In a widely expected move, the Bank of England raised the base rate again, this time, 0.75% from 0.50%. Besides, the regulator did not rule out more tightening in the not-too-distant future. The odds are that it will happen at the nearest policy meeting that will be held in just one and a half months.

The thing is that unlike the ECB and the Federal Reserve, the Bank of England considerably upgraded its inflation forecast. The Bank of England projects inflation to accelerate to 7.25% in April and to slow down smoothly hereafter. Inflation is expected to decline to the target level of 2.0% in two years.

This inflation forecast, which was way more pessimistic than the one by the ECB and the US Fed, was a culprit of a sharp fall of the pound sterling. In fact, sterling was completing an upward correction that had been going on for a few days. The pound’s nosedive should have happened a day earlier when the US central bank released its updated economic outlook, including the timeline for further rate hikes.

GBP/USD was trading higher for a while in an inertial move. The Bank of England’s policy decision was the catalyst that reversed the trajectory of the currency pair. Apparently, GBP/USD was set to move in favor of the US dollar. So, the pair will resume its downtrend that began in May 2021.

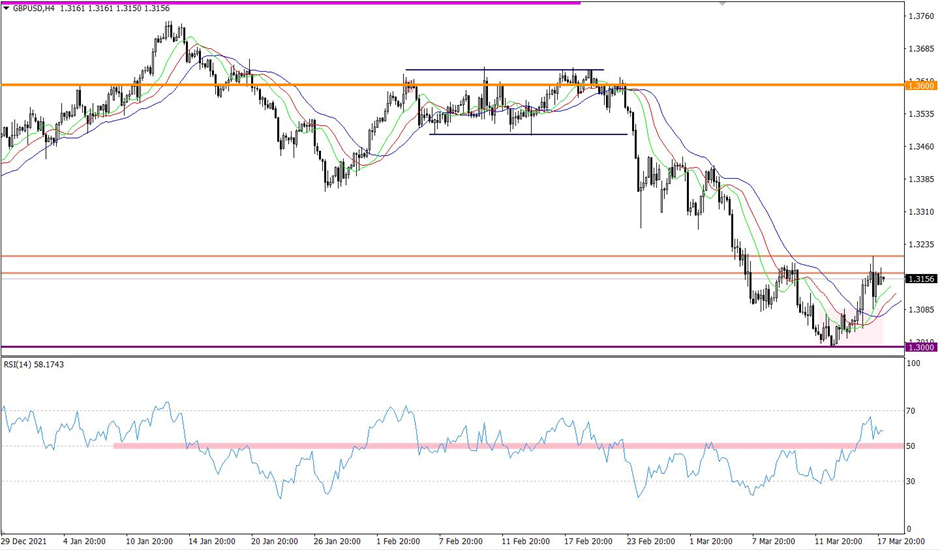

During the correctional move, GBP/USD rebounded to the swing high of Mar. 10 that coincided with resistance in the area of 1.3180/1.3200. When the price approached resistance, traders cut on long positions that eased the correctional move.

The RSI technical instrument came close to the overbought zone when it briefly touched the resistance zone on the 4-hour chart. It confirmed that the upward correction was waning.

The Alligator indicator also signaled a correctional move on the 4-hour chart as moving averages were pointed upwards. On the daily chart, the Alligator signaled a downtrend in the medium term. The indicator and moving averages are not intersected.

Outlook and trading tips

Under such market conditions, a slowdown in the upward correction can be viewed as a change in trading sentiment. When the price settles below 1.3100, traders will grasp it as a sell signal. This price action will confirm that GBP/USD was rejected by resistance.

The alternative scenario will come into play in case of an extended upward correction. If the price settles above 1.3200 on the 4-hour chart, this may assure traders to continue buying.

Complex indicator analysis provided mixed signals for the short term and intraday trading amid a slowdown in the upward correction. Indicators suggested selling GBP/USD in the medium term because of the overall downtrend.