Forex News and Events

Copper rally to accelerate? (by Peter Rosenstreich)

Metals continue to rally amid speculation of a President Trump infrastructure spend and declining global inventories. Copper reached a one-week high and is challenging levels not seen since the base-metal complex collapsed. In Asia, trading copper front month reached $269.90, just $5 short of the recent high. However, the factors driving the metal feel extremely strapped. Investors are betting that the US president-elect’s generous fiscal spend (expect close to $1trn) will drive growth and lower supplies due to China buying the metal as a yuan hedge. In addition, the bullish momentum has triggered demand from trend-following funds, increasing buying pressure. Paradoxically, despite the strong USD, industrial metals continue to trade higher. Yet, as with much of this rally, the fundamentals rationale remains extremely weak in our view. With traders looking at the world through fiscally-enhanced lenses, the marginal US data is now perceived as robust. Yes, the recent durable goods order increase of 4.8% was a solid read, yet leading indicators such as new home sales flattened -1.9% m/m, prior to election uncertainty and the recent rise in mortgage rates. Therefore, we are hesitant to forecast an increase in long-term inflation expectations on Trump’s potential fiscal stimulus (which is actually, far from a sure thing). Secondly, while the Chinese are buying up copper as a hedge against yuan depreciation, data indicates that supply growth will remain high. Also working against the current price rally are rumours that ShFe will raise margins and trading limits on most base metals (including copper, lead, nickel, zinc, tin and aluminum). Without real demand coming into the market, we believe that the current rally is speculative and unsustainable. We would see the rally in base metals as on opportunity to reload on short commodity trades.

OPEC meeting to take centre stage (by Yann Quelenn)

OPEC is certainly going to be next week’s hot topic. On the 30th of November, we will know whether OPEC members have managed to coordinate a deal to freeze production. Saudi Arabia is pushing to convince other members to cut production to around 4%. Expectations that the supply glut could be reduced has sent crude oil higher. The commodity is recording its second consecutive weekly gain - above 47$ a barrel.

In our view, it seems difficult that the OPEC will reach an agreement as geopolitical uncertainties have been significant since Trump’s election. First of all, we believe that president-elect Donald Trump will follow through on his decision to render America energetically independent or at least he will push towards this direction. American drillers should benefit from this political view and we believe that shale gas is set to become more attractive. Trump’s plan for day one is to fire up US shale gas. This is why the oil oversupply is far from over.

Secondly, Trump’s policies are likely to boost interest rates and one major consequence will be a stronger dollar. As a result, there are downside risks for emerging markets for which a stronger dollar is definitely not great news, in particular for their oil demand as oil would become more expensive. This is why we feel that the OPEC is going to be reluctant to freeze production as it is perhaps too early to predict the real impact of EM demand regarding US policies.

Thirdly, another question that still needs to be answered is what foreign policies Trump will apply, in particular in the Iranian case. The strongest hypothesis for the time being is that the nuclear agreement reached in 2015 will be ripped up, in which case Iran would face renewed sanctions. Iran is now facing a difficult choice at the OPEC meeting, either agreeing on cutting production and not being able to produce enough oil before new sanctions arise, or refusing any cut knowing that US shale gas has become more attractive.

The geopolitical context is very mixed. At the OPEC meeting, Donald Trump will remain at the centre of the debate and we believe that the intergovernmental organization will wait for the start of Trump’s presidency in order to better assess the geopolitical tone of the next four years. As a result, crude oil prices should adjust lower next week.

AUD/USD - Short-Term Bullish Consolidation.

The Risk Today

Yann Quelenn

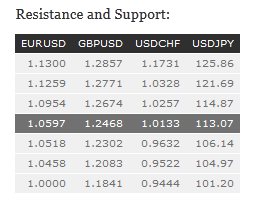

EUR/USD's buying pressures are clearly on. Hourly resistance is given at 1.0652 (intraday high). A break of resistance at 1.0746 (17/11/2016 high) is needed to confirm a reversal. Expected to show continued weakness. In the longer term, the death cross indicates a further bearish bias despite the pair has increased since last December. Key resistance holds at 1.1714 (24/08/2015 high). Strong support given at 1.0458 (16/03/2015 low) is on target.

GBP/USD is not having enough momentum to reach resistance at 1.2674 (11/11/2016 high). Hourly support is given at 1.2302 (18/11/2016 low). Expected to see further weakness. The long-term technical pattern is even more negative since the Brexit vote has paved the way for further decline. Long-term support given at 1.0520 (01/03/85) represents a decent target. Long-term resistance is given at 1.5018 (24/06/2015) and would indicate a long-term reversal in the negative trend. Yet, it is very unlikely at the moment.

USD/JPY's bullish momentum continues despite ongoing consolidation. Resistance given at 113.52 (intraday high) has been broken. The pair is heading toward 114.87 (16/02/2016 high). Support is given around 109.80 (16/11/2016 low). Stronger support lies at 108.56 (17/11/2016 low). Expected to see further upside moves. We favor a long-term bearish bias. Support is now given at 96.57 (10/08/2013 low). A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems absolutely unlikely. Expected to decline further support at 93.79 (13/06/2013 low).

USD/CHF rally is still on. The technical structure remains strongly bullish. Hourly resistance is given at 1.0191 (24/11/2016 high) has been broken. Expected to see further strengthening. In the long-term, the pair is still trading in range since 2011 despite some turmoil when the SNB unpegged the CHF. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours nonetheless a long term bullish bias since the unpeg in January 2015.