As the next month is likely to be characterised by the will and movements of the world’s central banks, hints as to their future expectations on economic performance are key to formulating a likely policy outlook. Today’s Bank of England Inflation Report will give the Bank’s latest assessment of the UK economy and up-to-date forecasts of growth and inflation.

We expect the overall tone will be one of caution, with the MPC signalling looser monetary policy (further QE and possibly a cut in rates) later on down the line. They won’t be as blunt as that, but the indication will be given through an impression of continually falling inflation and the uncertainty over the European situation, while also revising their growth expectations lower through the rest of 2012 and 2013.

We think that this will be a net negative for sterling through the day. Mervyn King is a great one for talking down the pound and the market has pushed EZ areas out of the spotlight, for now, courtesy of Draghi’s speech last week. While this will not last, it is likely to mean that the market will be looking closely at GBP and weakness will be seized upon. A near-term target of 1.25 in GBP/EUR looks sensible over the coming 48hrs or so.

On the European situation, all was quiet yesterday given most of the continent is on holiday. We continued to see peripheral bond yields retreat a little but on very little interest.

German factory orders were poor yesterday, falling by 0.8%, and further suggesting that once Europe comes back from its month-long vacation that the pressure on the core European nations will be similar to that being felt in the periphery. Of course, the ECB may light the blue touch paper in the opening week of September, but for now the market continues to drift.

We do also get German manufacturing production today at 11am and this has been a key indicator for future GBP/EUR moves. We are looking for a decline of 1% to confirm further GBP/EUR strength soon.

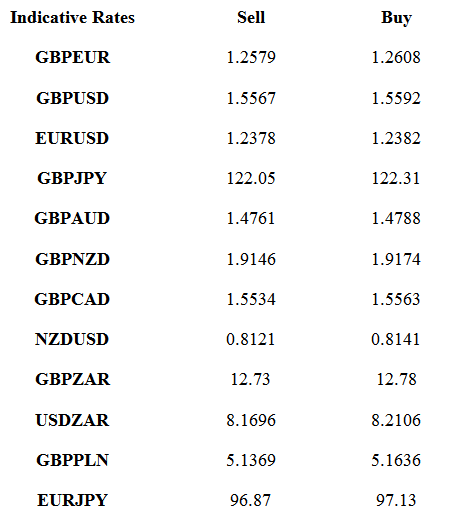

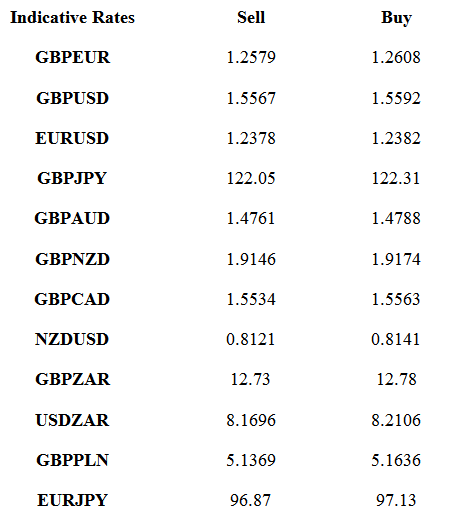

Latest exchange rates at time of writing:

We expect the overall tone will be one of caution, with the MPC signalling looser monetary policy (further QE and possibly a cut in rates) later on down the line. They won’t be as blunt as that, but the indication will be given through an impression of continually falling inflation and the uncertainty over the European situation, while also revising their growth expectations lower through the rest of 2012 and 2013.

We think that this will be a net negative for sterling through the day. Mervyn King is a great one for talking down the pound and the market has pushed EZ areas out of the spotlight, for now, courtesy of Draghi’s speech last week. While this will not last, it is likely to mean that the market will be looking closely at GBP and weakness will be seized upon. A near-term target of 1.25 in GBP/EUR looks sensible over the coming 48hrs or so.

On the European situation, all was quiet yesterday given most of the continent is on holiday. We continued to see peripheral bond yields retreat a little but on very little interest.

German factory orders were poor yesterday, falling by 0.8%, and further suggesting that once Europe comes back from its month-long vacation that the pressure on the core European nations will be similar to that being felt in the periphery. Of course, the ECB may light the blue touch paper in the opening week of September, but for now the market continues to drift.

We do also get German manufacturing production today at 11am and this has been a key indicator for future GBP/EUR moves. We are looking for a decline of 1% to confirm further GBP/EUR strength soon.

Latest exchange rates at time of writing: