The Greek saga continued overnight with an agreement on austerity once again unable to be found. The talks between Lucas Papademos, the technocratic PM, and the leaders of the three main political parties broke down over EUR300m worth of cuts to public sector worker pensions. According to the press, the EU/ECB/IMF troika have given the politicians 15 days to find the money somewhere else with talks between European Finance Ministers due in Brussels today.

And yet the euro keeps on going! EURUSD traded above the 1.33 level for the first time in 2 months while GBPEUR has printed within touching distance of the 1.18s overnight (low was 1.1903). It seems that any dip in the euro will be well supported, for now at least.

Finally we get some macro data today and a fair chunk of it comes from the UK. The Bank of England’s 2 day meeting began yesterday and the market is expecting another spurt of quantitative easing. The amount that analysts are expecting has dipped from £75bn to £50bn in the past few days as a result of the good PMI numbers from the UK economy in January. All these surveys are now showing growth and the services number was the highest since March 2010 but this has not altered our belief that the MPC will vote for £75bn.

This second round of quantitative easing has never really been about the UK in our opinion. It has been about insulating the UK economy from the fallout from the Eurozone and keeping the pound weak to help our beleaguered manufacturing base. Now, while a Lehman Brothers type event has been averted courtesy of the ECB’s new lending operation, recession and diminished confidence cannot be spirited away and herein lies the problem. The European recession will have a less deep but a more protracted effect on the UK economy and that’s why the increased amount should be voted for. Anything less, like £50bn would not have too much impact whereas £100bn would see the pace of the Bank’s purchases increases markedly over the 3 month period. The announcement is due at noon. No change in interest rates is expected.

We also receive UK manufacturing and industrial production for December at 09.30 with both measures expected to bounce back into positive territory, confirming the slight recovery in industry the UK is seeing.

The ECB meeting is also due today and while the meeting will garner less fanfare (on account of policy being likely to remain unchanged) but the press conference will always throw up a few surprises. The questions will focus on the ECB’s position on its holdings of Greek debt and how they may be able to help in the restructuring. Some are saying they should take the loss, some are proposing a scheme that would see the EFSF buy the Greek debt from the ECB so that Greece could then buy back the debt with money borrowed from the EFSF. Charles Ponzi – you’ve never been so relevant. Mario Draghi speaks at 13.30.

For instant reaction to Thursday’s Bank of England and European Central Bank announcements you can join our webinar on Thursday at 2pm. It is free and we will be looking at what sterling’s prospects are for further gains in the coming months. You can register here

Finally we also receive the NIESR’s latest estimate for GDP for the UK in the month of January at 15.00. December’s number was 0.1% and we will be looking for something around the 0.2-0.3% level.

Have a good day

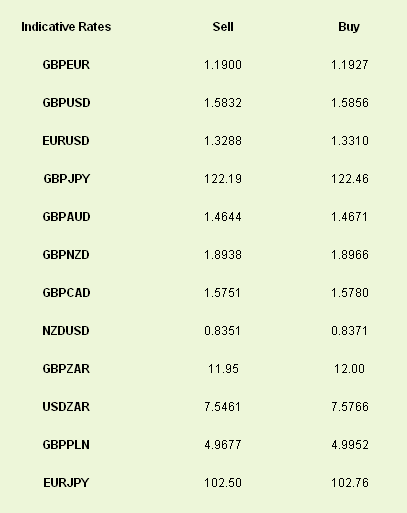

Latest exchange rates at time of writing

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Bank of England to Print as Greece Deal Remains Deadlocked

Published 02/09/2012, 05:10 AM

Updated 07/09/2023, 06:31 AM

Bank of England to Print as Greece Deal Remains Deadlocked

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.