance of 17-18%. Baxter expects full-year 2020 adjusted diluted earnings in the band of $3.25-$3.40 per share.

In fact, Baxter raised full-year 2017 expectations for sales growth to approximately 4% at cc (constant currency). Adjusted earnings per share from continuing operations are forecast in the range of $2.34-$2.40. For the third quarter of 2017, Baxter estimates sales rise of about 5% at cc. Adjusted earnings per share are projected in the 58-60 cents bracket.

Broad Product Spectrum: The latest 52-week high came on the back of the company’s impressive product line. Baxter has an exciting product portfolio with improved existing products and new product development namely, more convenient kidney dialysis solutions, regenerative tissue products and the next-generation SIGMA Spectrum infusion pump. Last quarter, Baxter launched a new version of the AK-98 HD system. The platform offers two-way IT connectivity and capabilities to meet the needs of potential patients.

Favorable Tidings on Regulatory Front: All was well on the regulatory front for Baxter last quarter. The company received clearances from all regulatory authorities regarding the proposed acquisition of Claris Injectables. Additionally, the FDA approval of two new premixed injectables is a key catalyst. The company’s new product, the home PD technology, also got an FDA nod in the second quarter. The platform leverages on Baxter’s flagship AMIA automated peritoneal dialysis (APD) system with SHARESOURCE telehealth platform.

Recently, Baxter achieved a regulatory milestone for advanced dialysis technology. Good news is that the company received significant guidance from the FDA which clarified the regulatory pathway for home peritoneal dialysis (PD) solution system to improve its patient access to the same.

Key Picks

A few better-ranked stocks in the broader medical sector are Edwards Lifesciences Corp. (NYSE:EW) , IDEXX Laboratories, Inc. (NASDAQ:IDXX) and Cogentix Medical, Inc. (NASDAQ:CGNT) .

Notably, Edwards Lifesciences sports a Zacks Rank #1 (Strong Buy), while IDEXX Laboratories and Cogentix Medical have a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Edwards Lifesciences delivered an average earnings beat of 10.8% over the trailing four quarters. The company has a long-term expected earnings growth rate of 15.2%.

IDEXX Laboratories delivered an average earnings beat of 9.3% over the trailing four quarters. It has a long-term expected earnings growth rate of 19.8%.

Cogentix Medical registered a positive earnings surprise of 200% in the last quarter. The stock represented a stellar return of 100.9% over the last year.

5 Trades Could Profit ""Big-League"" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure.

See these buy recommendations now >>

IDEXX Laboratories, Inc. (IDXX): Free Stock Analysis Report

Cogentix Medical, Inc. (CGNT): Free Stock Analysis Report

Baxter International Inc. (BAX): Free Stock Analysis Report

Edwards Lifesciences Corporation (EW): Free Stock Analysis Report

Original post