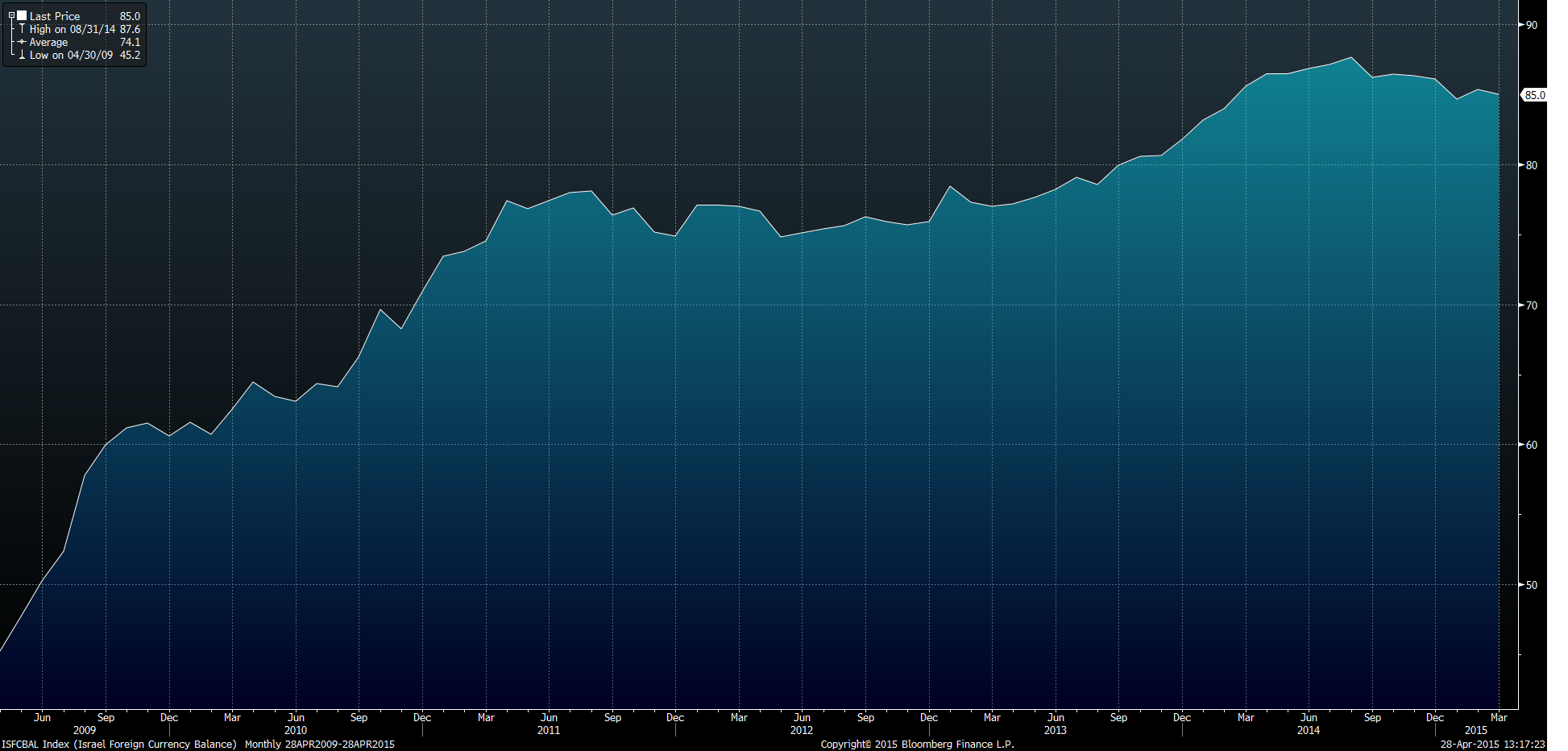

The past few years have seen the Bank of Israel (BOI) fighting to constrain Shekel appreciation, through a combination of both monetary easing and large scale FX interventions. However, the appreciation has continued and the BoI’s FX reserves have continued to swell their balance sheet leaving the bank with a very real legal impediment.

The acquisition of FX reserves by the bank has continued to be constrained by what is termed, the ‘Desirable Level’, which provides for an upper level of purchases between 65B and 90B. Legal convention subsequently restrains the central bank from exceeding those levels and, subsequently, the FX reserves are currently touching the upper band. So what is one to do when your credit card levels are maxed out… you simply increase your limit.

The BOI has therefore quietly increased the upper limit of their desirablerange to 110b, leading many to speculate that a large scale intervention in the FX markets may be pending. Considering the Bank of Israel’s strong FX interventions from 2008-2010, it is highly likely that the bank will seek to put the brakes on the unstoppable shekel through further aggressive moves.

Bank of Israel – Foreign Currency Reserves

Despite the increase in their desirable range, it is unlikely that the change represents a significant departure from their previous policy mix. Arguably, monetary easing is likely to remain a key ingredient in holding the Shekel back but the lag time in policy effectiveness also provides a strong incentive for direct intervention within the FX market.

Analysts at Goldman Sachs have also suggested that although the increase represents some needed breathing space for the BoI, that the optimal FX reserve range will not change and is likely to remain within the 70-75b range. This view is based upon the reported 25% fall in short term external debt since 2010, and suggests that further aggressive action would be unwarranted.

However, the mere act of increasing the desirable level leads to speculation of further FX interventions by the central bank. Considering the recent fragility, within US economic data, it is unsurprising that the Bank of Israel is seeking to review its policy mix whilst expanding the tools available to it. This is especially prescient considering that Israeli rates currently reside at the 10bp range and are effectively at the zero lower bound.

Despite the costs involved in any market interventions, it is likely that Israel seeks to realise not only the insurance benefits of increasing FX reserves but also the cushion that such reserves play in any economic shock. Ultimately, any intervention will have significant impacts not only for the FX market but also for domestic bonds as the central bank seeks to sterilize its operations.