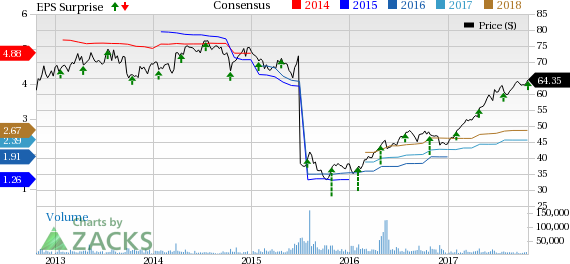

Baxter International Inc. (NYSE:BAX) reported third-quarter 2017 adjusted earnings per share of 64 cents, which beat the Zacks Consensus Estimate by 5 cents and improved from the year-ago figure of 56 cents. Baxter currently has a Zacks Rank #2 (Buy).

The figure was also above the company’s guided range of 58 cents to 60 cents. Interestingly, over the last four quarters, the company delivered positive earnings surprises, the average being 15.3%.

Baxter posted sales of $2.71 billion, beating the Zacks Consensus Estimate of $2.66 billion. At constant currency (cc), revenues increased 6% on a year-over-year basis. U.S. sales were up 8% year over year to $1.6 billion. International sales increased 4% at cc to almost $1.5 billion.

Baxter International Inc. Price, Consensus and EPS Surprise

Segmental Details

Sales at the hospital products segment climbed 7% at cc on a year-over-year basis to $1.7 billion. Hospital Products sales in the quarter were driven by solid sales in the U.S. fluid systems and select anesthesia and critical care products. Hospital Sales were also driven by solid demand for injectable pharmaceuticals and hospital pharmacy compounding services.

Meanwhile, sales increased 3% at cc to $1 billion at the renal products segment. Renal products sales were supported by improved performance across all major product lines and therapies globally.

Quarterly Highlights

Baxter Acquires Claris: In the third quarter, Baxter completed the acquisition of India-based Claris Injectables, a global generic injectables pharmaceutical company for almost $625 million. In December 2016, Baxter had initiated the agreement. Per management, the acquisition will bolster Baxter’s foothold in the generic pharmaceuticals space.

New Patients Enrolled: In the third quarter, Baxter registered patients under two new clinical trials for a unique expanded hemodialysis therapy enabled by THERANOVA, a dialyzer for treatment of chronic and acute renal failure. In fact, Baxter is expected to launch hemodialysis enabled by THERANOVA in Australia, New Zealand, France, Germany, Switzerland and Belgium by the end of this year.

Hurricanes Deal a Blow: Management at Baxter announced a possibility of shortfall in supply of certain products in the next quarter. This is because the company is still grappling with limited production at all three manufacturing sites in Puerto Rico Hurricane Maria. However, the company has been granted regulatory approval by the FDA for special importation of products from facilities in Ireland, Australia, Canada and Mexico to maintain the product supply balance in the U.S. market.

International Foothold Fortified: Baxter launched the oXIRIS set for continuous renal replacement therapy (CRRT) and sepsis management protocols in select markets of Europe, Middle East and Africa in the quarter. Notably, oXIRIS, which leverages on the company’s flagship PRISMAFLEX system, is expected to lend Baxter a competitive edge in the global market.

Guidance Lifted

For full-year 2017, Baxter estimates sales growth of approximately 4% at cc. Adjusted earnings for the full year are expected in the band of $2.40 to $2.43 per diluted share, up from the previous band of $2.34 to $2.40.

Baxter expects fourth-quarter revenues to face a negative impact of approximately $70 million, thanks to the operational disruption resulting from hurricane Maria. Adjusted earnings for the fourth quarter are expected in the band of 56 cents to 59 cents per diluted share. Net sales in the fourth quarter are expected to rise 2% at cc.

Other Companies With Solid Earnings Results

Intuitive Surgical Inc. (NASDAQ:ISRG) posted adjusted earnings of $2.77 per share in the third quarter of 2017, beating the Zacks Consensus Estimate of $1.97 on stellar revenue growth. The stock has a Zacks Rank #2.

PetMed Express, Inc. (NASDAQ:PETS) adjusted announced earnings per share of 43 cents for the second quarter of fiscal 2018, up 79.2% from the year-ago quarter. Also, earnings surpassed the Zacks Consensus Estimate by 43.3%. The stock has a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Abbott (NYSE:ABT) reported third-quarter 2017 adjusted earnings from continuing operations of 66 cents per share, up 11.9% year over year. Third-quarter worldwide sales came in at $6.83 billion, up 28.8% year over year. Abbott carries Zacks Rank #2.

Zacks' Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but selected members of our portfolio services. Would you like to peek behind the curtain today and view them?

Starting now, for the next month, I invite you to follow all Zacks' private buys and sells in real time from value to momentum...from stocks under $10 to ETF to option movers...from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors.

Click here for Zacks' secret trade>>

PetMed Express, Inc. (PETS): Free Stock Analysis Report

Abbott Laboratories (ABT): Free Stock Analysis Report

Intuitive Surgical, Inc. (ISRG): Free Stock Analysis Report

Baxter International Inc. (BAX): Free Stock Analysis Report

Original post