Bullion had a blasting start to the New Year with the entire precious metals complex finishing in the green on the first trading day of 2014. At the Comex markets, Gold and silver for most active February and March expiry contract managed gains of around 2% and 4% respectively. At close, the yellow metal was standing at $1225 per ounce whereas Silver was higher to $20.10 per ounce.

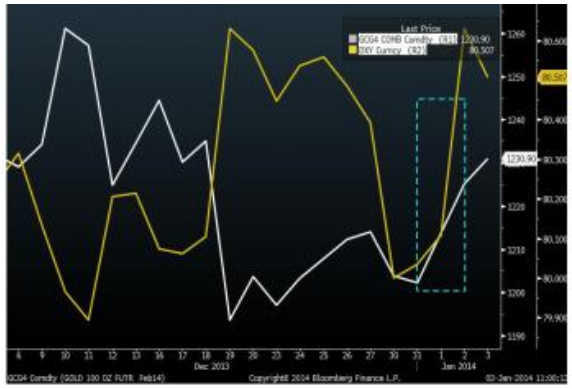

Gold which had a very bad 2013, falling by nearly 1/3rd for the full year has expanded around $50 since its low near $1,180 on December 31 when it touched its weakest level since late June. Prices rebounded on bargain hunting after plunging down to a six month low whereas fall in equities in the US and Asia also prompted additional gains into the commodity. Yesterday, while Gold was rising since the early morning trade, late evening session saw equities plunging from their highs in the US whereas the Dollar index shot higher, firmly above the 80.50 mark. As also updated earlier, lately we have seen the disconnect between the Dollar and Gold wherein both depict a linear movement as against inverse relationship earlier.

As per other market update, premiums for gold bars in Singapore were little changed from last week at $1.30 to $1.50 an ounce to the spot London prices. Premiums in Hong Kong were too steady at between $1.80 and a high of $2 an ounce as dealers awaited fresh supplies from Europe. On the institutional side, SPDR Gold Trust, the world's largest gold-backed ETF saw its holding continue to drop in 2014 with the first day’s drop seen by 3.60 tonnes to 794.62 MT. However, these cues are not having any major impact on prices either on the negative or positive side in the short-term.

The broader negative cues have had an upper hand in the commodity either on the side of economic cues or the Fed’s updates wherein speculation has increased that the Fed would extend its monetary tapering in 2014. However, gold has seen strong performance over last two days and at-least on a technical study; there is a strong case for further advancement in performance. We continue to maintain our moderate bullish outlook into the commodity, though feel scale of buying might be low in Intra-day.

Global Market Analysis: We are starting the year on a very faltering note; at least for equities and a few other assets. The US equities dropped more than half a per cent last day so the repercussion is seen in Ex-Japan Asian markets this morning as they are trading down over 1%. From the currency front, the US dollar index surged sharply and currently trading at 80.55 while euro currency went down towards $1.3650. There are no major economic numbers to watch for the day, other than the Euro area M3 Money Supply during the afternoon session.

Talking off commodities, markets are heterogeneous in nature. Gold and silver surged the most and at present trading at $1230 and $20.03 respectively. We could see a good start in bullion while still there are no clear signs for so much of gains and believe the gains might prolong at least for few more sessions. So, we prolong our buying activities in market. Nonetheless, profit potential on buying trade could be minimal as there are very less events expected today while weekend may shrink the volume too.