Markets rolled over this week and just continue to chop around this summer which is perfect and should setup up for some great fall action.

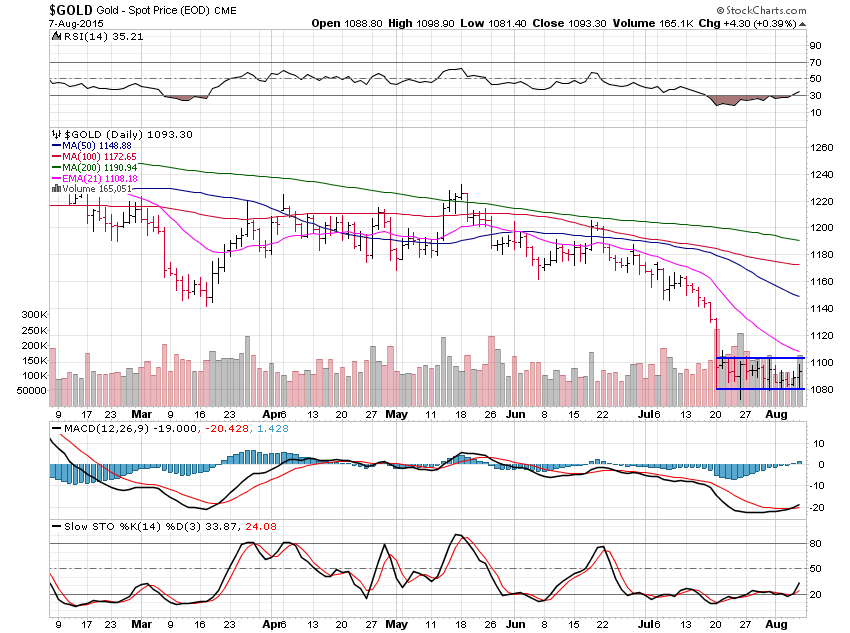

Gold and silver continue to look for lower and are trading in a tight range.

Gold did nothing to speak of and lost only 0.16% this past week.

Gold continues to sit in this range between $1,080 and $1,100 and this pattern does point to a move lower.

Ideally this break lower should begin Monday or Tuesday or risk getting stale and then we have to consider a move higher to the $1,150 area as the next move.

All in all, the low for gold is not in, but it may not come until late summer or early fall.

A break below this flat channel can be shorted, or a move above could be taken as a short-term long trade.

Silver gained a tiny 0.14% and also remains in a small flat base.

I can say the same thing about silver as I did gold so I won’t ramble on.

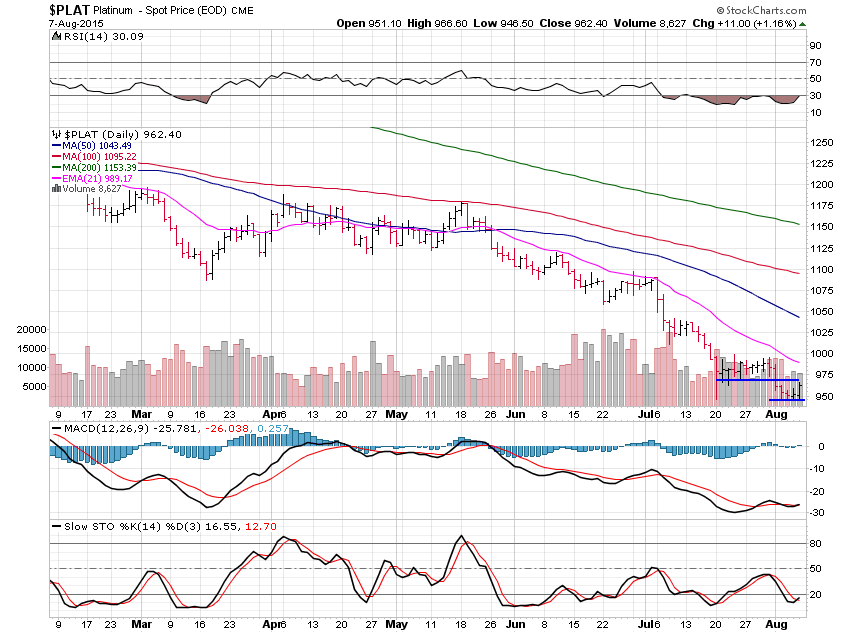

Platinum lost 2.15% this past week and is forming a small flat channel now as well.

The low is not yet in for platinum but it looks like it may need a while before the next leg lower.

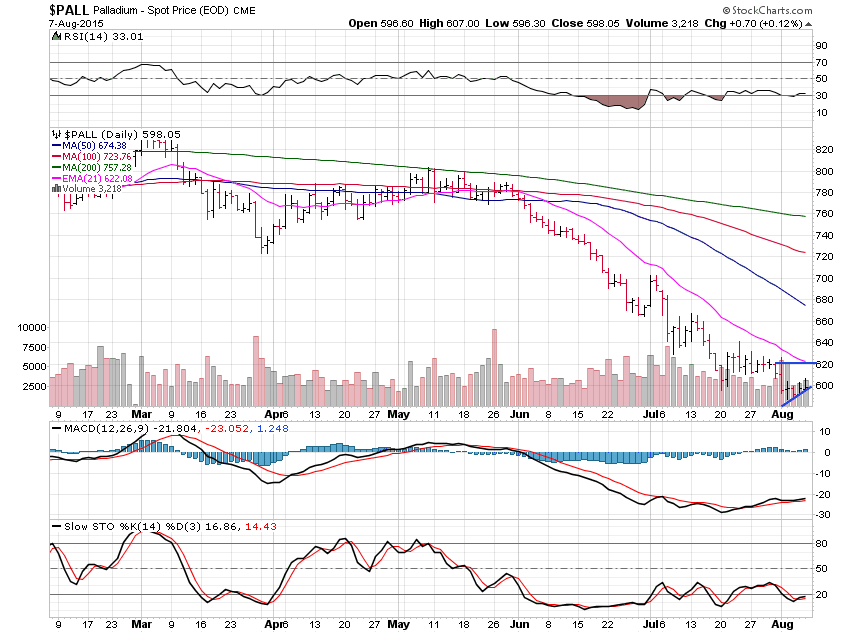

Palladium fell 2.09% this past week and is trending back up to the $620 resistance level now.

Waiting for setups to form is half the battle and that’s what we’ve been doing in my subscriber section mostly all summer with a few successful trades here and there.

So far, this summer has played out perfectly, chopping around for the most part.

The fall should bring some great setups, that take time to form and that’s what is happening right now.

I’’m still trying to enjoy the short summer while it’s here, and markets allow me some more freedom.

If you found this information useful, or informative please pass it on to your friends or family.