On Thursday, August 10th, NVIDIA (NVDA) will release its second quarter earnings results after the bell. The company is a Zacks Rank 2 (Buy), and have a Value, Growth, and Momentum score of F.

Dave will look at NVIDIA’s past earnings, take a look at what is currently going on with the company, and give us his thoughts on their upcoming earnings announcement.

Furthermore, Dave will uncover some potential options trades for investors looking to make a play on NVIDIA ahead of earnings.

NVIDIA in Focus

NVIDIA Corporation (NASDAQ:NVDA) designs, develops and markets a top-to-bottom family of award-winning 3D graphics processors, graphics processing units and related software that set the standard for performance, quality and features for every type of desktop personal computer user, from professional workstations to low-cost computers. NVIDIA Corporation's 3D graphics processors are used in a wide variety of applications, including games, the Internet and industrial design.

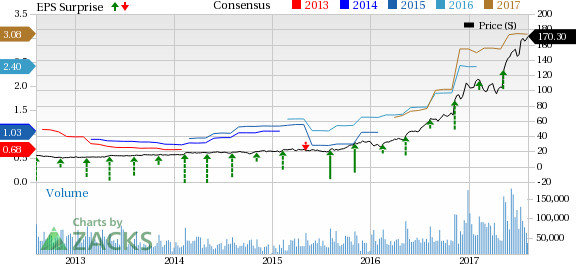

NVIDIA is expected to report earnings at $0.69 per share according to the Zacks Consensus Estimate. Last quarter they beat earnings expectations by 24.24%. They reported earnings at $0.82per share, beating their estimate by $0.16. They have an average earnings surprise of 27.01%.

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Original post

Zacks Investment Research