Barnes Group Inc. (NYSE:B) reported better-than-expected bottom line results for the fourth quarter of 2017, pulling off a positive earnings surprise of 4.41%.

Adjusted earnings in the quarter came in 71 cents per share, beating the Zacks Consensus Estimate of 68 cents. Also, the bottom line increased roughly 6% over the year-ago tally of 67 cents.

The adjusted results exclude charges of roughly 2 cents related to restructuring actions and $1.79 related to the U.S. tax reform.

For 2017, the company’s adjusted earnings were $2.88 per share, increasing 13.8% year over year.

Organic Growth and Forex Gains Drive Revenues

In the quarter, Barnes’ net sales grew 15.1% year over year to $373 million. The improvement was driven by 10% gain from organic sales growth, 1% benefits from acquired assets and 4% positive impact from foreign currency movements.

Also, the top line surpassed the Zacks Consensus Estimate of $361 million by roughly 3.3%.

Barnes Group reports its revenues under the segments discussed below:

Revenues from the Industrial segment were $254.3 million, increasing 17.9% year over year. The results improved on the back of 11% organic sales growth, 1% gain from acquired assets and 6% positive impact from foreign currency translations.

Businesses were strong in Nitrogen Gas Products, Engineered Components and Molding Solutions units.

Revenues from the Aerospace segment totaled $118.7 million, rising 9.4% year over year. The improvement came on the back of 6% growth in sales derived from original equipment manufacturing and from 17% growth in sales resulting from maintenance, repair and overhaul activities as well as sales from the spare parts business.

Backlog at the quarter-end was $714 million, increasing 14% growth over the year-ago quarter.

For 2017, the company’s net sales were $1,436.5 million, up 16.7% year over year.

Margins Fall on Higher Costs and Expenses

In the quarter, Barnes’ cost of sales jumped 18.6% year over year, representing 66.2% of net sales compared with 64.2% in the year-ago quarter. Selling and administrative expenses, roughly 20.5% of the net sales, increased 18.6% year over year.

Adjusted operating income decreased 1.5% year over year to $51 million while margin slipped 230 basis points to 13.7%.

Balance Sheet and Cash Flow

Exiting the fourth quarter, Barnes had cash and cash equivalents of $145.3 million, above $134.5 million at the previous quarter-end. Long-term debt balance increased 5.7% sequentially to $525.6 million.

In 2017, the company generated net cash of $203.9 million from its operating activities, decreasing 6.3% year over year. Capital spending totaled $58.7 million, up 23.4% year over year. Free cash flow for the year was $145.2 million, with an adjusted conversion ratio of 93%.

During the year, the company paid dividend totaling $29.6 million and repurchased shares worth $40.8 million.

Outlook

For 2018, Barnes anticipates gaining from a solid product portfolio, a focus on innovating new products and providing better services, strengthening end markets and initiatives directed to enhance operational efficiency.

Earnings per share are anticipated to be within the $2.98-$3.13 range, reflecting year-over-year growth of 3-9%. Total revenues will grow within the 4-6% range, including organic revenue growth of 3-5% and forex gains of roughly 1%. Operating margin will be 15.5-16.5% and effective tax rate will be 25-26%.

Capital expenditures are predicted to be around $60-$65 million.

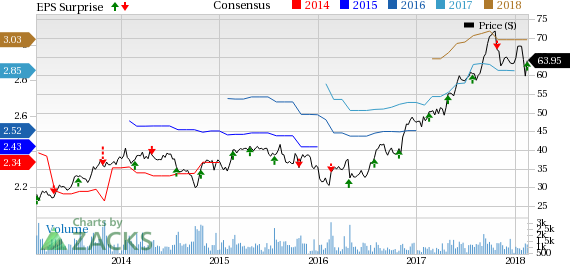

Barnes Group, Inc. Price, Consensus and EPS Surprise

Roper Technologies, Inc. (ROP): Free Stock Analysis Report

Dover Corporation (DOV): Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT): Free Stock Analysis Report

Barnes Group, Inc. (B): Free Stock Analysis Report

Original post

Zacks Investment Research