On Tuesday, July 18th, Bank of America (NYSE:BAC) will release its second quarter earnings results before the bell. The company is a Zacks Rank 3 (Hold), and have a Value, Growth, and Momentum score of F.

In our video David will take a look at the current state of Bank of America, their past earnings announcements, and he’ll give us his thoughts on their upcoming earnings call. Furthermore, David will also give us insight on how to play the options market.

Bank of America in Focus

Bank of America Corp. is one of the world's leading financial services companies. Bank of America provides individuals, small businesses and commercial, corporate and institutional clients across the United States and around the world new and better ways to manage their financial lives. The company enables customers to do their banking and investing whenever, wherever and however they choose.

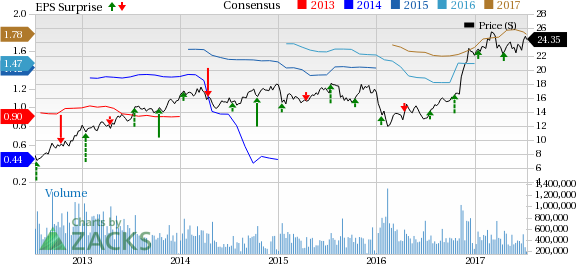

Bank of America is expected to report earnings at $0.43 per share according to the Zacks Consensus Estimate. Last quarter they reported earnings at $0.41 per share, beating expectations by $0.06. Their average EPS surprise is 12.22%..

Bank of America Corporation (BAC): Free Stock Analysis Report

Original post