The banking industry, which forms major part of the broader finance sector, appears to have performed decently in the just concluded quarter.

Banks that have reported earnings so far witnessed eased margin pressure and slow loan growth. But net impact of these two factors was positive on interest income.

The industry faced a number of challenges in the quarter. Benefits from the rate hikes were to some extent offset by lower treasury yields. Further, lack of any tangible progress on the reforms proposed by the Trump administration in the quarter affected the lending scenario.

Moreover, the non-interest income reported by the banks so far seems to be under pressure owing to the sluggish trading activities and lack of sufficient equity issuance and M&As in the quarter.

Notably, per the latest Earnings Outlook, overall earnings for Banks-Major and Banks & Thrifts in the quarter are expected witness year-over-year growth of 8.6% and 17.9%, respectively.

Our quantitative model offers some insights into stocks that are about to report their earnings. Per the model, in order to be confident of an earnings beat, a stock needs to have the right combination of the two key ingredients – a positive Earnings ESP and a Zacks Rank #3 (Hold) or better. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Let’s have a look at the banking stocks that are scheduled to report their second-quarter 2017 earnings on Jul 21:

For SunTrust Banks, Inc.’s (NYSE:STI) we cannot conclusively predict an earnings beat as it has a Zacks Rank #3 and Earnings ESP of 0.00%. The company is expected to witness improved revenues and decline in expenses.

The Zacks Consensus Estimate stands at 98 cents for the upcoming release, which indicates 10.5% year-over-year growth. Also, SunTrust’s earnings estimates remained stable over the last seven days. (Read more: Why an Earnings Beat is Likely for SunTrust in Q2)

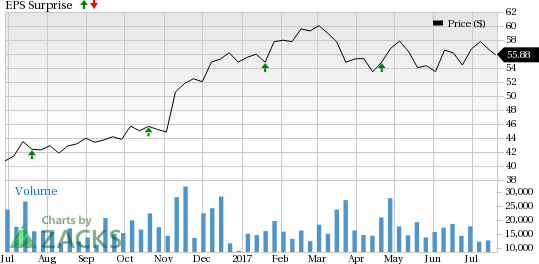

The stock surpassed the Zacks Consensus Estimate in each of the trailing four quarters, with an average beat of 2.6% as reflected in the chart below:

SunTrust Banks, Inc. Price and EPS Surprise

Fifth Third Bancorp’s (NASDAQ:FITB) Zacks Consensus Estimate is 42 cents for the quarter. It reflects year-over-year growth of about 6%. The estimates have remained stable over the past seven days.

An earnings beat is very likely for the company as it has the right combination — a Zacks Rank #3 and Earnings ESP of +2.38%. Eased margin pressure and slight growth in loans are likely to be the tailwinds. (Read more: Fifth Third to Post Q2 Earnings: Is a Beat in Store?)

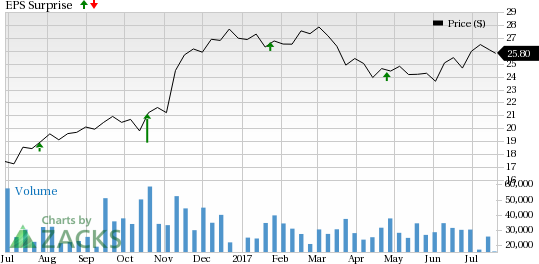

The company delivered an average positive earnings surprise of 19.6% in the trailing four quarters as depicted in the chart below:

Fifth Third Bancorp Price and EPS Surprise

A positive earnings surprise is very likely for Huntington Bancshares Incorporated’s (NASDAQ:HBAN) as well, as the company has the right combination — a Zacks Rank #3 and Earnings ESP of +4.35%. The results are likely to be supported by loan growth and higher rates. (Read more: Is a Beat in Store for Huntington in Q2 Earnings?)

The Zacks Consensus Estimate of 23 cents indicates an 11.26% jump on a year-over-year basis. The company’s earnings estimates remained stable over the last seven days.

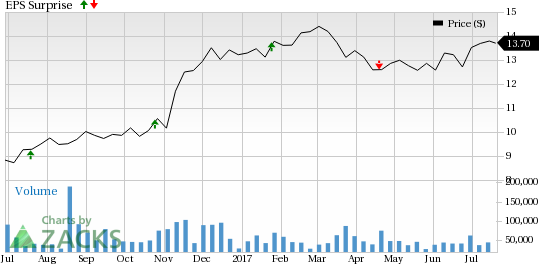

The company reported positive surprises in two of the trailing four quarters, with an average beat of 2.3%, as shown in the chart below:

Huntington Bancshares Incorporated Price and EPS Surprise

Regions Financial Corporation’s (NYSE:RF) Zacks Consensus Estimate stands at 24 cents for the upcoming release, which indicates 20% year-over-year growth. The company’s earnings estimates remained stable over the last seven days.

The company is expected to witness higher expenses and modest rise in interest income. We cannot conclusively predict an earnings beat for the quarter as Regions Financial has a Zacks Rank #3 and Earnings ESP of 0.00%. (Read more: Can Regions Keep the Earnings Streak Alive in Q2?)

The stock surpassed the Zacks Consensus Estimate in three of the trailing four quarters, with an average beat of 5.9% as reflected in the chart below:

Regions Financial Corporation Price and EPS Surprise

Check later our full write-up on earnings releases of these stocks.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

SunTrust Banks, Inc. (STI): Free Stock Analysis Report

Fifth Third Bancorp (FITB): Free Stock Analysis Report

Huntington Bancshares Incorporated (HBAN): Free Stock Analysis Report

Regions Financial Corporation (RF): Free Stock Analysis Report

Original post