On Tuesday May 18th, Alibaba (NYSE:BABA) will release its fourt quarter earnings results before the bell. The company is a Zacks Rank 3 (Hold), and have a Value, Growth, and Momentum score of C.

In our video David will take a look at the current state of Alibaba, their past earnings announcements, and he’ll give us his thoughts on their upcoming earnings call. Furthermore, David will also give us insight on how to play the options market.

Alibaba in Focus

Alibaba Group Holding Limited operates online and mobile marketplaces in retail and wholesale trade, as well as cloud computing and other services. It provides technology and services to enable consumers, merchants, and other participants to conduct commerce in its ecosystem. The Company operates Taobao Marketplace, an online shopping destination; Tmall, a third-party platform for brands and retailers; Juhuasuan, a group buying marketplace; Alibaba.com, an online business-to-business marketplace; 1688.com, an online wholesale marketplace; and AliExpress, a consumer marketplace. Alibaba Group Holding Limited is headquartered in Hangzhou, the People's Republic of China.

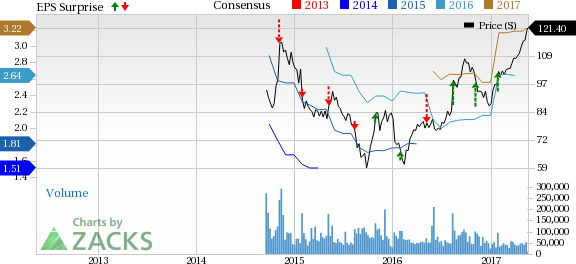

Alibaba is expected to report earnings at $0.49 a share according to the Zacks Consensus Estimate. Last quarter they reported earnings at $1.09, beating expectations by $0.24. Their average EPS surprise is 12.94%.

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

Original post

Zacks Investment Research