Barrick Gold Corporation (NYSE:ABX) has completed the sale of its 50% interest in the Veladero mine, located in San Juan province, Argentina, to Shandong Gold Mining Co. for about $960 million, thus completing the formation of a 50/50 joint venture (JV) at the mine. The company revealed that the sale from the deal will be mainly used to reduce debt.

The formation of the JV represents the first of the three stages, under the strategic cooperation agreement inked with Shandong Gold on Apr 6.

As the second stage of the agreement, Barrick and Shandong Gold have also formed a working group to explore and jointly develop the Pascua-Lama deposit. Under the third stage of the JV, both companies will assess additional investment opportunities in the highly prospective El Indio Gold Belt, located on the border of Chile and Argentina.

Both the companies will share knowledge and resources to achieve operational efficiency, safety and environmental stewardship with continued focus on underground mining. Barrick’s operating experience in the region will be complemented by Shandong’s access to substantial mining, construction and engineering expertise.

The strategic cooperation agreement will help Barrick to create long-term value for shareholders, government and the community. It will also help the company to lower debt and improve free cash flow per share.

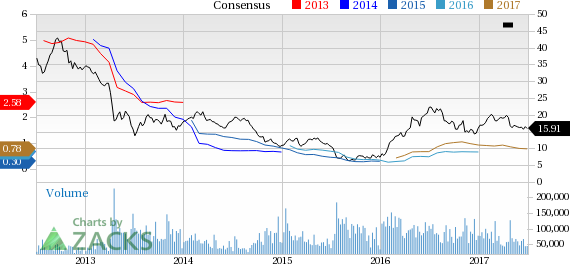

Barrick’s shares have lost around 17.6% in the last three months, underperforming the Zacks categorized Mining–Gold industry’s 5.9% decline.

While Barrick remains exposed to a volatile gold pricing environment, it should benefit from its major exploration programs. A significant portion of its exploration budget (roughly 80% of total exploration budget of $185–$225 million) for 2017 has been allocated to the Americas.

The company has also entered into a 50-50 JV with Goldcorp Inc. (NYSE:GG) in the Maricunga district in Chile that will merge the Cerro Casale and Caspiche deposits into a single project. The combination will offer significant economy of scale and will allow both companies to leverage potential synergies in the Maricunga Gold Belt.

Barrick currently carries a Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked companies in the basic materials space include The Sherwin-Williams Company (NYSE:SHW) and The Chemours Company (NYSE:CC) . Both the stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Sherwin-Williams has expected long-term earnings growth rate of 11.4%.

Chemours has expected long-term earnings growth rate of 15.5%.

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure. See these buy recommendations now >>

Chemours Company (The) (CC): Free Stock Analysis Report

Barrick Gold Corporation (ABX): Free Stock Analysis Report

Goldcorp Inc. (GG): Free Stock Analysis Report

Sherwin-Williams Company (The) (SHW): Free Stock Analysis Report

Original post