After starting the year at a mere 0.25% overnight interest rate, the Bank of Canada is poised to raise its benchmark rate another 75bps on Wednesday to 2.25%. As my colleague Joe Perry noted earlier today, the BOC cited risks that higher inflation could become entrenched at its last meeting, and with the May CPI report printing at 7.7%, BOC Governor Tiff Macklem and company will be eager to fight price pressures in any way that they can.

Meanwhile, the central bank’s other traditional focus, the labor market, is humming along steadily, despite Friday’s mixed headline jobs report. The truth of the matter is that over the last two months, part-time positions have been replacing full-time jobs to the tune of -135K and +131K. In other words, there’s been a low quantity of jobs created of late, but the quality of those jobs has been improving, signaling that the labor market (and consumers’ spending power) remains strong.

With a 75bps rate hike seemingly a done deal for this week’s BOC meeting, traders will be more interested in the central bank’s assessment of the economy and the outlook for interest rates at its next meeting in September. As it stands traders are essentially evenly divided between expecting a 50bps rate hike and a 75bps move. Like their neighbors to the south, BOC policymakers will be loathe to pre-commit to a path in advance and are likely to emphasize their data dependence moving forward. That said, with the price of WTI crude oil, Canada’s most important export, falling precipitously since late-June, we believe there are dovish risks to the BOC’s statement.

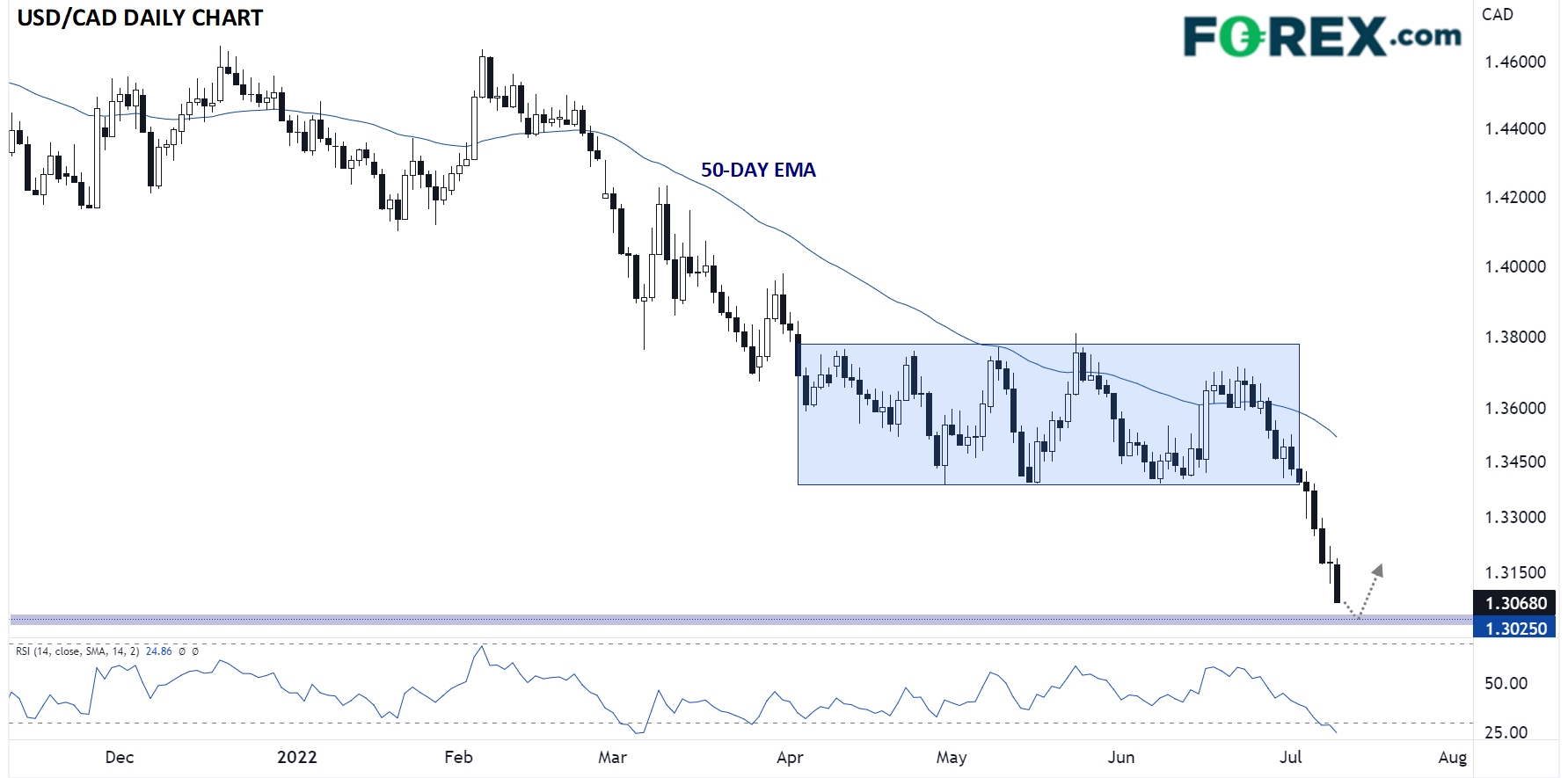

Technical view:

My colleague Joe Perry already covered the technical outlook for USD/CAD extensively in his Currency Pair of the Week article earlier today, so we wanted to check in on EUR/CAD. The trans-Atlantic pairing is on track for its 10th fall in the last 13 trading sessions, breaking down from its well-trodden 1.3400-1.3800 range in the process. The pair’s next level of long-term support comes in around 1.3025, marking where the April 2015 low and “measured move” objective of the sideways range converge. Rates are deeply oversold after the most recent drop, so any hint of dovishness from the BOC may provoke a counter-trend bounce from this support level as we move through the middle of the week.

Source: StoneX, TradingView