On Thursday, June 29th, Micron Technology (NASDAQ:MU) will release its fourth quarter earnings results after the bell. The company is a Zacks Rank 2 (Buy), and have a Value, Growth, and Momentum score of A.

In our video David will take a look at the current state of Micron Technology, their past earnings announcements, and he’ll give us his thoughts on their upcoming earnings call. Furthermore, David will also give us insight on how to play the options market.

Micron Technology in Focus

Micron Technology, Inc. has established itself as one of the leading worldwide providers of semiconductor memory solutions. The company's quality memory solutions serve customers in a variety of industries including computer and computer-peripheral manufacturing, consumer electronics, CAD/CAM, telecommunications, office automation, network and data processing, and graphics display. The company's mission is to be the most efficient and innovative global provider of semiconductor memory solutions.

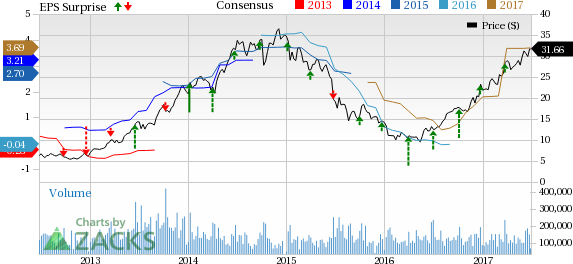

Micron Technology is expected to report earnings at $1.37 per share according to the Zacks Consensus Estimate. Last quarter they met earnings expectations at $0.77 per share. Their average EPS surprise is 23.49%.

Micron Technology, Inc. (MU): Free Stock Analysis Report

Original post