Big banks are starting to report earnings, with a rare profit miss for JPMorgan Chase (NYSE:JPM) in focus today. Bank of America (NYSE:BAC) is scheduled to take its turn in the earnings confessional ahead of the open tomorrow, Jan. 16. While the stock is trading down 0.8% today at $26.17, the options market is expecting a bigger-than-usual post-earnings swing in tomorrow's session.

Specifically, Trade-Alert places the implied earnings deviation for BAC at 5.1% -- much larger than the 1.2% next-day move the stock has averaged over the last two years. It's been a toss of a coin as to whether these earnings reactions were positive or negative, though not one has been large enough to match or exceed what the options market is pricing in this time around.

Options traders, it seems, have been positioning for a downside move. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the stock's 10-day put/call volume ratio of 0.33 ranks in the 90th annual percentile. So while calls have outpaced puts on an absolute basis, the rate of put buying has been quicker than usual.

Skepticism has been growing outside of the options pits, too, with short interest up 6% in the two most recent reporting periods, to 144.28 million shares. However, this represents just 1.5% of Bank of America stock's available float, or 1.5 times the average daily pace of trading.

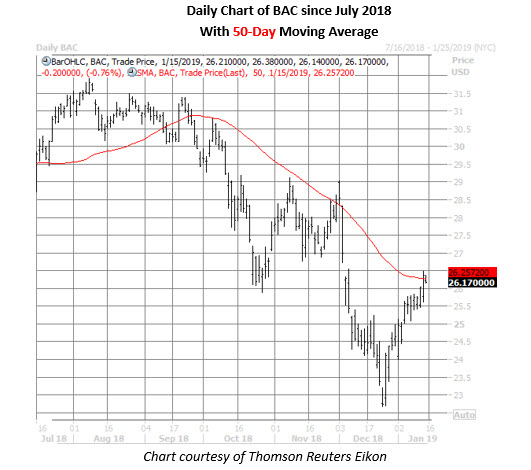

On the charts, BAC shares struggled in the fourth quarter alongside the broader equities market, shedding 16.4% over the three-month period. The stock has rebounded sharply off its 18-month low of $22.66 from Dec. 24, but is running out of steam in the $26.25 region -- home to its 50-day moving average and early December bear gap levels.