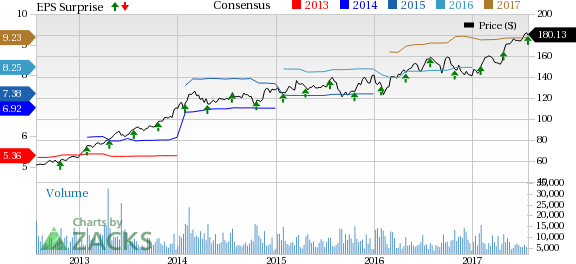

Baxter International Inc. (NYSE:BAX) reported second-quarter 2017 adjusted earnings per share of 63 cents, which steered past the Zacks Consensus Estimate by 6 cents and was way better than the year-ago figure of 46 cents.

The figure was also above the company’s guidance of 55 cents to 57 cents. Interestingly, over the last four quarters, the company delivered positive earnings surprises, the average being 17.14%.

Baxter posted sales of $2.60 billion, marginally beating the Zacks Consensus Estimate of $2.59 billion. At constant currency (cc), revenues increased 2% on a year-over-year basis. U.S. sales were up 4% year over year to $1.1 billion. International sales increased 1% at cc to almost $1.5 billion.

Major Factors

Positive Tidings on Regulatory Front: The quarter has been a favorable one for Baxter on the regulatory front. The company received clearances from all regulatory authorities regarding the proposed acquisition of Claris Injectables. Notably, Baxter is expected to close the transaction by the end of July.

Furthermore, FDA approval of two new premixed injectables is a key catalyst. The company’s new product, the home PD technology, also got a FDA nod in the second quarter. The platform leverages on Baxter’s flagship AMIA automated peritoneal dialysis (APD) system with SHARESOURCE telehealth platform.

Partnerships: In the second quarter, Baxter signed an agreement with India-based Dorizoe Lifesciences for expansion of its generic injectables pipeline. The duo is expected to develop more than 20 generic injectable products that include anti-infectives, oncolytics and cardiovascular medicines. However, the financial terms of the deal have been kept under wraps. Post the deal closure, Baxter will leverage on Dorizoe’s R&D expertise to accelerate the launch of generic molecules. The deal will combine Baxter’s manufacturing leadership and hospital channel strength with Dorizoe’s technical expertise, thereby boosting Baxter’s foothold in the niche space

Baxter also announced research and development collaborations with leading institutions -- Mayo Clinic and Ramot at Tel Aviv University.

Product Launch: In the second quarter, Baxter launched anew version of the AK-98 HD system. The platform offers two-way IT connectivity and capabilities to meet the needs of potential patients.

Segment Details

Hospital products: Sales at this segment climbed 2% at cc on a year-over-year basis to $1.6 billion. Hospital Products sales in the quarter were driven by solid sales in the U.S. fluid systems and select anesthesia and critical care products. Hospital sales were also driven by solid demand for parenteral nutrition therapies and international bio-surgery products.

Renal products: Sales increased 3% at cc to $968 million at this segment. Renal products sales were driven by solid demand for in-center hemodialysis (HD) products in the U.S., international acute renal care sales and global sales of peritoneal dialysis (PD) therapies.

Guidance Upbeat

Baxter raised the full-year estimates for sales growth to approximately 4% at cc. Adjusted earnings per share from continuing operations are forecasted in the band of $2.34 to $2.40.

For the third quarter of 2017, Baxter estimates sales growth of about 5% at cc. Adjusted earnings per share are forecasted in the range of 58 cents to 60 cents.

Long-Term Outlook

Buoyed by stellar growth in earnings and sales, the company raised its long-term outlook.

Baxter estimates sales growth of approximately 4% on a compounded annual basis from 2016 to 2020. Notably, adjusted operating margin in full-year 2020 is expected to be approximately 20% of revenues, much higher than the previously issued guidance of 17 to 18%.

Baxter expects full year 2020 adjusted diluted earnings in the band of $3.25 to $3.40 per share.

Share Performance

Baxter has had an impressive run on the bourse on a year-to-date basis. The company has gained roughly 40%, higher than the broader industry’s addition of almost 22.2%. Moreover, the current level compares favorably with the S&P 500’s return of 10.9% over the same time frame. This, together with a long-term expected earnings growth rate of almost 12 %, instills confidence in investors.

Currently, Baxter has a Zacks Rank #2 (Buy).

Other Key Picks

A few other top-ranked stocks in the broader medical sector are Edwards Lifesciences Corporation (NYSE:EW) , CryoLife, Inc. (NYSE:CRY) and Fresenius Medical Care Corporation (NYSE:FMS) . Notably, Fresenius Medical Care sports a Zacks Rank #1 (Strong Buy), while Edwards Lifesciences and CryoLife have a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Fresenius Medical Care represents an impressive return of 6.5% over the last one year. The company delivered a solid earnings surprise of 20.5% in the last reported quarter.

Edwards Lifesciences has a long-term expected earnings growth rate of 15.2%. Notably, the stock has an impressive one-year return of 1.3%.

CryoLife yielded a strong return of 40.6% over the last one year. The stock delivered a positive earnings surprise of 20% in the last reported quarter.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Fresenius Medical Care Corporation (FMS): Free Stock Analysis Report

Baxter International Inc. (BAX): Free Stock Analysis Report

Edwards Lifesciences Corporation (EW): Free Stock Analysis Report

CryoLife, Inc. (CRY): Free Stock Analysis Report

Original post

Zacks Investment Research