Markets are unpredictable. Picking a bottom is a difficult task as things can change quickly. However, for the first time since 2011, we are seeing enough positive signals to believe industrial metals might have bottomed out.

A broad recovery might be underway and metal buyers should have a plan. “Commodity price risk” might become a highly popular Google (NASDAQ:GOOGL) search again.

Why is the picture turning bullish? First of all, the two main drivers of metal prices are finally giving some bullish signals for the overall metal complex.

CRB commodity index hits 5-month high. Source: MetalMiner analysis of @StockCharts.com data.

The dollar has weakened since January, and it’s certainly showing no signs of strength. Second, and perhaps more importantly, the sugar rush of China’s not-so-mini fiscal stimulus, initiated late last year, has really picked up momentum in the first quarter.

Many now think that the stimulus program could have a similar effect to the one unleashed in 2009 when commodities rallied until the spring of 2011. We can’t predict how long the effect will last. What’s clear, though, is that the impact is real and it has the potential to extend this rally in commodity markets. A combination of these factors made commodities rise across the board, from oil to silver, we are witnessing a proliferation of bullish moves, which saw the CRB commodity Index hit a new five-month high.

Bullish Moves Among Base Metals

The first thing suggesting a trend shift is the latest bullish moves among base metals. All base metals are up this year but, particularly, four of them have recently made quite bullish moves which you don’t really see in bear markets. That suggests that sentiment is changing.

Tin hits a 13-month high. Source: FastMarkets.com.

A combination of tightening supply (amid lower Indonesian tin exports) and low LME stock levels has made tin investors’ favorite base metal this year. In March tin hit an 11-month high, the first metal to make such a bullish move.

At that time demand, before China’s latest stimulus took effect, looked weak and the recovery in commodity markets just wasn’t there yet. However, the macro picture now is now giving tin prices a tailwind.

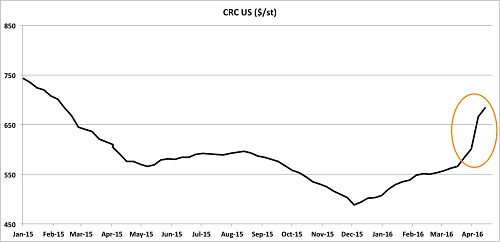

Cold-rolled coil steel hits a 13-month high. Source: FastMarkets.com.

Steel prices also started the year on the right foot. At first, the rally appeared to be lead by anti-dumping actions, but it’s turning into something more powerful thanks to the rebound in Chinese demand.

International prices are now increasing everywhere, including China. The upward move in steel prices is accelerating. Cold-rolled prices just hit a 13-month high. Not a typical move in bear markets.

Zinc hits a nine-month high. Source: FastMarkets.com.

Zinc was another investors’ favorite among industrial metals this year, thanks to the number of key large-scale mine shutdowns over the past few years. The metal recently hit a 9-month high. Zinc will now have an easier time extending its rally amid rising expectations on Chinese demand growth and a broad recovery in commodity markets.

Aluminum hits a nine-month high. Source: FastMarkets.com.

Aluminum prices lagged in Q1 due to poor fundamentals: sluggish demand and too much capacity with little to no willingness for production shutdowns.

However, April painted a different picture. Aluminum prices soared, hit a nine-month high and joined the broad commodity rally. This is a classic behavior in market upturns. Investors’ sentiment shifts and everyone looks into buying commodities, even those assets that appear to lack a bright fundamental story (like aluminum) get a lift.

The fact that the most liquid and watched metals are starting to see their prices increase gives more credibility to the broad rally. Copper and nickel also gained in April and it wouldn’t be a surprise to see these two metals joining the wagon of metals hitting multi-month highs this year.

What This Means For Metal Buyers

Since 2011 until now, a “buy down the market” strategy has worked pretty well, but the market environment changes. Metal buyers should be prepared for different scenarios, or your budget could get hurt.

by Raul de Frutos