Tin was the strongest base metal in February.

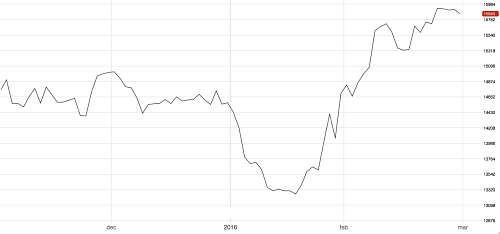

After hitting a new six-year low in mid-January, the metal has bounced back up like a tennis ball. Indeed, since January 15th tin has risen more than 20% and many would consider this a bull market.

This sharp move can be attributed to several factors:

Tin hits a new four-month high. Source: FastMarkets.

- A weaker dollar in February contributed to a price increase across dollar-denominated commodities, including, of course, the industrial metals complex.

- February’s gains come after significant losses in previous months. Low prices lured bargain hunters in February to buy tin.

- The latest data showed that the decline in Indonesian shipments intensified in January, with a 63% year-over-year drop. Indonesian refiners had begun suspending operations due to weak global prices and the country’s new environmental regulations and some investors see potential of future metal scarcity as Indonesian supply dries up.

- The recent flooding on the island of Bangka is expected to affect tin operations, possibly further shrinking shipping numbers for February. Indonesian tin smelter PT Refined Bangka Tin stopped refining operations in the last month due to environmental concerns.

Is Rising Tin Actually in a Bull Market?

No, it is not.

Tin is still below key resistance levels. Source: MetalMiner analysis of FastMarkets data.

While the metal advanced rapidly, prices are still within trading range and losing momentum as they near key resistance levels. In addition, recent customs data revealed that tin ore imports from Myanmar in January soared to an all-time record of 72,436 metric tons (gross weight), a 239% year-on-year increase and a 66% rise from the tonnage imported in December.

Myanmar’s rising supply could make up for Indonesian’s falling production. Finally, weak tin demand in China could also contribute and keep a lid on tin’s rise.

What This Means For Metal Buyers

Tin and other base metals rose in February, but it seems too early to call for a bull market. The next few weeks will probably give us good clues on whether this price rise is for real or just another dead-cat bounce.