Contrary to Fed Vice Chairman Yellen, who clearly sounded more than willing to take more insurance against adverse shocks that could compromise the fulfillment of the Fed job mandate, Chairman Bernanke avoided giving any hint of further QE during his testimony before the Congress Joint Economic Committee on June 7. Yet, Mr Bernanke did not take anything off the table. Instead he pointed out that the decision will be taken in light of the new GDP forecasts that FOMC participants will present at the upcoming June 19-20 meeting. If we were part of the FOMC, we would be voting for providing more support to the economy given our GDP forecast which call for the U.S. economy to grow by only 1.8% from Q1 2012 to Q1 2013. This said, one has to decide what form of action the Fed should take.

In this regards, Allan Posen's speech “Making the Most of Doing More” (June 11, 2012) is interesting. He suggested that the time has come to engage in a different policy than making government bonds unattractive in other to push investors in different assets classes. Allan Posen argued the BoE should buy from banks securitized bundles of loans to small and medium enterprises. This would allow a more direct targeting of financial dysfunctions at a time when QE seems to be pushing on a string.

A less efficient, but still worthwhile initiative according to him would be for the BoE to provide long-term repo operations against a wide range of loans from banks. This would lower banks funding costs against commitment of lending out the cash. This seems to be avenue Sir Mervyn King, Governor of the BoE, plans to take. On June 14, he announced the BoE and the Treasury were planning to launch a “funding for lending scheme that would provide funding to banks for an extended period of several years, at rates below current market rates and linked to the performance of banks in sustaining or expanding their lending to the UK non-financial sector.”

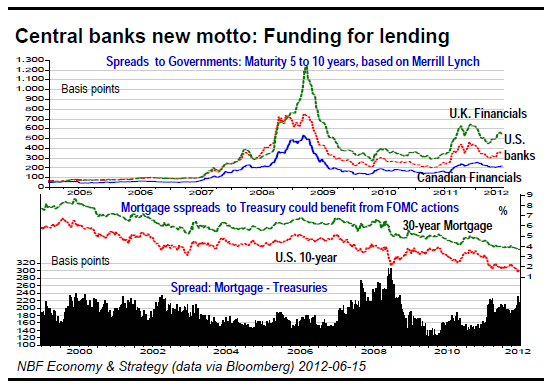

Looking at the amount of excess reserve held at the Fed, may be the FOMC could look at the Bank of England initiative and twist it to better suit the U.S. situation. In the short run, the easiest twist that FOMC could come up with would be to extend by $200 to $300 billion their current purchase of long term assets against selling short Treasury, but to target the housing market, MBS should be added to the purchasing list. Still the Fed also has to remain prepared to ensure financial institutions have access to liquidity if financial markets were to hit pockets of turbulence in the event that the eurozone situation were to deteriorate.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Bank Of England New Twist, Some Thoughts For The Fed

Published 06/19/2012, 03:07 AM

Updated 05/14/2017, 06:45 AM

Bank Of England New Twist, Some Thoughts For The Fed

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.